Trump Tells Howard Stern About Watching A Man Almost Die

Listen to Donald Trump tell a bizarre story about the time he DIDN'T help a dying man

Posted by NowThis Politics on Thursday, September 28, 2017

Month: September 2017

Why the Trump Tax Plan Is Doomed

CheatSheet

This Innocent Photo of Paul Ryan Reveals Why the Trump Tax Plan Is Doomed

Sam Becker September 30, 2017

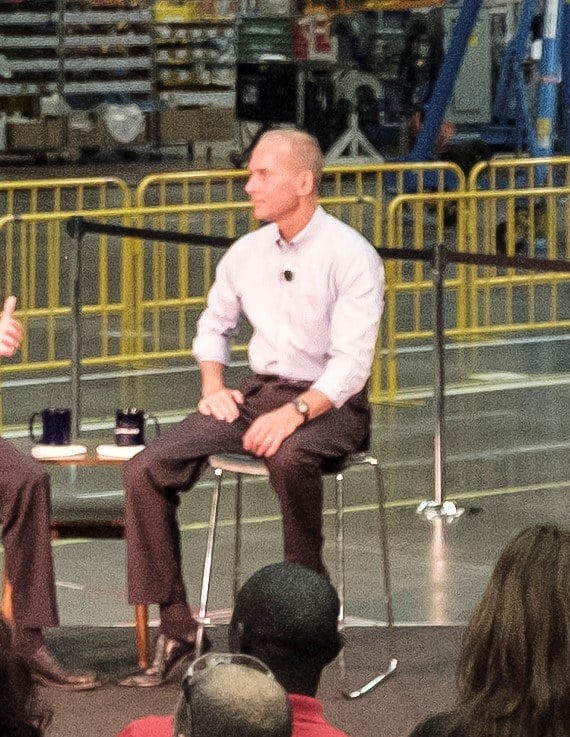

House Speaker Paul Ryan speaks during a town hall with Boeing Company CEO Dennis Muilenburg and Boeing employees at the company’s plant in Everett, Washington. Ryan also toured the factory and promoted the need for tax reform. | Stephen Brashear/Getty Images

House Speaker Paul Ryan speaks during a town hall with Boeing Company CEO Dennis Muilenburg and Boeing employees at the company’s plant in Everett, Washington. Ryan also toured the factory and promoted the need for tax reform. | Stephen Brashear/Getty Images

Paul Ryan, speaker of the House and the conservative movement’s intellectual darling, recently paid a visit to a Boeing plant in Everett, Washington. Everett is a medium-sized, working-class city just north of Seattle that’s been home to Boeing facilities for decades. In fact, the biggest building in the world — the Boeing Everett Factory — is the company’s crown jewel in the region.

But Ryan wasn’t there for a simple tour and to take in an AquaSox game. He was there to garner support for the Trump tax plan — a series of tax reforms Republicans claim will create jobs and spur the economy.

Right now, the details are sparse on what that plan would actually include. We know the Republican platform for a very long time has pushed for significant tax cuts for both corporations and individuals. And the basic idea is to free up money for wealthier people and employers, so they take that money and invest or spend it. Investing, in this case, means hiring more workers and buying more equipment for employers (a win-win for everyone), as well as spending money for individuals who will increase demand for goods and services. More demand? More jobs.

But the photo above, taken at the Boeing plant in Everett during Ryan’s visit, tells a larger story. While you see Ryan on stage with Boeing CEO Dennis Muilenburg, the devil is in the details. We’ll dig into the elements of the photo and what it means for Ryan, Donald Trump, the Trump tax plan, and the concept of tax reform in general.

Let’s take a quick look at why Ryan was there in the first place and what is means for you and America.

The Trump and ‘MAGA’ agenda

Paul Ryan had to convince the workers the tax plan would benefit them. | Stephen Brashear/Getty Images

The Trump tax plan has yet to be fully fleshed out but includes plans for cutting corporate rates from 39.5% to 15%.

We’re still waiting on the full details of the Trump tax reform plan, but we do have an outline. During Ryan’s visit, his job wasn’t just to convince Boeing execs and workers that tax reform would benefit them — many already agree — but that it would benefit Americans of all stripes. That includes all the workers in the room, both white- and blue-collar. It’s only one prong in Trump’s grand plan to “Make America Great Again,” and that includes freeing up corporate cash to hire more workers.

But Boeing and the state of Washington have a complicated past, and we’ll get to that. First, though, let’s address the main question everyone has about tax reform.

The Trump tax plan: Will it work?

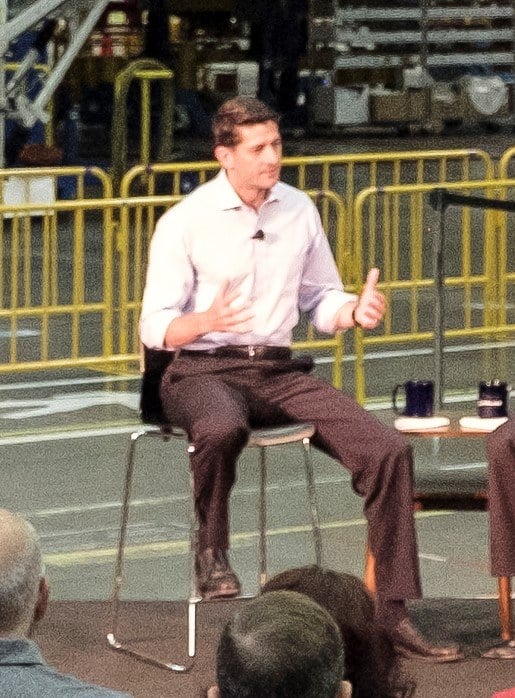

The CEO of Boeing received tax cuts for the business. | Stephen Brashear/Getty Images

In 2016, Boeing paid $1.2 billion in federal taxes — an effective rate of 23%.

Everything hinges on this one (well, maybe two) simple question: Will tax reform work? And, perhaps most significantly, can Republicans pass a new plan into law? We don’t know for sure, but we can look at what experts think and what experiments have wrought in the past.

Several analyses seem to think the Trump plan won’t work in that it won’t lead to increased economic growth. There are complicated reasons for this, but suffice it to say many think those who get the biggest tax breaks — wealthier individuals and corporations, typically — will stash the money and sit on it rather than invest or spend it. And a Tax Policy Center analysis says 20% of taxpayers will end up being worse off under the new plan than before. But for corporations and high earners? It should amount to a sweet deal.

We can’t forget about the recent tax experiment that took place in Kansas, either. Kansas Gov. Sam Brownback basically took this same plan and ran with it, slashing taxes to the bone. The result? Well, it wasn’t pretty. We can just leave it at that.

How, then, is Ryan supposed to sell this idea to the American people?

Selling tax reform to workers as ‘unrigging the economy’

Ryan claims the employees will receive higher pay thanks to employer tax cuts. | Stephen Brashear/Getty Images

Ryan claims the employees will receive higher pay thanks to employer tax cuts. | Stephen Brashear/Getty Images

The tax reform plan would lead to an average tax cut of $175,000 for members of the 1%.

In order to get people on board, Ryan needs to take a page from the MAGA playbook. Specifically, go back to rhetoric about the “rigged” economy and how it’s screwing everyday, hardworking people. For the middle class, who might not find tax cuts for millionaires and billionaires a very sexy idea, Republicans like Ryan have to appeal to their desires — namely, better jobs and higher pay.

That, Ryan will say, will be realized only after employers have more money — money they will keep as a result of tax breaks. The hard part is squaring the fact that there isn’t much evidence to back up what the Republicans are selling. That doesn’t mean it won’t work, of course, but it’s an uphill battle.

And getting back to the photo for a second, there’s one thing you don’t see: the laid-off and fired workers who have streamed out of Boeing factories for years now, even as Boeing has paid an effective tax rate well below the actual rate. If the company didn’t use the money to retain its workforce and hire more in the past, why would it in the future?

We’ll get into that now.

Boeing versus Washington state: A cautionary tale

With the tax breaks Boeing was given, it still cut jobs. | Stephen Brashear/Getty Images

With the tax breaks Boeing was given, it still cut jobs. | Stephen Brashear/Getty Images

In 2013, Boeing was given $8.7 billion in tax breaks as an incentive to “maintain and grow its workforce within the state.” Since then, it’s fired nearly 13,000 people and cut its Washington workforce by more than 15%.

Recently Boeing has been the recipient of massive tax cuts on the state level. In fact, Washington gave Boeing the biggest corporate tax break ever. At the time, the deal was that Boeing would get its tax breaks and keep jobs in Washington. As you can imagine, it didn’t pan out as planned.

Instead, Boeing took the money and ran. It has reduced its workforce in Washington by 15% since receiving the tax breaks and let go of around 13,000 workers. So, if you see some skeptical faces in Ryan’s crowd from our photo, that’s a big reason why.

For many who might be on the fence, a question of whether this type of plan would work nationwide is justifiably at the forefront of their minds.

Now imagine that, economy-wide

Investments in technology could mean bad news for employees. | Stephen Brashear/Getty Images

Investments in technology could mean bad news for employees. | Stephen Brashear/Getty Images

AT&T CEO Randall Stephenson estimates that every $1 billion in tax savings creates 7,000 jobs.

While we can’t expect every employer to act like Boeing did in Washington, we can expect corporations to act in their own self-interest. Politicians may want to use tax incentives (cuts) to get employers to hire more people and raise wages, but in reality it’s a different story. You end up with what happened in Kansas. Sure, there will be investments, but they might be in automation and technologies that help make business processes cheaper and more efficient. That’s good news if you’re a corporation, but bad news if you’re Joe Sixpack.

On CNBC a few months ago, AT&T CEO Randall Stephenson pushed for corporate tax breaks by saying 7,000 jobs are created for every $1 billion in tax savings. But as a New York Times writer points out, an analysis showed AT&T paid only 8% in taxes between 2008 and 2015 and actively downsized its workforce. Where did all the money go? $34 billion went toward buying back company stock in order to boost the share price.

With that, are Ryan and his Republican colleagues up to the task of selling the Trump tax plan to middle-class America?

Paul Ryan’s job is to convince workers it will be different

People aren’t convinced. | Stephen Brashear/Getty Images

A July 2017 survey shows a majority of Americans (62%) don’t approve of the Trump tax plan.

Suffice it to say, Ryan has his work cut out for him. Sitting in that room at the Boeing factory in Everett, he was facing a polarized audience. On one side, you have executives and white-collar managers who will easily buy into his rhetoric. On the other, you have the workers who have seen firsthand what happens when governments give in and hand out corporate tax breaks.

These are people who’ve been screwed. They’ve seen their co-workers and colleagues get laid off. And as all that has happened, they’ve seen stock prices soar and corporate profits reach new heights.

Again, this is an incredibly tough sell, especially for guys like Ryan and Trump.

Given Ryan (and Trump’s) history, tax reform will be a tough sell

Middle class workers are far from convinced. | Stephen Brashear/Getty Images

Middle class workers are far from convinced. | Stephen Brashear/Getty Images

Research from the Institute for Policy Studies shows of 92 U.S. corporations that paid less than 20% in corporate taxes, many used the money to buy back stock and increase their own share prices — not hire workers.

Tax reform isn’t very popular. It’s going to be a tough fight. And given that Republicans were unable to pass their health care plan (despite years of promises and complete control of the government), passing the Trump tax plan might prove to be even more difficult than anticipated.

You also have to look at our two central figures, Trump and Ryan, and their histories with middle-class America. In Wisconsin, unions have been decimated. Job growth has fizzled, and the state ranked 33rd in 2016. And as for Trump? He has a long history of stiffing workers and reneging on contracts. He’s not exactly the type of character middle America would trust, despite what happened in November 2016.

$4.8 Trillion in Tax Cuts? These States Are the Big Losers (and Winners) in Trump’s Tax Plan

CheatSheet

$4.8 Trillion in Tax Cuts? These States Are the Big Losers (and Winners) in Trump’s Tax Plan

Megan Elliott October 01, 2017

House Speaker Paul Ryan and President Donald Trump attend a meeting. Ryan is part of the group working on a federal tax reform plan. | Mark Wilson/Getty Images

House Speaker Paul Ryan and President Donald Trump attend a meeting. Ryan is part of the group working on a federal tax reform plan. | Mark Wilson/Getty Images

The White House and Congressional Republicans are gearing up to overhaul America’s famously complex tax code and “make taxes simpler, fairer, and lower for hard-working American families.” But if the legislation that eventually reaches Congress looks anything like the ideas floated by the Trump administration so far, average Americans might not have much to celebrate. That’s the conclusion of a report from the Institute on Taxation and Economic Policy. However, some states are more affected than others.

Proposals to streamline tax brackets, eliminate the alternative minimum tax, and get rid of many itemized deductions would result in $4.8 trillion in total tax savings through 2027. But 61.4% of all those savings would go to the top 1% of taxpayers, the organization concluded, and 14% of middle-income taxpayers would end up paying more in taxes, not less.

A tax cut for the richest Americans?

In addition to disproportionately benefiting the rich — who would receive tax cuts equivalent to 6.9% of their income, compared to 1.4% for the middle 20% — the suggested tax reforms would also benefit some states more than others. Generally, states with more rich people win big, while those with poorer people lose, though the possible elimination of deductions for state and local taxes makes the “picture somewhat more complicated,” according to the institute.

Which states will lose and benefit the most? Let’s take a look at the biggest losers first.

The tax reform losers

The institute ranked all 50 states and the District of Columbia based on the share of the tax cuts they’d receive relative to their share of the total U.S. population. It also looked at how different groups in each state would fare in 2018 if tax reform happens. Many, but not all, of the states that would get a smaller piece of the tax cut pie backed Trump in the 2016 election. Here are the seven that would get the worst deal.

7. Maine

Lubec, Maine | Don Emmert/AFP/Getty Images

Lubec, Maine | Don Emmert/AFP/Getty Images

Share of tax cuts relative to share of population: 71%; Average tax cut: $1,570

Overall, Maine would get a smaller share of the total proposed tax cuts than its share of the population. However, the tax cuts would be somewhat more equally distributed among different income groups in this state than they are in the U.S. in general. The richest 1% would get about 34% of all the tax cuts in Maine, while nationwide more than 61% of the cuts would go to the top sliver of the population. Fifteen percent of all the cuts would go to the bottom 60%, compared to 10% nationwide.

6. Oregon

A view of Oregon’s Mount Hood | Craig Mitchelldyer/Getty Images

A view of Oregon’s Mount Hood | Craig Mitchelldyer/Getty Images

Share of tax cuts relative to share of population: 69%; Average tax cut: $1,550

The richest 1% of taxpayers in Oregon would save $71,200 a year on their taxes if Trump’s various proposals are enacted, the institute estimated. The poorest 20% would save $110, while middle-income taxpayers would get an extra $740 in their pockets. Overall, the wealthiest 20% would get just over 70% of all the tax cuts.

5. New Mexico

Albuquerque, New Mexico | iStock.com/alex grichenko

Albuquerque, New Mexico | iStock.com/alex grichenko

Share of tax cuts relative to share of population: 67%; Average tax cut: $1,790

Middle-income taxpayers in New Mexico would save an estimated $580 a year if the administration’s tax reform proposals become reality. The richest 1%, who earn more than $1.2 million on average, would save $73,070. The poorest 20% would get an extra $80 a year.

4. Kentucky

A farm outside of Lexington, Kentucky | Jeff Haynes/AFP/Getty Images

A farm outside of Lexington, Kentucky | Jeff Haynes/AFP/Getty Images

Share of tax cuts relative to share of population: 66%; Average tax cut: $1,590

In Kentucky, middle-income taxpayers would save $640 a year if Trump’s tax changes become law — 1.4% of their total pre-tax income. The top 1%, on the other hand, would get an extra $68,550 per year, on average, equivalent to 5.2% of their total pre-tax income.

3. Arkansas

Little Rock, Arkansas | iStock.com/csfotoimages

Little Rock, Arkansas | iStock.com/csfotoimages

Share of tax cuts relative to share of population: 66%; Average tax cut: $1,600

Close to half of all Trump’s tax cuts would go to the richest 1% of Arkansans. This group would get to keep 6% more of their pre-tax income per year, or an average of $80,800. The middle 20% of taxpayers would get 1.3% of their income back, an average of $570 per year.

2. West Virginia

A state park in West Virginia | iStock.com

A state park in West Virginia | iStock.com

Share of tax cuts relative to share of population: 61%; Average tax cut: $1,380

The middle 20% of West Virginia taxpayers, who earn an average of $41,200 a year, would get an extra $500 a year in their pocket under Trump’s tax proposals. That’s 7.2% of all tax cuts in the state. Nearly three-quarters of all tax cuts in West Virginia would go to the top 20%.

1. Mississippi

Welcome to Mississippi. | iStock.com/Meinzahn

Welcome to Mississippi. | iStock.com/Meinzahn

Share of tax cuts relative to share of population: 53%; Average tax cut: $1,290

Fifty bucks. That’s how much the poorest 20% of people in Mississippi would save on their taxes under Trump’s proposals. Overall, the people at the bottom of the economic ladder would get less than 1% of all the tax cuts going to Mississippi, while the wealthiest 1% of taxpayers in the state would get 47.8% — equivalent to an average savings of $62,390 on their 2018 taxes. The middle 20% would get 13% of the tax cut, saving an average of $850 a year.

The tax reform winners

The following seven states would get a greater share of tax reform savings relative to their total population.

7. Florida

A beach in Boca Raton, Florida | iStock.com/ddmitr

A beach in Boca Raton, Florida | iStock.com/ddmitr

Share of tax cuts relative to share of population: 146%; Average tax cut: $3,160

Florida would get a disproportionate share of total tax cuts, according to the institute’s estimates. The bottom 60% of taxpayers in the Sunshine State would get 5.5% of all the tax cuts. Just under 8% would go to people in the fourth income quintile, and the remaining 86.6% would go to the top 20% of Floridians.

6. South Dakota

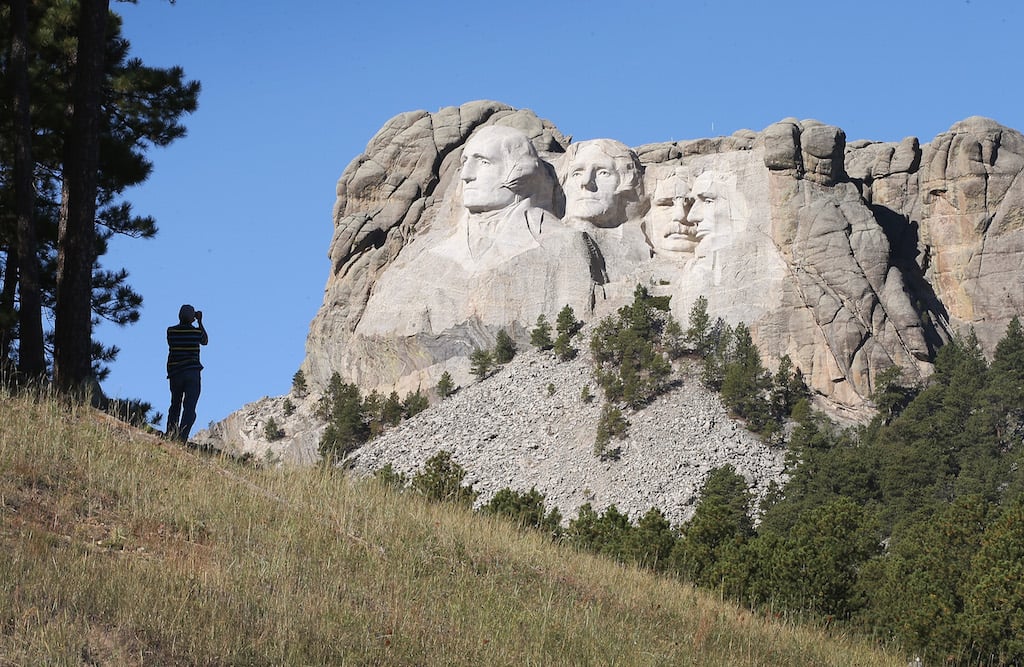

Mount Rushmore National Memorial in South Dakota | Scott Olson/Getty Images

Mount Rushmore National Memorial in South Dakota | Scott Olson/Getty Images

Share of tax cuts relative to share of population: 150%; Average tax cut: $3,530

The bottom three-fifths of South Dakota taxpayers, who earn an average of $59,300 per year, would receive an estimated $410 under Trump’s tax proposals. The richest 1%, who make an average of $1.77 million, would see their taxes fall by $203,110, or 11.5% of their pre-tax income.

5. Massachusetts

Harvard University in Cambridge, Massachusetts | Jorge Salcedo/Shutterstock

Harvard University in Cambridge, Massachusetts | Jorge Salcedo/Shutterstock

Share of tax cuts relative to share of population: 157%; Average tax cut: $3,380

People in Massachusetts may have overwhelmingly backed Hillary Clinton for president in 2016, but the state still would come out ahead when it comes to Trump’s tax proposals. Most of the gains would go to the top 1%, though, who would save an average of $215,670 on their taxes. Middle-income taxpayers, who earn $60,800 per year on average, would get $1,150 in tax savings.

4. North Dakota

Fargo, North Dakota | iStock.com/Ben Harding

Fargo, North Dakota | iStock.com/Ben Harding

Share of tax cuts relative to share of population: 163%; Average tax cut: $3,570

More than half of the $1.3 million in tax cuts for North Dakota would go to a handful of the state’s richest residents, who each would receive an average savings of $187,660. The middle 20%, who earn $58,600 per year on average, would get 4.4% of the savings, or roughly $800 each.

3. District of Columbia

Washington Monument | iStock.com/SeanPavonePhoto

Washington Monument | iStock.com/SeanPavonePhoto

Share of tax cuts relative to share of population: 169%; Average tax cut: $3,520

Not only does D.C. get more than its share of tax cuts relative to the population, but the wealthiest individuals get an extra large share of that pie. Nearly 70% of all the tax cuts would go to the district’s richest 1%, who each would save an average of $245,770 a year. Interestingly, the bottom 15% of the top 20% of D.C. taxpayers would actually pay more under Trump’s tax proposals — an additional $600 a year on average.

2. Connecticut

Lighthouse Point Park in Connecticut | iStock.com/enfi

Lighthouse Point Park in Connecticut | iStock.com/enfi

Share of tax cuts relative to share of population: 176%; Average tax cut: $3,960

Connecticut, home of bankers and hedge fund millionaires, would make out pretty well if Trump’s various tax reforms become law. The state would get a disproportionate share of the total cuts relative to its population, and the richest 1% would get close to 63% of all the benefit. People in this group would save an average of $253,050 per year on their taxes. The middle 20%, who earn $62,300 on average, would get $720 a year, or 3.7% of all the cuts.

1. Wyoming

Sunset at Teton Range | iStock.com/SeanXu

Sunset at Teton Range | iStock.com/SeanXu

Share of tax cuts relative to share of population: 213%; Average tax cut: $5,030

Wyoming may have a small population, but it’s the big winner when it comes to tax cuts. The $1.38 million the state would save on taxes in 2018 works out to a little over $5,000 per person. But the state’s poorest wouldn’t see nearly that much. The bottom 20% of taxpayers would get an extra $110 per year, and the middle 20% would get a tax savings of $940. The top 1%, meanwhile, would get to keep 10% more of their income, or $308,540 on average.

How The GOP Tax Plan Could Radically Reshape U.S. Housing Policy

HuffPost

How The GOP Tax Plan Could Radically Reshape U.S. Housing Policy

Arthur Delaney, HuffPost September 29, 2017

WASHINGTON ― The tax reform blueprint Republicans unveiled this week would upend U.S. housing policy if it becomes law.

Even though the plan maintains a special tax break for homeowners called the mortgage interest deduction, other provisions of the framework would basically make it useless for all but the richest homeowners.

“This proposal will take away any tax benefit for owning homes for the vast majority of people who own homes,” said Gregg Polsky, a tax expert at the University of Georgia.

Mortgage interest and property tax deductions cost the U.S. Treasury more than $100 billion a year in lost tax revenue, expenditures that are bigger in dollar terms than any other housing program. The federal government spends about $50 billion annually on housing assistance for people with low incomes, an amount that still leaves millions of people on waitlists for rental assistance. The mortgage interest deduction, meanwhile, overwhelmingly benefits homeowners with incomes above $100,000.

The National Association of Realtors, a powerful real estate lobbying group, commissioned a study earlier this year finding the proposal would increase taxes on middle- and upper-class homeowners and reduce incentives for homeownership, thereby shrinking home values by about 10 percent.

“Plummeting home values are a poor housewarming gift for recent homebuyers and a tremendous blow to older Americans who depend on their home to provide a nest egg for retirement,” NAR President William Brown said in a press release this week.

Lower housing prices can be bad for homeowners but good for renters, roughly a third of whom deal with unaffordable rents, according to the Joint Center for housing Studies at Harvard University. Most American households are owner-occupied, though ownership rates have declined from a high of 69 percent in 2004 to 63 percent today.

The Republican tax reform outline actually maintains the mortgage interest deduction, but other parts of the plan seriously undermine it.

“They really leave it in name only,” Polsky said.

Current policy allows tax filers to choose whether they would like to reduce their taxable income by deducting the value of various expenses ― which is known as “itemizing” ― or would rather take a so-called standard deduction. For a married couple the standard deduction takes away $12,600 of their taxable income. The vast majority of filers go with the standard deduction because their expenses that would be itemized don’t exceed $12,600.

The Republican plan would raise the family standard deduction to $24,000 while eliminating most itemized deductions, including ones for local taxes. Homeowners could still itemize their mortgage interest payments and charitable donations, but only about 5 percent would have itemized deductions that exceed the value of the $24,000 standard deduction, according to NAR.

The doubled standard deduction would not necessarily be a better deal for all middle-class families, however. The Republican plan also calls for eliminating the “personal exemption,” which allows taxpayers to deduct $4,050 per family member from their taxable income. Some families with multiple children would benefit less from the higher standard deduction than they currently do from being able to claim multiple personal exemptions.

In other words, the Republican tax plan could hike taxes on some middle-class families, a possibility one presidential adviser has acknowledged. And some Republicans in Congress are already chafing at repealing the deduction for state and local taxes. It’s unlikely that the tax framework released this week can get through Congress without a lot of changes.

Liberal policy groups have advocated converting the mortgage interest deduction into a credit that more narrowly targets homeowners with lower incomes. Diane Yentel, president of the National Low Income Housing Coalition, said the Republican plan would only make the mortgage interest deduction “even more regressive than it is today.

Trump’s “Trickle down economics is fundamentally flawed.”

Daily Kos

September 29, 2017

“Trickle down economics is fundamentally flawed.” Never worked; never will. America’s middle class cannot drive demand for goods and services unless they have disposable living wages to spend. And because our manufacturing sector has been decimated by corporate greed, offshoring jobs, our economy depends on a retail sector comprising more than 70% of our economy. JH

Trickle down economics is fundamentally flawed.

Posted by Daily Kos on Thursday, September 28, 2017

I’m Out of Empathy. I’m Out of Pity. I’m Out of Patience.

Esquire

I’m Out of Empathy. I’m Out of Pity. I’m Out of Patience.

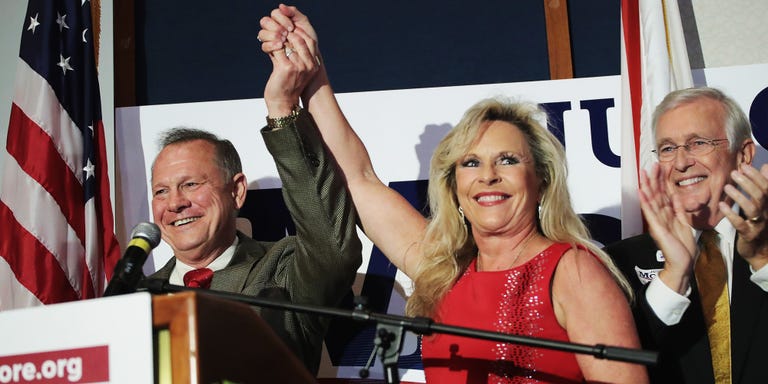

Roy Moore is a lawless theocratic lunatic, and those who support him are destroying our democracy.

Getty

Getty

By Charles P. Pierce September 27, 2017

On Tuesday night, the voters in the great state of Alabama pushed a lawless theocratic lunatic named Roy Moore one tiny step away from a seat in the United States Senate. Moore lost his job as chief justice of that state’s supreme court twice; on both occasions, he lost it by flouting the authority of the federal court system as though he were Orval Faubus in 1957.

Lawless.

Moore believes that homosexual conduct should be illegal, and, as he said, he believes:

“God is sovereign over our government, over our law. When we exclude ‘Him’ from our lives, exclude ‘Him’ from our courts, then they will fail We’ve forgotten that God is intimately connected with this nation. Without God there would be no freedom to believe what you want.”

Theocratic.

And, to conclude, from The Washington Post:

“There is no such thing as evolution,” he said at one point as he waited for his lunch. Species might adapt to their environment, he continued, but that has nothing to do with the origins of life described in the Bible. “That we came from a snake?” he asked rhetorically. “No, I don’t believe that.”

Lunatic…Period.

Getty

Getty

Any report about Roy Moore that doesn’t specifically refer to him as a right-wing extremist is not worth your time. No more “firebrand.” No more impotent yap about his “controversial views.” Roy Moore is an extremist or the word no longer has meaning. If, as appears likely, he gets elected to the Senate from Alabama, then a majority of Alabama voters are extremists, too. If he gets elected, then the Republican Party ever more should be referred to as an extremist party. That, of course, is if we’re being honest about what’s really going on in this country in 2017.

If Moore gets elected, then the Republican Party ever more should be referred to as an extremist party.

And, no, when it comes to the people who voted for Moore, I don’t have to “respect their beliefs.” I don’t have to “understand where they’re coming from.” I don’t have to “see it from their side.” These people are preparing to make a lawless theocratic lunatic one of 100 United States Senators, and that means these people are about to inflict him and his medievalism on me, too. If you think that Roy Moore belongs in the Senate, then you are a half-bright goober whose understanding of American government and basic civics probably stops at the left side of your AM radio dial. You have no concept of the national interest and very little concept of your own, unless, as I suspect, you’ve made your own fears, and hating people and hawking loogies in all directions, the sum total of your involvement in self-government. You are killing democracy and you don’t know it or care. If you had any real Christian charity in your hearts, you’d keep Roy Moore in the locked ward of your local politics and not loose him on a nation that deserves so much better than him.

Why do I not have to “respect their beliefs,” besides the fact that most of those beliefs belong in a cage? I don’t have to “respect their beliefs” because the U.S. Senate to which they are preparing to send him is in the process of screwing them with their pants on and they could care less.

Getty

Getty

The Senate’s tax plan emerged full-grown from the forehead of Mania on Tuesday. As is customary for some documents, it is vague in almost all its major details. But we do know that it eliminates the estate tax entirely—a plutocratic goodie that probably caused a postmortem emission from the grave of John D. Rockefeller that looked like the gusher from his first oil well—and it gives to the middle class with one hand while taking it away from the other, thereby robbing Peter to bribe Paul. Ultimately, the estimates are that it will cost the federal treasury $1.5 trillion over the next decade, and the people pushing it decline to say how they’re going to make that cut pay for itself, proving that the Republicans at least continue to adhere to the first half of the blog’s First Law of Economics, to wit: Fck The Deficit. The only details that are clear about the plan are the ones that benefit the country’s real owners.

What I do know is that the people who elected Roy Moore elected him to join the Senate majority that will pass this thing, if and when it ever comes to a vote. Then, come some April morn, they will be stunned to discover that they can’t deduct what they pay in state taxes anymore, and that their charitable contributions don’t count any more either. How could ol’ Judge Roy let this happen?

You are killing democracy and you don’t know it or care.

Because he’s a lawless theocratic lunatic, that’s how. Because you voted for him specifically because he was a lawless theocratic lunatic. It was the basis of his campaign, no matter how many times Steve Bannon tells you you’re part of a bold populist crusade. He very likely doesn’t know enough about tax policy to throw to the cat, so he’ll go along on that as long as they let him make his floor speeches about how Cecile Richards is an imp from hell. (Condom: The Devil’s Party Hat.) And you’ll cheer him so loudly that you won’t even notice that your pocket’s being picked again by someone with a solid-gold Rolex on his wrist.

I’m out of empathy for this stuff. I’m out of pity. I’m out of patience. And, not for nothing, but Moore’s opponent is a guy named Douglas Jones. In 2001, Jones convicted two men for the bombing of the 16th Street Baptist Church in Birmingham in 1963, one of the iconic white supremacist terrorist acts of that period. One of those bastards already died in prison and the other keeps getting denied parole. If you’d rather be represented in the Senate by a lawless theocratic lunatic, rather than a guy that finally got justice for four murdered little girls, well, you deserve anything that goddamn happens to you.

The Trump administration is waging an unprecedented war on governing

Washington Post, The Plum Line

The Trump administration is waging an unprecedented war on governing

By Paul Waldman September 28, 2017

It can be tough to keep up with all the antics of President Trump’s Cabinet, especially when its members are cruising around the country on all those private jets. But eight months into the Trump presidency, it has become clear that never in our history have we seen so many Cabinet officials who are fundamentally opposed to the mission of the department they’ve been chosen to lead.

What is happening now goes far beyond the standard Republican desire to cut government and restrain regulation. It is nothing less than a war waged on governing itself from inside the executive branch.

To illustrate what’s going on, let’s start with this report from Charlie Savage of the New York Times:

Scott Pruitt, the Environmental Protection Agency administrator who has aggressively pushed to dismantle regulations and downsize the organization, is threatening to reach outside his agency and undermine the Justice Department’s work enforcing antipollution laws, documents and interviews show.

Under Mr. Pruitt, the E.P.A. has quietly said it may cut off a major funding source for the Justice Department’s Environment and Natural Resources Division. Its lawyers handle litigation on behalf of the E.P.A.’s Superfund program seeking to force polluters to pay for cleaning up sites they left contaminated with hazardous waste.

This is just one of the many things that Pruitt is doing, but it shows how he has utterly and completely rejected the premise that the role of the Environmental Protection Agency is to protect the environment. Just the opposite, in fact — everything Pruitt is doing seems designed to produce more pollution and a dirtier environment. He has now turned himself into a roving pollution advocate, trying to undermine environmental protection wherever it might be going on.

Before you say, “Well, what did you expect?,” remember that this isn’t how previous Republican presidents have done things. They were never fans of the EPA, but even if they were trying to loosen environmental regulations in a variety of different ways, they’d usually find some moderate Republican to put in charge at the EPA, at least for show if nothing else. George W. Bush appointed Christine Todd Whitman, one of a dying breed of northeastern moderates. His father appointed William Reilly, who had been president of the World Wildlife Fund. The worst EPA administrator up until now was undoubtedly Ann Gorsuch (yes, Neil M. Gorsuch’s mother), but even she didn’t do the damage Pruitt is attempting, and after scandal engulfed her, Ronald Reagan replaced her with William Ruckelshaus, who had been the agency’s first administrator and was a strong environmentalist.

Washington Post reporter Dennis Brady talks with Mustafa Ali, a former EPA environmental justice leader who served more than two decades with the agency, to discuss the consequences of President Trump’s budget proposal. (McKenna Ewen/The Washington Post)

Washington Post reporter Dennis Brady talks with Mustafa Ali, a former EPA environmental justice leader who served more than two decades with the agency, to discuss the consequences of President Trump’s budget proposal. (McKenna Ewen/The Washington Post)

Now let’s go to our next example.

Many assumed that if Republicans failed to destroy the Affordable Care Act through legislation, the administration would put some effort into making it work properly, since they’re now responsible for it and will be held accountable for whatever problems there are in the health-care system. But just the opposite has happened. In fact, the Department of Health and Human Services under Tom Price has undertaken a positively breathtaking campaign of sabotage. It is no exaggeration to say they are doing everything they can to create a death spiral in the individual health-care market, trying to discourage as many people as possible from getting insurance so that the only ones who do are the sick and the old, which will drive premiums ever higher until the market completely melts down.

They have threatened to withhold cost-sharing payments from insurers, which has already driven premiums up substantially. They cut the open enrollment period in half. They slashed the budget for advertising to encourage people to enroll by 90 percent, and used some of what was left to create videos meant to discourage people from getting insurance. They canceled contracts with community groups that assist people in the sometimes complicated process of signing up. And in a particularly creative move, they’ll be shutting down healthcare.gov on all but one Sunday during open enrollment, for “maintenance.”

And when Vox asked HHS about its decision to abruptly pull out of all outreach events in the South, the department issued a statement that read in part:

The American people know a bad deal when they see one and many won’t be convinced to sign up for ‘Washington-knows-best’ health coverage that they can’t afford. For the upcoming enrollment period, Americans are being hit with another round of double-digit premium hikes and nearly half of our nation’s counties are facing Obamacare monopolies. As Obamacare continues to collapse, HHS is carefully evaluating how we can best serve the American people who continue to be harmed by Obamacare’s failures.

I have truly never seen anything like that in all my years of observing politics. This is the agency that is mandated by law to implement the Affordable Care Act, which includes taking all the steps it can to maximize enrollment, proclaiming that it has no intention of doing so. It’s mind-boggling.

I’d contend that this is a direct result of Trump’s personal style and approach to government, which is in large part about not bothering to pay lip service to commonly-held norms of behavior or even explicit rules. Trump doesn’t bother to pretend that he cares about Americans who didn’t vote for him, or that he has a commitment to foundational democratic principles, or that there’s something wrong in using the presidency for personal financial gain. Every element of his repugnant personality and utter lack of morality is right on the table; there is nothing hidden or subtle about him.

Just as his railing against political correctness gave his supporters permission to let their hate flags fly, his naked contempt for anything resembling integrity in government gives his appointees permission to be open about their intentions. In another Republican administration, these same people at HHS would have issued a statement saying something like, “We’re carrying out all our duties as the law requires, but this particular meeting was inconvenient.” They would have continued to find ways to undermine the ACA, but they would have done it quietly, on the assumption that attracting too much attention to their efforts would have been problematic. But now, they just don’t care.

President Trump spoke about religious freedom at the Celebrate Freedom Concert in Washington D.C. on July 1. (The Washington Post)

There are other Cabinet officials who are waging their own wars on their departments. There’s Rex Tillerson, who can’t seem to figure out why the State Department exists. There’s Ryan Zinke, who acts as though the purpose of public lands is to be nothing more than a receptacle for fossil fuels that private companies should extract at their will. And there’s Betsy DeVos, who leads the Education Department despite having devoted her adult life to the destruction of public education in America.

At the same time, we should acknowledge that some of Trump’s appointments are repugnant but not much different from what you’d expect from another Republican president. For instance, you could easily see Marco Rubio or Ted Cruz putting a coal mining executive with a history of safety violations in charge of the agency that polices mine safety, as Trump has done. Trump has also picked a lot of people for key positions who are simply unqualified, such as Ben Carson and Rick Perry.

But the kind of outright assault on the core mission of the departments many of Trump’s appointees are leading, and the unapologetic way in which it’s being done, are something new. The equivalent for a Democrat would be if they appointed the leader of Code Pink to be secretary of defense and instructed her to set about dismantling the American military. Which of course a Democrat would never do.

There’s an old saying that Republicans claim that government doesn’t work, then when they get control of it they set about to prove themselves right. But Trump is going much further than Republicans have before. And who knows how long it will take to undo the damage.

Paul Waldman is a contributor to The Plum Line blog, and a senior writer at The American Prospect.

Ryan Zinke Claims One Third of Interior Workforce ‘Not Loyal’ to Him, Trump and Flag

EcoWatch

Ryan Zinke Claims One Third of Interior Workforce ‘Not Loyal’ to Him, Trump and Flag

Lorraine Chow September 27, 2017

Interior Sec. Ryan Zinke, who recently recommended shrinking a “handful” of national monuments to President Trump, said that one third of the department’s employees are “not loyal” to him, the president and the flag.

Interior Sec. Ryan Zinke, who recently recommended shrinking a “handful” of national monuments to President Trump, said that one third of the department’s employees are “not loyal” to him, the president and the flag.

The remarks were made at the National Petroleum Council meeting in Washington, DC on Monday.

According to an Associated Press report:

Zinke, a former Navy SEAL, said he knew when he took over the 70,000-employee department in March that, “I got 30 percent of the crew that’s not loyal to the flag.”

In a speech to an oil industry group, Zinke compared Interior to a pirate ship that captures “a prized ship at sea and only the captain and the first mate row over” to finish the mission.

“We do have good people” at Interior, he said, “but the direction has to be clear and you’ve got to hold people accountable.”

To help steer this proverbial pirate ship, Zinke has appointed a crew from the fossil fuel industry, including former oil lobbyist David Bernhardt as the deputy interior secretary.

He has also reassigned senior officials to completely unrelated positions, including climate change expert Joel Clement, who was notoriously transferred to an office that oversees fees and royalty checks from oil and gas companies.

“I’m the climate change guy, and they moved me to the accounting office that collects fossil fuel royalties,” Clement wrote in the Washington Post. “They couldn’t have found a job less suited for me, or that sent a clearer signal that they were trying to get me to quit.”

Zinke has said before that he wants to cut his department’s workforce by 4,000 employees, or about eight percent of the full-time staff, as part of budget cuts to downsize the department.

During his speech to oil execs, the former Montana Republican senator said he is working to change the Interior Department’s regulatory culture to be more business friendly, and is working on a major agency reorganization so that decision-making would go outside Washington, according to the AP.

The secretary also wants to move several agencies, including the Bureau of Reclamation and Bureau of Land Management, to states in the West.

In the same wide-ranging speech, Zinke said he wants to speed up permits for oil drilling, logging and other energy development; that the Endangered Species Act has been “abused” by bureaucrats and environmental groups and needs to be reformed to be less “arbitrary”; and, oddly, “Fracking is proof that God’s got a good sense of humor and he loves us.”

Norway has built one of the worlds greenest airports

EcoWatch

It uses stockpiled snow to cool the building in the summer.

Posted by EcoWatch on Tuesday, September 26, 2017

Dallas Sportscaster Dale Hansen Explains what Trump Doesn’t Understand

Occupy Democrats

WOW. Watch these 3 minutes from Dallas sportscaster Dale Hansen talking about what Trump doesn't understand about the national anthem and the right to protest. Compare this to any right-wing media whining and that's why this is one to remember.

Posted by Media Matters for America on Monday, September 25, 2017