When it rains, it powers. Learn more about Chinese investment in renewables:

Read About The Tarbaby Story under the Category: About the Tarbaby Blog

August 27, 2018

***NEW VIDEO***

Some people without brains do an awful lot of talking.

IF YOU EVER GOT IMPEACHED – Randy Rainbow Song Parody

***NEW VIDEO***Some people without brains do an awful lot of talking. 🌪🌈🎵❤️🧠

Posted by Randy Rainbow on Monday, August 27, 2018

August 13, 2018

Watch one of the most viral political ads of 2018

MJ Hegar Has One of the Most Viral Ads of 2018

Watch one of the most viral political ads of 2018

Posted by NowThis Politics on Monday, August 13, 2018

The GOP tax cuts for the wealthy has another layer: It’s helping them funnel that money into the 2018 midterms

Robert Reich on the GOP Tax Cuts for the Rich and the 2018 Midterms

The GOP tax cuts for the wealthy has another layer: It's helping them funnel that money into the 2018 midterms

Posted by NowThis Politics on Tuesday, August 28, 2018

August 27, 2018

What Floridians are enduring is decades in the making. Agricultural runoff polluting the water and Big Sugar blocking its natural flow. Bianca Graulau with 10News in Tampa Bay does a remarkable job telling the story here.

What does Big Sugar have to do with Florida's red tide?

You've been hearing a lot about the toxic algae situation in Florida. But what's causing it? @Bianca Graulau explains.https://on.wtsp.com/2oddXNH

Posted by 10News WTSP on Sunday, August 26, 2018

August 8, 2018

You can trade it for groceries, fuel or even school fees. Learn more about the fight against plastic waste:

These stores accept plastic waste as money

You can trade it for groceries, fuel or even school fees. Learn more about the fight against plastic waste: https://wef.ch/2JC1fEx

Posted by World Economic Forum on Wednesday, August 8, 2018

A Lesson on Happiness From a 92 Year Old

I agree with her 100%!

Posted by Power of Positivity on Monday, October 30, 2017

August 25, 2018

Like George was calling out Big Sugar by name: “They spend billions of dollars every year lobbying, lobbying, to get what they want. Well, we know what they want. They want more for themselves and less for everybody else.

But I’ll tell you what they don’t want: They don’t want a population of citizens capable of critical thinking. They don’t want well informed, well educated people capable of critical thinking. They’re not interested in that. That doesn’t help them. That’s against their interests.”

Like George was calling out Big Sugar by name: “They spend billions of dollars every year lobbying, lobbying, to get what they want. Well, we know what they want. They want more for themselves and less for everybody else. But I'll tell you what they don’t want: They don’t want a population of citizens capable of critical thinking. They don’t want well informed, well educated people capable of critical thinking. They’re not interested in that. That doesn’t help them. That’s against their interests.”

Posted by Everglades-Trust on Saturday, August 25, 2018

U.S. Senator Bernie Sanders — US Senator for Vermont

August 26, 2018

Despite Trump and Scott Pruitt, the world is making progress to address climate change. Costa Rica is proving that it’s possible to rapidly transition away from fossil fuels to renewable energy. (via The Years Project)

Despite Trump and Scott Pruitt, the world is making progress to address climate change. Costa Rica is proving that it's possible to rapidly transition away from fossil fuels to renewable energy. (via The Years Project)

Posted by U.S. Senator Bernie Sanders on Sunday, August 26, 2018

Kathleen Elkins August 27, 2018

That means about a third of Americans have only a few thousand dollars, or less, put away for their golden years.

Of course, some people are more prepared: A quarter report having $200,000 or more stashed away, while 16 percent have between $75,000 and $199,999. But overall, Northwestern Mutual found that Americans with retirement savings have an average of $84,821 saved, which is far from enough. Experts typically recommend trying to accumulate at least $1 million.

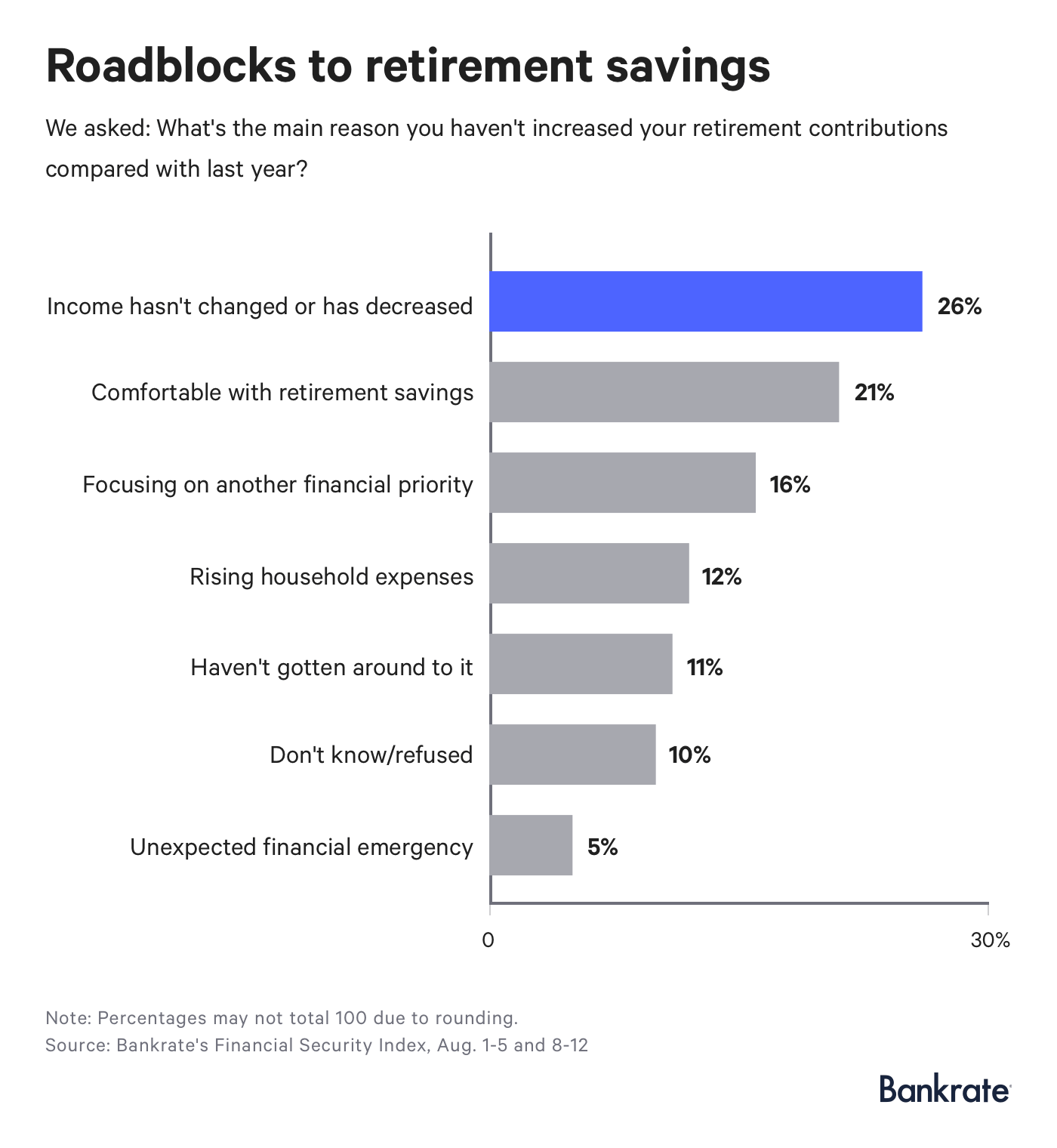

Meanwhile, a new survey from Bankrate finds that 13 percent of Americans are saving less for retirement than they were last year and offers insight into why much of the population is lagging behind. The most popular response survey participants gave for why they didn’t put more away in the past year was a drop, or no change, in income.

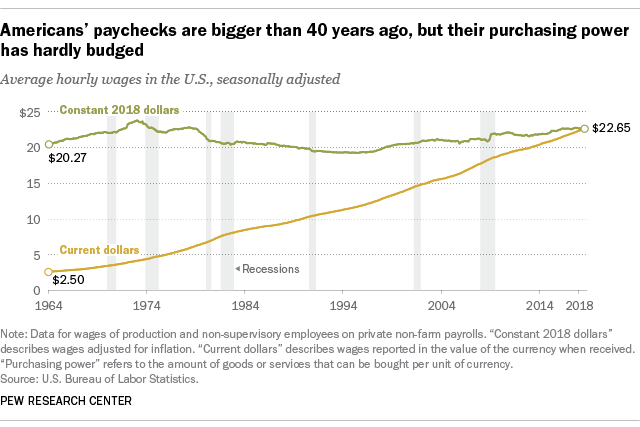

“That’s consistent with federal data that show real wages have barely budged in decades,” Bankrate reports. According to the Pew Research Center, the average paycheck has the same purchasing power it did 40 years ago.

Day-to-day costs continue to soar, and salaries don’t go as far as they once did to cover the necessities, author and executive director of the Economic Hardship Reporting Project Alissa Quart tells CNBC Make It. That makes it more difficult to set aside money for the future.

Still, the longer you put off planning for your golden years, the farther behind you’ll fall.

The good news is there are ways to make progress without feeling cash-strapped or committing to any drastic lifestyle changes. Here are three effective strategies:

1. Start ASAP. The sooner you begin putting your money to work, the less you’ll have to save each month to reach your goals, thanks to the power of compound interest.

If you start at age 23, for instance, you only have to save about $14 a day to be a millionaire by age 67. That’s assuming a 6 percent average annual investment return. If you start at age 35, on the other hand, you’d have to set aside $30 a day to reach seven-figure status by age 67.

Ideally, you’ll want to work your way up to setting aside at least 10 percent of your pretax income, but if you’re only comfortable with setting aside 1 percent, start there!

Check online to see if you can set up “auto-increase,” which allows you to choose the percentage you want to raise your contributions by and how often. This way, you won’t forget to up your contributions or talk yourself out of setting aside a larger chunk when the time comes.

If you can’t find the feature online, call your retirement plan provider to find out what’s possible.

3. Bank any surplus money. Whenever you come across any extra cash — a bonus, birthday check or small windfall — rather than blowing it on a new pair of shoes or a vacation, send at least a chunk of it straight to savings.

To resist the temptation to spend any surplus money, deposit it right away, so you never even see it.

Don’t miss: The economy is booming, yet Americans are struggling. An award-winning author explains why

Here’s how this North Carolina couple could retire in their 30’s.

Here’s how this North Carolina couple could retire in their 30’s.