Miami Herald

They bought their dream homes from the ‘King of Coconut Grove.’ They still can’t move in

Linda Robertson – March 12, 2023

Twelve new townhouses line a block of Coconut Avenue. Lushly landscaped, outfitted with high-end appliances and spacious closets, they’re in move-in condition. Yet the Coconut City Villas are empty, as empty as their backyard swimming pools and unsullied trash bins sitting in unoccupied driveways.

Instead of “For Sale” signs, house hunters see “No Trespassing” notices posted along the street and “Do Not Enter” decals stuck to the front doors, a curious contrast in Coconut Grove, one of the most hotly desired neighborhoods in the country, where housing prices have nearly doubled over the past three years.

The lack of residents can’t be explained by lack of demand. The 4,000-square-foot townhouses, originally priced from $1.2 million to $1.8 million, are under contract to buyers who put down as much as $500,000 starting as far back as 2018. They were told by developer Doug Cox their homes would be ready in 45 to 90 days, or at the latest six months.

They’ve been waiting ever since. Their plans have been perpetually postponed by Cox, owner of Drive Development, who has not closed a house sale in four years despite a booming market. His completion dates teased buyers as the houses beckoned. But their dreams of a dream home have gone bust.

They have been locked out and led into a dead end darkened by threats, lawsuits, non-disclosure agreements and unsavory lenders, buyers say.

The delays have turned buyers and their families into nomads — moving from one expensive rental to another, cramming in with relatives while living out of suitcases — draining their finances and testing their marriages. When they go past their houses they are tantalized by memories not made — cooking in the kitchen, playing in the pool, celebrating birthdays, hosting block parties.

“We’ve spent three Christmases in limbo,” said Alan Lombardi, who signed a contract three years ago with the assurance that he, his husband and their newborn twin daughters would move in by summer 2020. The twins are now age 3. “The developer has kept us hanging on his hook, ruining people’s lives by deceiving us with false promises, just like Bernie Madoff.”

Lombardi has asked the FBI to investigate Cox for running a Ponzi scheme.

READ MORE: Real estate contracts tend to favor developers. What homebuyers should watch out for

The buyers can’t move in because Cox has failed to complete inspections and get certificates of occupancy from city of Miami building department officials, whose lack of oversight enabled Cox to ignore expired permits and a Stop Work order and avoid applying finishing touches on houses for years. The city, which has ceased responding to buyers’ calls and emails, says it can’t intervene in a private dispute.

The buyers got caught in the fallout from Miami’s COVID-driven housing gold rush. Some are transplants from New York, Chicago and California who were eager to sign purchase agreements for new homes that looked — outside and inside — like they were ready to sleep in, missing only a mirror, some paint, a fence. They want their plight to serve as a warning: Don’t make one-sided deals with developers.

Cox is deliberately stalling to frustrate them into canceling their contracts so he can flip each house for an additional $1 million or more, buyers allege. They feel trapped: As time passed, the market skyrocketed, and in 2023 they will never find comparable homes in the neighborhood for the price they planned to pay and the mortgage rate they had secured.

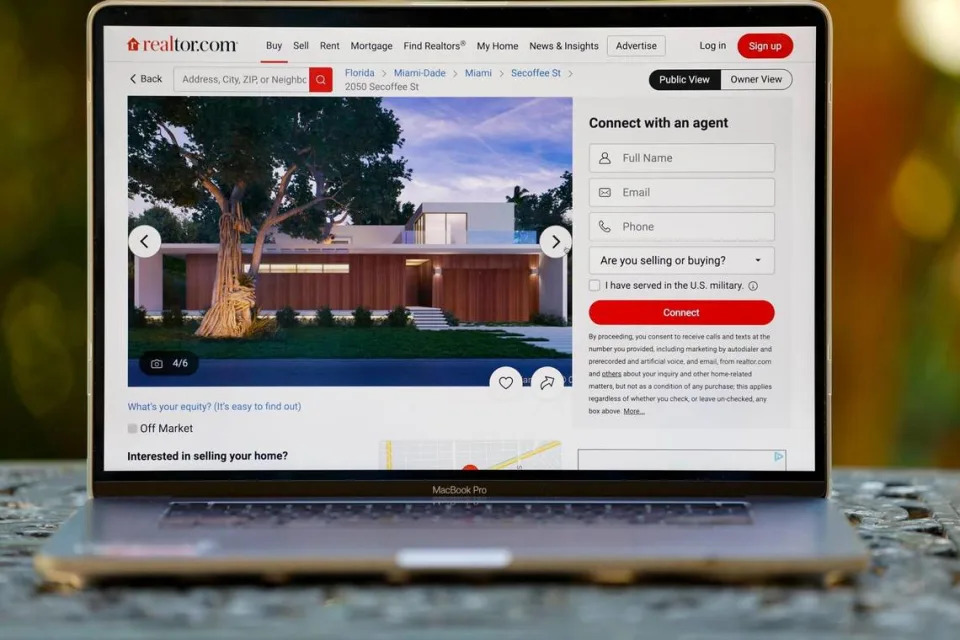

On Wednesday, Drive Realty listed 2986 Coconut Ave. for $2.495 million. Original sales price in July 2020 was $1.385 million, a difference of $1.11 million. One catch: It doesn’t have a certificate of occupancy so anyone who buys it can’t move in.

“Seems like a shell game,” said Andy Parrish, a longtime Miami developer who lives in Coconut Grove. “He’s put these people through hell by stonewalling them with excuses.”

One weary buyer confided in Parrish, cried on his shoulder.

“She said, ‘I can’t believe people lie to other people like this,’ ” Parrish said. “I told her, ‘Welcome to Miami! A sunny place for shady people.’ ”

Cox, 52, initially agreed to an interview with the Miami Herald, then changed his mind and asked for emailed questions. He didn’t respond to questions sent twice or attempts to talk to him over the past two weeks.

Nicole Pearl, 37, who is Cox’s business partner and mother of their three children, declined to talk to the Herald. Her law firm, Pearl & Associates, is the registered agent of companies connected to the properties, Florida corporate records show. She is a licensed real estate agent who lists homes for Drive Realty.

The Herald spoke to 16 buyers — many did not want their names published, fearing retaliation by Cox — and examined lawsuits, mortgages, purchase agreements, property records and Miami building department reports, which substantiated buyers’ chorus of complaints.

No sales closed since 2019

Cox calls himself the “King of Coconut Grove.” His clients call him less flattering nicknames. What his gambit is no one can say for certain because he has not sold a home since August 2019 when he and Pearl closed on a Bridgeport Avenue townhouse for $1.15 million. Closing on the new homes should be a mutual goal but there are no signs of progress. He offers clients refunds of their deposits and says he’s got a line of backup buyers.

“It’s a strange way to run a real estate development company,” Lombardi said. “It’s really an anti-development company. Why doesn’t he want to deliver? How can he afford to operate?”

Cox has told buyers he wants to get them into their special houses, but he’s been delayed by factors beyond his control: the pandemic, supply-chain problems, manpower shortages, rising construction costs, subcontractor snafus and now bureaucratic red tape in the building department tangling his efforts to finish inspections.

Double contracts on homes

Is Cox playing musical chairs? At least three of the townhouses have double contracts on them. The legal descriptions correspond to 2955, 2960 and 2990 Coconut Ave.

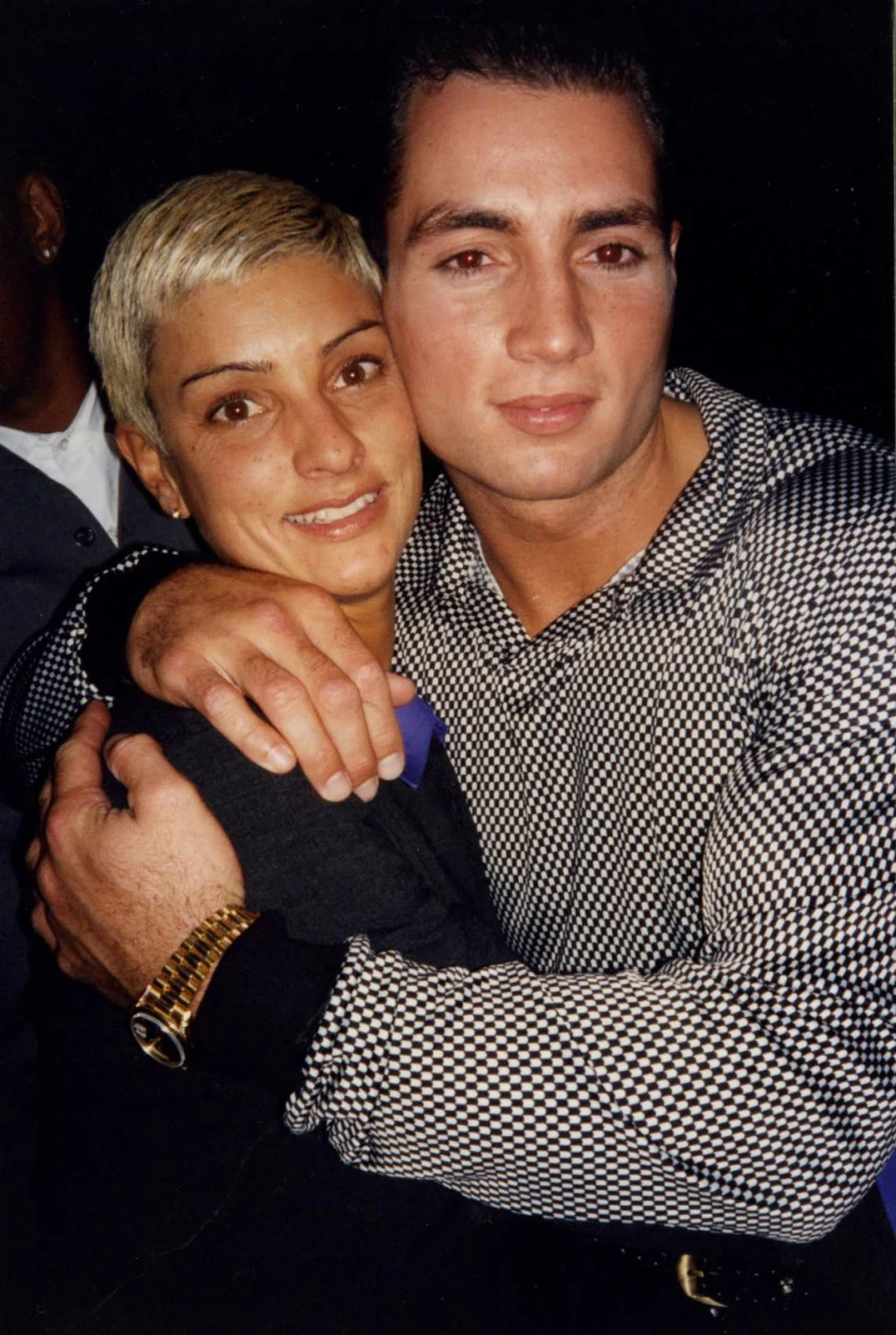

Some buyers discovered through Miami-Dade Clerk of Court records that near the end of 2022 Cox signed a “memorandum of contract” on their houses with Chris Paciello, the former South Beach nightclub impresario, and his business partner, Mio Danilovic. Before he became famous for hosting parties at Liquid and dating Madonna, Sofia Vergara and Jennifer Lopez, Paciello was a Mafia henchman and thief in New York City.

Once Paciello’s past caught up with him in 2000, he became an FBI informant, pleaded guilty to racketeering and served six years in prison for robbing $300,000 from a New York bank and driving the getaway car in a home invasion during which a Staten Island housewife was shot in the face and killed.

Paciello, the owner of four Anatomy Fitness deluxe gyms in South Florida, has ventured into real estate investment since the pandemic and flipped houses for $9 million and $14 million in Miami Beach. It’s unclear how much of a deposit Paciello and Danilovic put down in their backup contract deal with Cox. Backup contracts are not illegal.

When contacted by the Herald, Paciello, 51, declined to comment.

In another complication that has alarmed buyers, Cox took out a $350,000 loan in December from DC Fund based in Sunny Isles Beach, whose associates include men who were sued for racketeering in an alleged loansharking scheme that disguised “criminally usurious loans” as cash advances that had to be repaid with 430 percent interest, according to a lawsuit filed in Brooklyn. Cox put up eight properties as collateral. If he defaults on the loan, he could lose them.

Buyers have observed Cox showing their houses to prospective buyers on multiple occasions. He says he is merely displaying his handiwork, and not offering those particular houses for sale. But contract holders have heard from acquaintances whose names are on a list of backup buyers Cox has compiled. One is upset he’s only No. 3 on the list.

If Cox is flipping the townhouses, for how much? Miami real estate agent Randi Connell, who identifies herself as a Drive Development sales associate, recently texted a prospective buyer about two off-market Coconut Avenue houses available for $2.7 million and $3 million, which is $1.5 million and $1.2 million more than the original sales prices.

Pearl listed 2986 Coconut Ave. for sale for $2.495 million on Wednesday morning. The house first went under contract for $1.385 million on July 8, 2020, to Jonathan Schonfeld and Aviva Auslander, with a completion date of Sept. 1, 2020, or at the latest, March 1, 2021. They waited two years. Disgusted, they gave up.

If Cox and Pearl land a buyer for 2986, they could collect at least a $500,000 deposit and “utilize” it as they please, according to two Send Enterprises contracts the Herald reviewed. Contrary to realty ethics rules, Pearl did not disclose in the listing that the house doesn’t have a certificate of occupancy, and its building permit expired Feb. 15.

“If the delays are indeed outside their control, how can they list a property if they don’t know when or if they can close?” Lombardi asked.

South Florida real estate lawyer Dennis Eisinger said home buyers can get “boxed in” by contracts that typically favor the developer and waive buyers’ rights.

“It appears this developer is bullying the buyers to get the financial advantage,” he said. “We saw this situation before the recession in 2003-2006 when defiant and unscrupulous developers tried to get buyers to rescind contracts so they could resell at higher prices.”

Lawsuits, ‘worst decision of my life’

At least three buyers, including Schonfeld and Auslander, sued Send Enterprises, alleging fraud and breach of contract. The cases were assigned to mediation, as required in the contracts; buyers cannot seek a jury trial. They had to sign non-disclosure agreements. At least four others have taken Cox up on his offer to refund their deposits and walk away; they also signed NDAs.

Catherine and Andrew Prescott of Miami Beach signed a $1.82 million purchase agreement on May 25, 2021, and paid a $455,000 deposit for 2960 Coconut Ave. The contract stipulated a completion date of Aug. 1, 2021, and an “outside” closing date within six months.

The Prescotts sued Send Enterprises in January 2022 for its alleged failure to achieve specific performance of its obligations, fraudulent inducement, unfair trade practices, negligent misrepresentation and unjust enrichment.

In their lawsuit, which also named Cox, Schonfeld and Auslander asserted that Cox “repeatedly lied” about “fabricated dates.” The Prescotts said the developer made promises “without any intention of performing, or with the positive intention to not perform” to entice them to sign and pay a deposit. The cases went to mediation and everyone signed NDAs.

Three months after the Prescotts sued, a real estate agent who works with Cox offered the house for $2.4 million, about $600,000 more than the original sales price.

Other buyers are determined to stick it out. They can’t afford to hire a lawyer. They’re not ready to abandon the houses they’ve invested in, emotionally and financially. And they don’t want to let Cox win.

“If I could rewind time — this was the worst decision of my life,” said Kevin Ware, who owns an insurance brokerage firm. He moved his family from Chicago in March of 2021, walked through a Coconut Avenue townhouse that was weeks from completion and fell in love with it. They’ve lived in three rentals since. “We cannot let Doug keep scamming more people. We don’t want anyone else to get caught in this predicament. Buyer beware.”

Strung along by Cox, buyers acquired mortgages with 2 percent rates that have since tripled.

“It must be exhausting to be Doug Cox. He lives in 15-minute increments. Think of all the lies he has to keep track of,” Ware said. “We have paid a high price for dealing with him. From the sheer expense of living in short-term housing to the financial damage of losing our mortgage rate locks to the strain on our relationships and mental health, Doug has constantly and cruelly put his greed above our well-being.”

‘Cautionary tale for other home buyers’

For Lombardi and his family, it’s been a three-year ordeal, first sharing his mother’s small Hollywood condo with his partner and infant twins, now in a $5,000-per-month Midtown apartment.

“We thought it would be a three-month wait because the house was 80 percent done, so we sold our Brickell condo, put everything, including baby equipment, in a sealed storage pod, packed four suitcases and moved in with my mom — for two years,” said Lombardi, a real estate agent.

The twins never had the nursery Lombardi envisioned.

One buyer described himself and his wife as “40-year-old couch surfers.” They’ve lived in seven different places.

New York transplants Michael Coyne and his wife, Oksana, have 1-year-old twin daughters and a 3-year-old son, and expected to share 2978 Coconut Ave. with her parents, who fled Ukraine after Russia attacked. Among the six places they have lived since their closing date evaporated was a one-bedroom apartment.

Coyne said they moved to a rental in Rhode Island to wait it out because they couldn’t afford “insane” rents in Miami. Fueled by inflation that’s made housing unaffordable for many and the influx of remote workers and newcomers moving to a no-income tax state, Miami has become the most competitive rental market in the country with prices 76 percent higher than the national median, a Zillow study showed.

Coyne, an investment banker, wanted to open an office with two of his business associates in Miami but he’s told them not to come. Oksana, a registered nurse, was scheduled to do her clinical work to become a nurse practitioner; she’s postponed her career plans. The chaos has been difficult for the children and Oksana’s Ukrainian parents, who speak limited English.

“Doug and Nicole either lie to you or ignore you,” Coyne said. “You work really hard for your family to buy the most important asset of your life and you get caught in a calculated, malicious, exploitative scheme by a flimflam developer.

“I’m not letting him get away with it. Let this be a cautionary tale for other homebuyers.”

One family has suffered the longest. They chose a four-bedroom model four and a half years ago so their 12-year-old daughter would have her own room and so her grandmother, recovering from cancer, could live with them. Now, the daughter is a high school senior heading to college in the fall. The grandmother never got to move in with her family.

City of Miami should be ‘embarrassed’

Cox brags about his chummy connections to the city’s building department and Miami Mayor Francis Suarez.

Cox’s customers recount the exact same comments he’s made to all of them — that he can remove any obstacle by “having a cafecito” with officials. Drive Development contributed $50,000 to Suarez’s re-election campaign in 2020 and $100,000 to Suarez’s 2018 initiative to create a strong mayor position (voters rejected it), campaign finance records show.

Buyers who have sought relief from the city have gotten nowhere: Emails, phone calls and meetings have prompted no corrective action.

Buyers acknowledge they signed contracts that gave lots of leeway to the developer but decided to sign because they were shown nearly completed houses by a persuasive seller who had previously built fine houses. What could go wrong?

The Herald asked to speak to three City of Miami building department officials about inspection delays and an audit of Drive Development plans. The city’s reply: “The Building Department takes this matter seriously and is tasked with enforcement of the building code and other technical standards, as well as City ordinances. The Building Department has no authority over the pace of construction, nor any contractual matters between the buyers and the developer.”

The city does have authority over permitting and inspections, but wouldn’t explain why it has taken years for Cox to receive city approvals and certificates of occupancy. Nor would officials answer questions about penalties for permit violations or prolonging the inspection process.

“The city should be embarrassed,” Lombardi said.

When the Coynes asked Pearl for an update three weeks ago, she told them inspectors can’t work during an audit. The city said that’s not true; inspectors are allowed to carry on.

Developers like Cox can hire “private providers” to conduct inspections and submit the results to the city. Cox hired MEP Consulting Engineers of Coral Gables. He’s told buyers he blames MEP for bungling reports. MEP blames Cox for not giving inspectors the information they need to finish the job.

MEP President Katrina Meneses said that the city’s audit is done and in the hands of Cox.

“What we’re waiting on is paperwork from the owner, our client,” she said. “We love to finish projects so we can move on to the next one. Anything that takes over a year, it’s difficult to continue and slows us down. Yes, if I was a customer, I’d feel upset.”

The city is notorious for its lack of transparency and accountability, said Parrish, the Miami developer who lives in the Grove.

“We’re in a pro-development city, county and state where everything is driven by developers and their money. Florida is a creation of developers,” he said. “Developers control elections, elections control politicians and politicians control building and zoning. The city of Miami is one of the worst examples of how the gravy train works. It’s an absolute mess.”

Buyers have asked for help from the city, ex-Miami commissioner Ken Russell, Mayor Suarez, the Miami-Dade State Attorney’s Office, the state’s Department of Business and Professional Regulation and the FBI. The response: If Cox isn’t doing anything illegal, we can’t get involved.

Ware’s experiences illustrate the relationship between Cox and the city.

Cox was allowed to work through a Stop Work order for more than a year. The city issued the order because Cox failed to submit plans for the five three-story townhouses he was building on Coconut Avenue; he only submitted plans for the two-story units. His reason: Plans were proprietary and he didn’t want his design stolen.

Ware discovered there was a Stop Work order and expired permit on his house when he checked the city website iBuild in summer 2021.

According to Ware, Cox told him not to worry, the order wasn’t being enforced and he’d have a cafecito with officials to smooth things over. Five months later, after repeated requests for an update, Cox told Ware he had submitted a substantial number of reports to the city after giving MEP engineers a $50,000 bonus each to expedite inspections, and promised Ware “we’re almost there.”

A month later, Ware met with city inspector Perla Mutter. She told him Cox had submitted nothing, and that because of the expired permit, nothing could be submitted until Cox and his contractor Eric Myers met with the building department.

A month after that, on April 26, 2022, Ware went to the meeting at city offices expecting to talk to Cox, Myers and Miami building department assistant director Luis Torres. But Cox met with Torres privately first. And there was no sign of Myers.

“Doug comes out of the office and admits he met with Torres early so that, ‘Everything would be taken care of,’ ” Ware said. ”The following week Doug paid a $100 fine and reopened his permit.

“The city can try to cleanse its hands but it is enabling this developer to abuse the system,’’ Ware said.

The permits for 2984 and 2986 Coconut Ave. expired last month. Cox must sign onto iBuild and pay $100 to re-activate the permits for six months. It’s part of a years-long pattern: His permits expire, he reactivates them months later, then doesn’t enter documentation in time for the city to complete reviews before they expire again, records show.

Permits for the other townhouses on Coconut Avenue are scheduled to expire March 12, April 30 and July 4. Buyers check iBuild and see a vicious cycle: Submit, Pending, Review, Deny, repeat.

To fix the slow and complicated permitting process that has stranded buyers, they advocate new laws with strict 120-day deadlines for the review and approval of applications and harsh penalties for breaking them.

There’s a cost to the city as well. Cox has been paying property taxes of $10,000 per lot, or $60,000 per year on the Coconut Avenue townhouses. Homeowners would pay about $20,000 per unit, or a total of $240,000 per year.

‘House of Rumors’

Then there’s the seven-year saga of 4010 Park Ave.

The two-story South Grove house still has plywood for a front door and a Porta Potty in the front yard.

On realtor.com, it’s listed as a 5-bedroom, 6-bathroom home “active with contract” for $2.95 million.

In 2019, Steven Salm bought the home for $2.55 million. He sued Send Enterprises in November 2020; the lawsuit went to mediation and NDAs were signed. The house was re-listed in February 2021 for $2.95 million.

Marcos Junges has lived next door for 27 years. He said the building of 4010 Park began back in 2016.

“Goes in fits and starts, with long hiatus periods,” he said.

He and his neighbors — who paused to chat during one of their evening walks — call it the “House of Rumors.” They’ve heard it’s been under contract for five years with a succession of buyers. Junges said Cox bought the modest house that used to be there from his elderly neighbor’s family when she died.

At 2050 Secoffee St., majestic oak trees shade a vacant lot. Secoffee is a quintessential Grove street in the rapidly transforming North Grove, where developers capitalize on the neighborhood’s expansive lots by tearing down old houses and the jungle that surrounds them and building new ones with much larger footprints. Price-per-square-foot in the Grove’s 33133 ZIP code rose to a record $874 last year.

Drive Development’s website shows a gorgeous rendering of a 5,302-square-foot house with atrium, listed for $4.85 million in July 2021, then removed in January 2022. A description currently on movoto.com includes three different wishful details: Under construction! Expected completion Q3 2022 and Year built 2021.

No ground has been broken.

Cox tells buyers he’s finishing his own dream townhouse at 3167 Shipping Ave. in central Coconut Grove. The adjacent one is under contract with a buyer from New York City who is growing more impatient. Both look ready for move in. Around the corner on Gifford Lane, a buyer from southern California awaits a townhouse that was supposed to be done in November. Other than grass growing, nothing’s happening on the lot.

The loans

Cox’s companies have taken out at least $59 million in loans, for which he put up 20 properties as collateral, according to public records.

But it’s his most recent loan that has buyers concerned about the fate of their houses. Cox borrowed $350,000 from DC Fund on Dec. 30, 2022, soon after three buyers decided to cancel and get their deposits back. Around the same time, Pearl signed the double contracts with Paciello and Danilovic. And now Cox and Pearl have listed a house for which they could pocket $500,000 or more in deposit money.

Cox put up eight properties as collateral on the DC Fund loan. If he defaults, lenders get first dibs.

DC Fund’s registered agent is Ariel Peretz, principal of Diverse Capital, a lender that advertises “we say yes when others say no” and urges customers to get in touch “if you’re in search of desperately-needed money.”

Peretz and DC Fund members run firms in the merchant cash advance business, mostly based in Brooklyn, which attempt to skirt state usury laws by saying they are not lending quick money at exorbitant rates but are buying the future earnings of their borrowers.

Peretz and DC Fund associates Yoel Getter and Jonathan Allayev and their companies were sued in 2021 by a Texas businessman who accused them of collaborating in a “criminal enterprise that profits by making and collecting on illegal loans.”

The businessman took out a $150,000 loan for which he agreed to repay $224,850 at 215 percent interest via $3,748 daily debits from his bank account. Two weeks later, the businessman borrowed $350,000 — in part to repay the first one — at 430 percent interest, for which he owed $524,650 via $17,488 daily debits.

The businessman dropped the case.

Peretz didn’t return messages left by the Herald.

“We are very worried,” Coyne said. “If Doug gets in trouble with these high-risk loans and debts, we may be left with nothing.”

Cox boasts to buyers that he and Pearl are independently wealthy with $70 million in savings, but if his cash flow has dried up, they fear he can’t pay off mortgages, can’t obtain the clean title necessary to close and could declare bankruptcy.

“He may have thought, ‘I sold these too cheap and I can make more money if I resell,’ but that makes less sense every day because the market is cooling,” Parrish said. “Maybe he got in too deep and has problems paying lenders. He can’t close so he’s kicking the can down the road.”

The two sides of Doug Cox

Cox can be a charming salesman.

Or a belligerent bully.

Michael Coyne has seen both sides. But as a U.S. Army combat veteran, he is not intimidated.

“The last time I saw him he ran up to my car, leans in and says he’s hired a former CIA operative to tail me because my wife made disparaging comments on social media,” Coyne said. “Another time he told me, ‘Bring it!’ I deal with plenty of nasty lawyers on Wall Street and none of them have ever challenged me to a street fight.”

Lombardi has felt Cox’s wrath. Cox terminated Lombardi’s 3-year-old contract last month, accusing him of trespassing at his house at 2984 Coconut Ave. and making derogatory comments. Cox prohibits buyers from going on their properties and has installed surveillance cameras. But he allowed Lombardi to go inside last May with his family.

Eight months later, when Cox heard Lombardi called the FBI, Lombardi said, Cox canceled his contract. They are in mediation. Lombardi wants his deposit back, and believes Cox wants him out so he can list 2984 at a higher price and collect another $500,000 deposit.

Buyers are also wary of Cox because they’ve read a graphic police report from Sept. 6, 2020, when Cox and Pearl got into an argument.

Pearl, who describes Cox in the report as her “live-in boyfriend,” told police Cox began texting her with insulting names from the master bedroom where he was with their daughter as she put their 3-year-old son to bed in his room. Cox stormed in and hit her, choked her, pulled her hair and spit on her as their son watched, “terrified and screaming.” She wrote this description for police:

“He has a pattern of domestic violence and extreme childhood abuse and trauma which has left him with deep unresolved issues and anger problems. This has culminated into a cycle of violence with me since 2014. … He has repeatedly threatened that if I report it, it will destroy his life and in turn he will destroy mine and that of my family.”

Pearl also checked boxes asserting he has “threatened to conceal, kidnap or harm” their children and “intentionally injured or killed a family pet.”

Cox was charged with battery and domestic violence by strangulation and spent the night in jail, Miami-Dade Corrections records show. He was given a restraining order. Pearl dropped the charges.

Cox has perfected the art of evasion.

“I call it the Doug Cox two-step,” Coyne said.

When buyers are able to chase him down on the phone — he avoids putting anything in writing — he swears he’s pushing against the forces obstructing him. He wants them living in their dream homes as ardently as they do.

A vacant lot on Woodridge, a sweet little street in the South Grove next to Merrie Christmas Park and its towering banyan trees, has been overtaken by vegetation. As people in Miami clamor for more housing, this spot where a cottage once stood has grown wild. Vines climb the trees instead of children. The scraping racket of a bulldozer echoes down the block.

On this patch, owned by the King of Coconut Grove, all is still. The ripe land, taking revenge, has reclaimed itself.

Miami Herald Director of Research Monika Leal contributed to this report.