Yahoo – Finance

Super rich’s wealth concentration surpasses Gilded Age levels

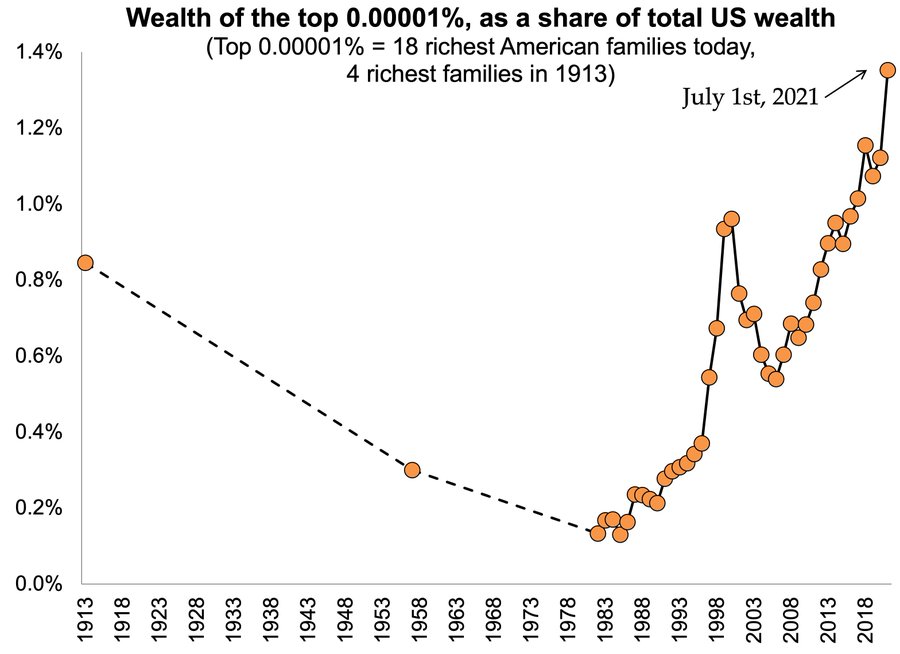

The wealth of the richest 0.00001% of the U.S. now exceeds that of the prior historical peak, which occurred in the Gilded Age, according to economist Gabriel Zucman.

In the late 19th century, the U.S. experienced rapid industrialization and economic growth, creating an inordinate amount of wealth for a handful of families. This era was also known for its severe inequality; and some have called the period that began around 1990 a “Second Gilded Age.” Back then, just four families represented the richest 0.00001% – today’s equivalent is 18 families.

Zucman, a French economist whose doctoral advisor was the historical economist Thomas Piketty, author of bestseller “Capital in the Twenty-First Century,” released data this week showing that as of July 1, the top 0.00001% richest people in the U.S. held 1.35% of the country’s total wealth. These 18 families include those of Jeff Bezos, Mark Zuckerberg and Bill Gates.

Zucman used real-time data from Forbes for the calculations. In 1913, at the end of the Gilded Age, the Rockefeller, Frick, Carnegie, and Baker families – names all tied to monopolistic power – held 0.85% of the country’s total wealth.

The richest 0.01% — around 18,000 U.S. families — have also surpassed the wealth levels reached in the Gilded Age. These families hold 10% of the country’s wealth today, Zucman wrote. By comparison, in 1913, the top 0.01% held 9% of U.S. wealth, and a mere 2% in the late 1970s.

The increasing concentration of wealth comes as the ultra-rich face more scrutiny for the money they’re not paying in taxes. Recent reports have highlighted that because so much of their wealth consists of unrealized gains in stocks and real estate, they pay little or nothing in income tax. Many CEOs and founders take small salaries given their outsized stock holdings, as lower capital gains tax is preferable to a higher tax on ordinary income.

Zucman gained fame in 2019 as an architect of then-presidential candidate Sen. Elizabeth Warren’s wealth tax plan, which aimed to address the fact that the extremely rich pay little in taxes compared to their net worth. The plan would have imposed a 2% tax on net wealth above $50 million and 6% above $1 billion.

Since the pandemic began, the stock market’s gains have widened the gap between the wealthy and non-wealthy because stock ownership is largely concentrated among wealthy people. The number of millionaires globally jumped 5.2 million to 56.1 million, according to Credit Suisse. Though the pandemic’s wealth gains largely benefitted the richest Americans, “most” Americans did fare well financially during the pandemic, according to the Federal Reserve. Around $13.5 trillion of wealth was added to all households. Still, while a large portion of the country got somewhat richer, the rich saw most of that, with the top 1% seeing a third of the $13.5 trillion and the top 20% seeing 70% of it.

Ethan Wolff – Mann is a writer at Yahoo Finance focusing on consumer issues, personal finance, retail, airlines, and more.