Resilience

Building a world of resilient communities

Organic Agriculture for 10 Billion People

By Adrian Muller, from Food Climate Research Network November 27, 2017

This post is written by Adrian Muller, FCRN member and senior researcher at FiBL (Research Institute of Organic Agriculture) and ETH Zurich, Switzerland. His post is based on the paper Strategies for feeding the world more sustainably with organic agriculture,(link is external) published in Nature Communications earlier in November.

Organic agriculture can feed the world. The only question thereby being what “feeding the world” may mean. Today, it basically means high shares of animal products in diets and that a third of production is wasted. Projections for 2050 look similar. Does this make sense? No. And this is the entry point for organic agriculture to play a role in sustainable food systems and for contributing to food security.

How can we feed 10 billion people in 2050 while at the same time reducing negative environmental impacts of the food system, such as biodiversity loss and greenhouse gas emissions? Today, we produce about 2850 kcal per capita per day on average globally, according to the United Nations Food and Agriculture Organization FAO. These calories come with a high share of animal products. In the FAO projections for 2050, this value is even higher, at well over 3000 kcal per capita and day, and this is supplied for a population that is 30 percent larger than today. Without further changes in food production, this would result in correspondingly higher environmental impacts as well.

Scenarios for future food systems

These values are absurdly high, but there is much room for improvement: imagine, which changes in feeding the world would be possible if we would not produce a third of agricultural output for the garbage can and if we would not use 40 percent of all croplands to grow feed for animals to meet our high demand in animal products. We definitely have enough to eat and there are clearly problems with distribution and access, but I will leave these considerations aside in this short blogpost.

We have to make use of this room for improvements if we want to feed the global population sustainably in 2050. Which role can organic agriculture play in this? Research has shown that it has advantages regarding soil fertility and lower environmental impacts when it comes to nitrogen surplus and eco-toxicity from pesticide use, but the commonly discussed downside is its lower yields.

Figure 1: Organic agriculture improves soil quality: soils under conventional (left) and organic management (right) after heavy rain (from the long-term systems comparison trial DOK; Photo: Research Institute of Organic Agriculture FiBL, Switzerland).

Another interesting question is what role grass-fed animal production may play, where there is no competition for cropland to produce feed or food, while greenhouse gas emissions per kilogram product are higher than for animals that eat concentrate feed.

Such questions can be explored with mass- and nutrient flow models. Such models provide insights into the bio-physical and agronomic feasibility of different scenarios of future food systems. Thereby, economic and social aspects are not addressed albeit they are clearly central as well. It is however legitimate to first focus on the bio-physical and agronomic feasibility and to understand those in detail.

Unavoidable trade-offs

We analyzed the role that organic agriculture may play in sustainable food systems by creating and deploying such a mass and nutrient flow model. The results of this work have recently been published in Nature Communication(link is external). We find that more cropland would be needed than in the conventional reference scenario, to supply the production as projected by the FAO for 2050. We also find, however, that the nitrogen surplus would be reduced significantly, with corresponding positive environmental effects. Furthermore, pesticide use would clearly be reduced as well and even greenhouse gas emissions would be somewhat lower than in the reference scenario. This is the case for a food system with high shares of animal products in diets, and high wastage volumes. This would change if we would feed animals with less concentrate feed and more grassland-based forage, and if we would reduce food waste and loss.

In a food system with, for example, 50% less concentrate feed, 50% less food wastage and 100% conversion to organic agriculture, land use would also be lower than in the reference scenario. Further and more detailed results can be found in the paper linked at the end of this blogpost.

It is important to emphasize that these results clearly depend on a number of central assumptions such as the yield gap between organic and conventional agriculture, the impact of climate change on yield projections, the share of nitrogen fixing legumes in organic crop rotations, or the yields of grass-fed ruminants and from pigs and poultry fed without food-competing concentrates but fed on by-products from food production only. For our main results, we primarily adopted conservative values using higher yield gaps, for example. Results for lower yield gaps and results of sensitivity analyses regarding other key assumptions are reported in the supplementary material to the paper linked below.

In any case, trade-offs are thus always central when assessing the sustainability of agricultural production systems. The negative impacts from high nitrogen surplus and pesticide use can be reduced, if we are prepared to crop relatively more land (but this in turn would have negative impacts). Thus, which indicator may be the most important one?

Efficiency, consistency and sufficiency

Here, another result becomes relevant. Organic agriculture can play a central role if we refrain from focusing on agricultural production alone and adopt a food systems perspective instead. If we also address the consumption level, e.g. via the sustainability potential of reduced concentrate feed use and reduced food wastage, we can achieve improvements along all sustainability indicators and none of them needs to be judged as being more important than any other. In a food system with these changes regarding animal feed and wastage, dietary composition would clearly look very different, as the share of animal products would drop considerably. This would be so in particular for pigs and poultry that are predominantly fed on concentrate feed, and less so for ruminants that can eat grass. We emphasize that these statements refer to the global average and reductions are relevant in particular for high-income countries and future projections; in certain regions, increasing shares of animal source food in diets clearly still makes sense.

The food systems approach can be captured by three central concepts; efficiency, consistency and sufficiency. First, sustainable agriculture is often assessed with a focus on “efficiency”: how to produce more with as low as possible inputs and environmental impacts. This concept puts environmental impacts in relation to production volumes and gives guidance on improvements of single farm processes and production practices. It is however blind for aspects that become effective on an aggregate level only, such as in relation to the carrying capacity of ecosystems or cropland and water scarcity. Therefore, we also need to work with “consistency”. This concept stands for optimal resource use in a systemic context and for closed nutrient cycles. An example are ruminants that feed on grass.

Figure 2: Ruminants utilize grasslands and turn them into a source for food (Photo: Flickr (https://www.flickr.com/photos/justanotherhuman/14564836544/(link is external)), Creative Commons).

Like this, it is possible to utilize these areas for food production, which would otherwise not be possible. Furthermore, these animals are then fed without competition on cropland areas for food or feed production. On the other and, such grass-fed animals are less efficient regarding greenhouse gas emissions per kilogram meat and milk. Thus, we also need “sufficiency”. This concept relates to the overall size of the system and its impacts. Sufficiency opens up the space for producing with lower yields or higher emissions per unit product while harvesting the benefits such as from reduced nitrogen surplus or pesticide applications, without increasing total land use or total greenhouse gas emissions. Sufficiency is often explained via “consumption reduction”, in our case here, this is the reduction of animal source food that is produced with concentrate feed inputs and also behavioral change resulting in the reduction of food waste and loss.

Conclusions

When working on and discussing sustainable agriculture, we need to address the whole food system including consumption and not only production. On the food systems level, we have to open up the needed space to deal with the unavoidable trade-offs. We do not have to rely on extreme solutions for this, but a wise combination of different promising complementary strategies is already able to deliver a more sustainable food future. In such a setting, organic agriculture can play a central role as one of these complementary strategies to move towards more sustainable food systems.

References:

This is a blog post based on the paper “Muller, A., Schader, C., El-Hage Scialabba, N., Brüggemann, J., Isensee, A., Erb, K.-H., Smith, P., Klocke, K., Leiber, F., Stolze, M. and Niggli, U., 2017, Strategies for feeding the world more sustainably with organic agriculture, Nature Communications”.

The paper is open-access and can be found here: https://www.nature.com/articles/s41467-017-01410-w(link is external) and you can see a video by lead author Muller here https://www.youtube.com/watch?v=z4daLqmureU(link is external)

A discussion of the Nature paper is posted on the FCRN website here.

For further discussion of the ‘livestock on leftovers’ approach, see Section 5.4.1 (pp 105-116) of the FCRN Grazed and Confusedreport.

See also the report Lean mean green obscene…? What is efficiency and is it sustainable? which explores and critiques different understandings of the concept of ‘environmental efficiency’ and as part of this discusses some of the ideas raised in Adrian’s blog and paper.

Jim Carrey at the Jane Fonda Hand And Foot Print Ceremony as part of the 2013 TCM Classic Film Festival (

Jim Carrey at the Jane Fonda Hand And Foot Print Ceremony as part of the 2013 TCM Classic Film Festival ( Jim Carrey, The GOP and WH have become sinister conclaves of souless traitors, liars and thieves – a gangrene we must remove so democracy can live.

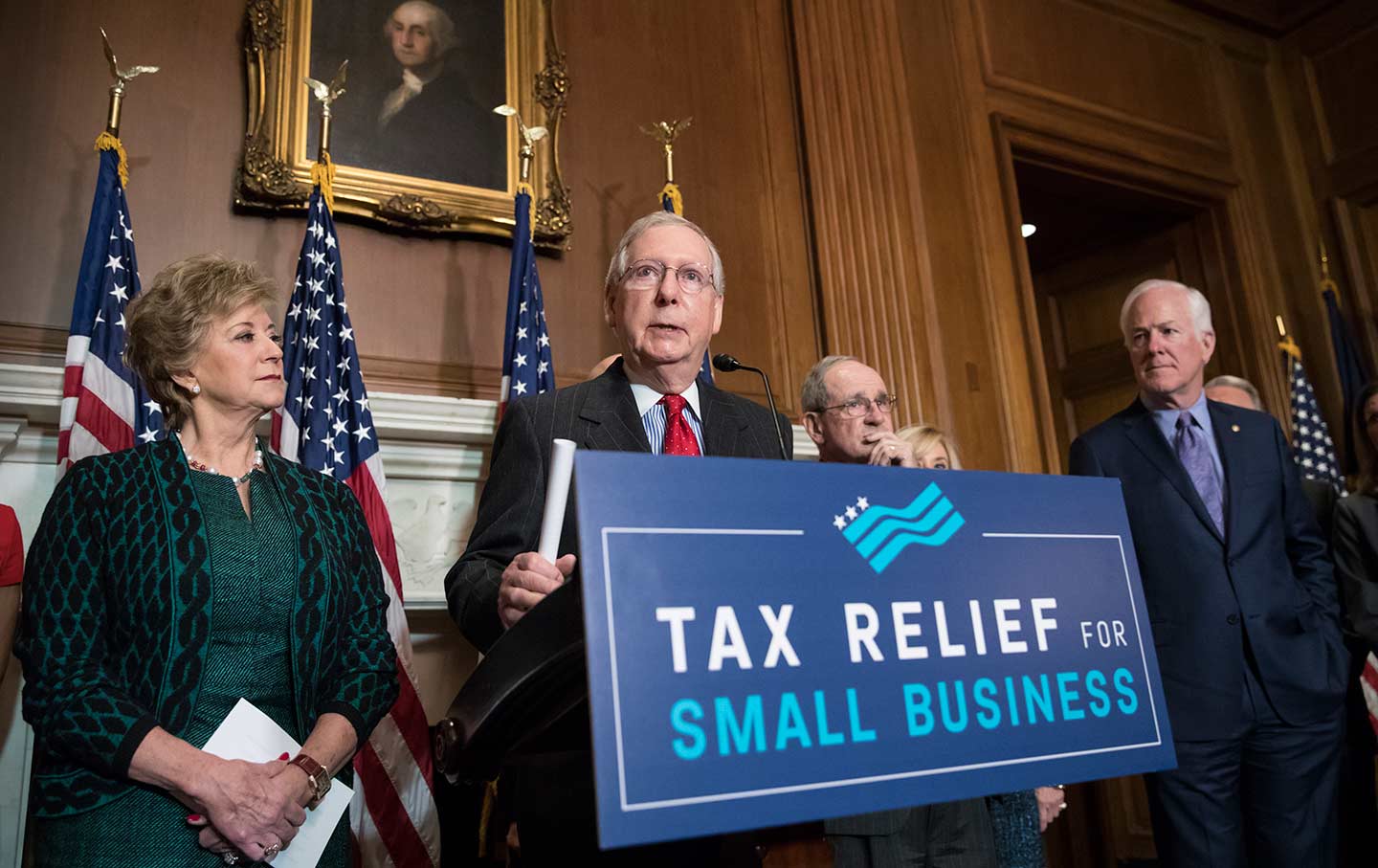

Jim Carrey, The GOP and WH have become sinister conclaves of souless traitors, liars and thieves – a gangrene we must remove so democracy can live.  Mitch McConnell holds a news conference to talk about the Republican tax plan in Washington, DC, November 28, 2017. (AP Photo / J. Scott Applewhite)

Mitch McConnell holds a news conference to talk about the Republican tax plan in Washington, DC, November 28, 2017. (AP Photo / J. Scott Applewhite) In this Jan. 12, 2016 file photo, Kansas Gov. Sam Brownback speaks to the legislature in Topeka, Kan. Photo by Orlin Wagner/AP

In this Jan. 12, 2016 file photo, Kansas Gov. Sam Brownback speaks to the legislature in Topeka, Kan. Photo by Orlin Wagner/AP