Yahoo! News

Climate change is causing more billion-dollar weather disasters

David Knowles, Senior Editor – October 12, 2022

When Hurricane Ian barreled into Florida’s Gulf Coast last month, it became the 15th extreme weather event in the U.S. this year to rack up damages totaling more than $1 billion. Climate change, data shows, is helping to make expensive disasters much more frequent in recent years.

In fact, 2022 marks the eighth straight year that at least 10 separate $1 billion weather-related disasters occurred, according to the National Oceanic Atmospheric Administration (NOAA).

“In the last five years [2017-2021], there were just 18 days on average between billion-dollar disasters—compared to 82 days in the 1980s,” Climate Central, a consortium of scientists and journalists, found in a new analysis posted to its website.

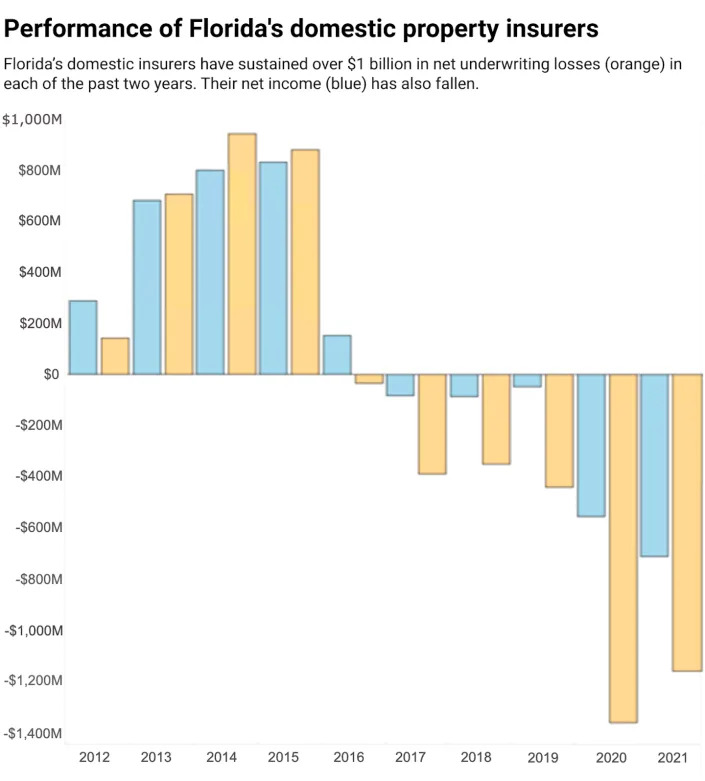

This year’s extreme weather disasters in the U.S. have resulted in over 340 deaths, the NOAA said, and the financial toll is still being tallied. The insurance losses alone from Hurricane Ian are projected to cost between $53 billion and $74 billion, according to an estimate by RMS, a risk modeling company. In addition to that staggering sum, the National Flood Insurance Program could face an extra $10 billion in losses, Insurance Business America reported.

“The number and cost of weather and climate disasters are increasing in the United States due to a combination of increased exposure (i.e., more assets at risk), vulnerability (i.e., how much damage a hazard of given intensity — wind speed or flood depth, for example — causes at a location), and climate change is also supercharging the increasing frequency and intensity of certain types of extreme weather that lead to billion-dollar disasters — most notably the rise in vulnerability to drought, lengthening wildfire seasons in the western states, and the potential for extremely heavy rainfall becoming more common in the eastern states,” Adam Smith, a climatologist at the National Centers for Environmental Information and a lead analyst on the NOAA’s findings on $1 billion disasters, told Yahoo news in an email. “Sea level rise is worsening hurricane storm surge flooding.”

Among the other $1 billion or greater weather-related disasters to hit the U.S. this year are the extreme flooding that occurred in Kentucky and Missouri from July 26 to 28, the prolonged drought and heat waves that gripped the western U.S. between Jan. 1 and Sept. 30, devastating wildfires that consumed thousands of acres in New Mexico this spring, a derecho that plowed through Indiana on July 13, and the extreme precipitation event in Summerville, Ga., on Sept. 4 that dumped more than 12 inches of rain.

While climate change is not the sole cause of events like hurricanes, drought, rainfall or wildfires, ample scientific research has shown that rising global temperatures are amplifying all of them, making each potentially more destructive.

“The year-to-date average temperature for the contiguous U.S. was 56.8 degrees F — 1.7 degrees above average — ranking in the warmest third of the YTD record. California and Florida saw their third- and fourth-warmest January-through-September periods on record, respectively,” the NOAA stated on its website.

Across the West, nearly 1,000 heat records were broken in early September, the NOAA said, a month that will go down as the fifth-warmest on record. In all, the last seven years have been the warmest on record, according to data from NASA, the NOAA and Berkeley Earth.

The Intergovernmental Panel on Climate Change has for years been sounding the alarm about the risks related to global temperature rise and tried to convince world governments to agree to limit greenhouse gas emissions so as to keep average temperatures from rising above 1.5 degrees Celsius (2.7 degrees Fahrenheit) above preindustrial levels.

In its most recent report, which was issued in February, the IPCC reiterated that the planet could expect an increase in the kinds of severe weather consequences seen in recent years that have been liked to climate change.

“This report is a dire warning about the consequences of inaction,” Hoesung Lee, chair of the IPCC, said in a statement that accompanied the release of the report. “It shows that climate change is a grave and mounting threat to our well-being and a healthy planet. Our actions today will shape how people adapt and nature responds to increasing climate risks.”