The Guardian

Trump deregulated railways and banks. He blames Biden for the fallout

David Smith in Washington – March 18, 2023

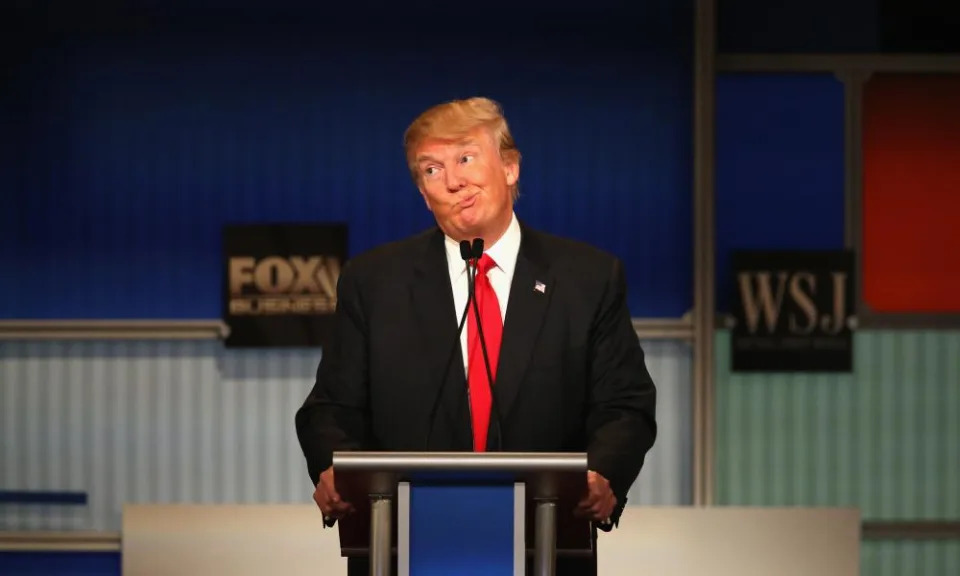

When a fiery train derailment took place on the Ohio-Pennsylvania border last month, Donald Trump saw an opportunity. The former US president visited East Palestine, accused Joe Biden of ignoring the community – “Get over here!” – and distributed self-branded water before dropping in at a local McDonald’s.

Related: Levels of carcinogenic chemical near Ohio derailment site far above safe limit

Then, when the Silicon Valley Bank last week became the second biggest bank to fail in US history, Trump again lost no time in making political capital. He predicted that Biden would go down as “the Herbert Hoover of the modrrn [sic] age” and predicted a worse economic crash than the Great Depression.

Yet it was Trump himself who, as US president, rolled back regulations intended to make railways safer and banks more secure. Critics said his attacks on the Biden administration offered a preview of a disingenuous presidential election campaign to come and, not for the first time in Trump’s career, displayed a shameless double standard.

“Hypocrisy, thy name is Donald Trump and he sets new standards in a whole bunch of regrettable ways,” said Larry Sabato, director of the Center for Politics at the University of Virginia. “For his true believers, they’re going to take Trump’s word for it and, even if they don’t, it doesn’t affect their support of him.”

The collapse of Silicon Valley Bank on 10 March and of New York’s Signature Bank two days later sent shockwaves through the global banking industry and revived bitter memories of the financial crisis that plunged the US into recession about 15 years ago.

Fearing contagion in the banking sector, the government moved to protect all the banks’ deposits, even those that exceeded the Federal Deposit Insurance Corporation $250,000 limit for each individual account. The cost ran into hundreds of billions of dollars.

The drama reverberated in Washington, where Trump’s criticism was followed by that of Republicans and conservative media, seeking to blame Biden-driven inflation or, improbably, to Silicon Valley Bank’s socially aware “woke” agenda. Opponents saw this as a crude attempt to deflect from the bank’s risky investments in the bond market and more systemic problems in the sector.

The 2008 financial crisis, triggered by reckless lending in the housing market, led to tough bank regulations during Barack Obama’s presidency. The 2010 Dodd-Frank Act aimed to ensure that Americans’ money was safe, in part by setting up annual “stress tests” that examine how banks would perform under future economic downturns.

But when Trump won election in 2016, the writing was on the wall. Biden, then outgoing vice-president, warned against efforts to undo banking regulations, telling an audience at Georgetown University: “We can’t go back to the days when financial companies take massive risks with the knowledge that a taxpayer bailout is around the corner when they fail.”

But in 2018, with Trump in the White House, Congress slashed some of those protections. Republicans – and some Democrats – voted to raise the minimum threshold for banks subject to the stress tests: those with less than $250bn in assets were no longer required to take part. Many big lenders, including Silicon Valley Bank, were freed from the tightest regulatory scrutiny.

Sabato commented: “The worst example is the bank situation because that is directly tied to Trump and his administration and changes made in bank regulations in 2018. Yes, some Democrats voted for it, but it was overwhelmingly supported by Republicans and by Trump who heralded it as the real solution to future bank woes.”

The minority of Democrats who supported the 2018 law have denied that it can be directly tied to this month’s bank failures, although Bernie Sanders, an independent senator from Vermont, was adamant: “Let’s be clear. The failure of Silicon Valley Bank is a direct result of an absurd 2018 bank deregulation bill signed by Donald Trump that I strongly opposed.”

You do need government to regulate finance … but that point cannot be made if you’ve got Donald Trump inventing reality

Larry Jacobs

Sherrod Brown, a Democratic senator for Ohio who introduced bipartisan legislation to improve rail safety protocols, drew a parallel between the banks’ collapse to rail industry deregulation lobbying that contributed to the East Palestine train disaster. “We see aggressive lobbying like this from banks as well,” he said.

Trump repealed several Barack Obama-era US Department of Transportation rules meant to improve rail safety, including one that required high-hazard cargo trains to use electronically controlled pneumatic brake technology by 2023. This rule would not have applied to the Norfolk Southern train in East Palestine – where roughly 5,000 residents had to evacuate for days – as it was not classified as a high-hazard cargo train.

But the debate around the railway accident and bank failures points to a perennial divide between Democrats, who insist that some regulation is vital to a functioning capitalism, and Republicans, who have long claimed to believe in small government. Steve Bannon, an influential far-right podcaster and former White House chief strategist, framed the Trump agenda as “the deconstruction of the administrative state”.

Antjuan Seawright, a Democratic strategist, said: “The Republican party has gotten by for many years on this idea that less is better. However, we’re now learning in this country that, as America continues to mature, in some cases more is better, and more has to be how we get to better. Otherwise the mistakes can spin out of control and cause generations of people long-term damage.”

Biden called on Congress to allow regulators to impose tougher penalties on the executives of failed banks while Warren and other Democrats introduced legislation to undo the 2018 law and restore the Dodd-Frank regulations. It is likely to meet stiff opposition from the Republican-controlled House of Representatives and even some moderate Democrats.

Biden has also insisted that no taxpayer money will be used to resolve the current crisis, keen to avoid any perception that average Americans are “bailing out” the two banks in a way similar to the unpopular bailouts of the biggest financial firms in 2008.

But Republicans running for the 2024 presidential nomination are already contending that customers will ultimately bear the costs of the government’s actions even if taxpayer funds were not directly used. Nikki Haley, the former governor of South Carolina, said: “Joe Biden is pretending this isn’t a bailout. It is.”

Another potential 2024 contender, Senator Tim Scott, the top Republican on the Senate banking committee, also criticised what he called a “culture of government intervention”, arguing that it incentivises banks to continue risky behavior if they know federal agencies will ultimately rescue them.

Larry Jacobs, director of the Center for the Study of Politics and Governance at the University of Minnesota, said: “This is familiar ideological territory. The battle lines between liberalism and a fake conservatism appear to be playing out here. But the tragedy of the situation is that the liberals are right.

It’s not new that the Republicans will deregulate an industry and then it collapses … look at American political and economic history of the last 50 years

Wendy Schiller

“You do need government to regulate finance and, when you don’t, you get mischief making and bank failures but that point cannot be made if you’ve got Donald Trump inventing reality. He’s demonstrated that facts and position taking don’t matter. It’s an extraordinary political strategy but it’s even more devastating to our whole political system and our media that this could be allowed.”

This poses a huge messaging challenge for Democrats, who after the 2008 financial crisis came up against the Tea Party, a populist movement feeding off economic and racial resentments. Long and winding explanations about the negative impacts of Trump era deregulation are a hard sell compared to the former president’s sloganeering in East Palestine.

Wendy Schiller, a political science professor at Brown University in Providence, Rhode Island, said: “Once again we see that Trump is taking advantage of the Achilles’ heel of the Democratic party by telling voters that the Democrats like big government because it bails out industries and it never provides a bailout for the little guy.”

Democrats’ efforts to point out that Trump was responsible for deregulation are unlikely to cut through, Schiller added.

“Any time it takes more than 10 seconds to explain something, you’re done in politics. This is why Trump has catchy phrases, sound bytes. He understands that all voters see is that rich people made a bad investment and then more rich people are making sure that their money’s available to them within three days, coming off the heels of all the closures during Covid, lost business, lost income, people struggling, inflation.

“Democrats don’t want to call it a bailout but it is a bailout. The high visibility of this bailout smothers anything else the Democrats are doing for the average voter. It’s a perfect issue for the Republicans. It’s not new that the Republicans will deregulate an industry and then it collapses and the Democrats have to save it. Look at American political and economic history of the last 50 years: this is exactly what happens.”