The Washington Post

Wildfire smoke puts Chicago among cities with worst air quality in the world

It’s the latest in a series of smoke invasions from Canada this month.

Ian Livingston – June 27, 2023

A new round of dense smoke has invaded the United States, specifically the Great Lakes region, as wildfires munch through forests across Quebec and Ontario, with more than 3.7 million acres scorched over the last week in those provinces alone. Throughout Tuesday, Chicago air quality ranked as the worst in the world among major cities.

Minneapolis and Detroit joined Chicago among the 10 worst, all dealing with conditions no better than Code Red. Air quality was even worse in other locations, such as Waukesha, Wis., west of Milwaukee, where the more severe Code Maroon was reached. Grand Rapids, Mich. — which through Tuesday has been between Red and Maroon, at Code Purple — is among places from eastern Iowa through Michigan and into Ontario that have endured air in this bout that is very unhealthy or worse.

Air quality alerts will be in effect into Wednesday or Thursday from Minnesota and Iowa through most of the Midwest, the Great Lakes region, and into parts of the Northeast, Mid-Atlantic and the Carolinas.

The Air Quality Index (AQI) moves to Code Orange (unhealthy for sensitive groups) at a reading of 101. Code Red (unhealthy for everyone) starts at 151. Once reaching 201, it’s Code Purple (very unhealthy), and finally a Code Maroon (hazardous) begins at 301.

Wildfire smoke’s primary pollutant is often referred to as PM2.5. These are fine particles from burned organic matter less than or equal to 2.5 microns in diameter — a microscopic soot.

The latest on the Canadian wildfires and smoke

Haze obscures the skyline in Cedar Rapids, Iowa, on Tuesday, June 27, 2023. (Nick Rohlman/The Gazette via AP)

Haze obscures the skyline in Cedar Rapids, Iowa, on Tuesday, June 27, 2023. (Nick Rohlman/The Gazette via AP)

Canada is experiencing its worst fire season in modern history. Smoke from wildfires in Canada has also brought record-breaking air pollution to the United States, creating unhealthy air quality conditions from the Midwest to the East Coast. Check to see how bad wildfire smoke has been in your area.

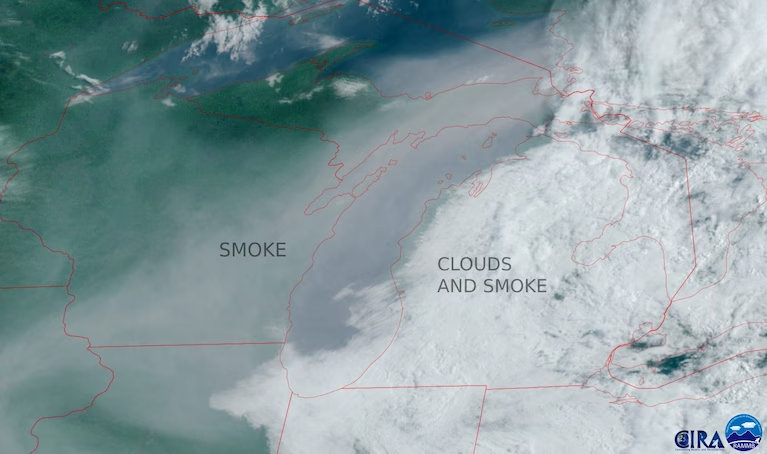

The plume on Tuesday

A thick pall of smoke was draped from Quebec and Ontario to the southwest, toward parts of the Midwest and Great Lakes region, and began moving into the Ohio Valley and points east in the early evening. The worst of it late Tuesday was centered over Lake Michigan and surrounding states. A particularly thick patch of smoke was approaching Chicago from the north late afternoon.

In Michigan and surrounding areas, it was a mix of smoke and low clouds.

Air quality values as severe as Code Purple have been recorded in Iowa, Wisconsin, Michigan, Illinois and northern Indiana so far, with an hourly AQI near Milwaukee of 312 and climbing, according to an Environmental Protection Agency monitor late afternoon. The Canadian city of Sault Ste. Marie, on the international border of Michigan, reached an AQI reading Monday night as high as 353, which is Code Maroon. The city was under Code Purple for much of Tuesday.

Many more locations, from eastern Minnesota to the western slopes of the Appalachians, were seeing Code Red conditions. The thickest of the smoke plume had advanced as far east as Cincinnati and Akron, Ohio.

In Chicago, the National Weather Service wrote that “low visibility due to wildfire smoke will continue today. Consider limiting prolonged outdoor activities.”

Visibility in the city was down to two miles, with smoke reported from Chicago O’Hare International Airport. The Weather Service expected visibility of one to three miles across the region for much of Tuesday.

“You can literally smell the smoke in the air today in Chicago from the Canadian wildfires,” wrote a Twitter user.

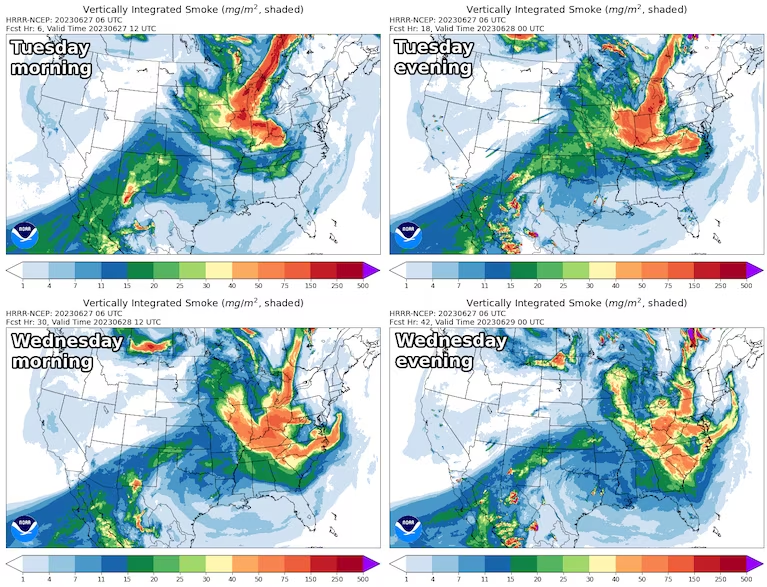

Into Wednesday, smoke should keep slowly moving east and somewhat south. It should remain in the lower Great Lakes and push into the Midwest or Ohio Valley region. Some of the smoke was beginning to spill over into the Appalachians late Tuesday.

Many such days

The number of days at Code Orange or worse as a result of wildfire smoke continues to increase in the northeastern United States, though that number is comparatively low when examined against areas immediately surrounding the fires in Canada.

Many of these days also saw spikes beyond Code Orange.

This month but before the current wave, much of western Wisconsin — in the thick again — had already recorded four or five 24-hour readings at Code Orange or higher. It’s a similar story in and around Detroit, with five Code Orange days in the city and up to seven or eight in nearby locations.

Wildfire smoke, air quality and your health

(Photo by AFP PHOTO / Nova Scotia Government) (Handout/AFP/Getty Images)

(Photo by AFP PHOTO / Nova Scotia Government) (Handout/AFP/Getty Images)

Wildfire smoke can travel great distances, with particulates small enough to enter the bloodstream through your lungs if inhaled. If you’re in an area affected by smoke, limit your outdoor activities (especially when exercising) and wear a good mask outside that can filter fine particles. Here’s how to protect yourself from wildfire smoke.End of carousel

More than a dozen days at Code Orange or worse have been tallied in June across the hardest-hit spots north of the border, in Ontario and Quebec, especially north and northwest of Ottawa.

The D.C. region just saw its worst smoke pollution on record

The number of bad air quality days may soon increase in the Northeast, as well. The Washington, D.C., region has had two bad air days this month, both Code Red. Much of Pennsylvania and New Jersey and parts of Southern New England have piled up three such days, with a few locations at four or five.

While AQI values in this plume are somewhat lower than they were earlier in the month — when hourly AQI values soared toward 400 in the Northeast — any values of Code Red or above are concerning for the general public.

Smoke’s future travel plans

This round of smoke, like the one June 7-8 that smothered the Northeast, is moving into circulation via a crawling low-pressure area that’s now over the eastern Great Lakes.

In general, winds blow from the east to the north of the low pressure center, pushing smoke westward from the source, before winds out of the north and northwest behind the center push smoke south. As the low pressure inches east, so does the area of smoke it is carrying along with it.

Over the next several days, the low should track through the Mid-Atlantic and offshore along the East Coast. This trajectory is expected to bringsmoke eastward.

Code Red is now in the forecast Wednesday for Buffalo, Pittsburgh, Cleveland and Columbus, Ohio, on the eastern side of the thickest plume. Code Orange is forecast for Syracuse, N.Y., Baltimore, Washington and Raleigh, N.C.

Higher-level smoke will likely cover a larger area from the northern and central Plains, through the Midwest and Great Lakes region, then through the Mid-Atlantic and as far south as Georgia on Wednesday.

The potential for smoky skies could last into the weekend, although it will probably drop in intensity as the pattern shifts slightly.

Canadian wildfire smoke

Latest news: Why are Canada’s wildfires getting worse? Meteorologists aren’t sure how long fires will persist, but it’s already Canada’s worst fire season in modern history. Smoke from Canadian wildfires has spread over much of the Midwest, Northeast and Mid-Atlantic.

Air quality and your health: Breathing in wildfire smoke is bad for your health. The EPA uses a color-coded system to measure air quality — here’s what Code Red, Code Purple and more mean. Learn how to protect yourself including which air filters and air purifiers to choose for your home.

Environmental impact: Wildfires send greenhouse gases into the air, but Canada doesn’t count some of them as part of its official emissions contributions, a Post report found.