Only we humans make waste that nature can’t digest.

What If Plastic Was Never Invented?

Only we humans make waste that nature can’t digest.

Posted by What.If on Wednesday, April 25, 2018

Read About The Tarbaby Story under the Category: About the Tarbaby Blog

Only we humans make waste that nature can’t digest.

What If Plastic Was Never Invented?

Only we humans make waste that nature can’t digest.

Posted by What.If on Wednesday, April 25, 2018

Mike Hand April 25, 2018

Two Democratic house members have called for an investigation into superfund adviser Albert Kelly, who the FDIC banned for life from banking. Credit: C-Span/Screenshot.

Two Democratic house members have called for an investigation into superfund adviser Albert Kelly, who the FDIC banned for life from banking. Credit: C-Span/Screenshot.

Environmental Protection Agency (EPA) Administrator Scott Pruitt selected an old friend to oversee the nation’s toxic waste cleanup program. The friend, Albert Kelly, had no experience in environmental regulation, although he had invested in fossil fuel companies responsible for toxic waste that led to the designation of official Superfund sites.

Two lawmakers are now calling on the EPA’s internal watchdog to investigate why Pruitt’s friend was hired to serve as his top adviser for the agency’s Superfund program. They want to find out if Kelly — a former banker who was banned from the profession — was properly vetted before getting appointed to his high-level position and whether Kelly has violated federal rules since joining the EPA.

Reps. Don Beyer and Gerry Connolly, both Democrats from Virginia, sent a letter to the EPA’s Office of Inspector General on Tuesday requesting the investigation. Pruitt appointed Kelly in April 2017 to oversee the nation’s Superfund program.

Beyer and Connolly want the inspector general to find out whether Kelly disclosed to the EPA and the Office of Personnel Management that, when he was hired by Pruitt in April 2017, he was also under investigation by the Federal Deposit Insurance Corporation (FDIC) for possibly violating banking laws and regulations that contributed to significant losses for his bank .

The lawmakers also believe Kelly did not have the necessary qualifications to serve as Pruitt’s Superfund adviser. In the letter, Beyer and Connolly said there are “still-unexplained red flags” about Kelly that they believe the inspector general’s office should examine.

“At the time of his appointment by Administrator Pruitt, Mr. Kelly’s resume showed no qualification related to environmental regulation nor to the oversight of a government agency,” the lawmakers wrote in the letter. “Mr. Kelly’s only apparent connections to environmental regulation were his investments in companies deemed by the EPA to be responsible for the creation of Superfund sites and his longstanding friendship and financial relationship with Administrator Pruitt.”

EPA official blew off scheduled meeting with toxic Appalachian coal town

In recent weeks, Kelly has been working with Pruitt to help him survive allegations of ethics violations and corruption. In early April, Kelly failed to show up at a scheduled meeting with residents of a West Virginia town contaminated by toxic chemicals — Kelly stayed behind in Washington to help Pruitt deal with the fallout from the barrage of controversies.

Instead, Kelly sent his top assistant, Nick Falvo, to Minden, West Virginia, to hear from residents about why they believe the town should be placed on the Superfund program’s priorities list. Falvo told residents that Kelly would come back to visit Minden himself “once the storm in D.C. clears up,” referring to scandal-plagued Pruitt.

Kelly has also been criticized for his fossil fuel investments. He has held as much as $75,000 in financial stakes in several fossil fuel companies, including investments in Phillips 66, according to a financial disclosure report. The EPA deemed Phillips 66 responsible for contaminating Bayou Verdine in 2010, which is located in the Calcasieu estuary in Lake Charles, Louisiana. And more recently, in 2016 Phillips 66 was among a group of companies forced to pay to clean up the Portland Harbor Superfund site — a process which is expected to take 30 years.

And previously, Kelly headed SpiritBank which is based in Pruitt’s hometown of Tulsa, Oklahoma. Last year, though, the Federal Deposit Insurance Corp. (FDIC) reached a settlement with Kelly over alleged wrongdoing. The FDIC issued an order in July 2017 that banned Kelly from the banking industry for life for violating federal banking laws.

“Despite such severe action from a federal financial institution, Mr. Kelly now oversees a landmark environmental program with a budget of $1 billion,” Beyer and Connolly wrote in their letter to the EPA’s inspector general.

Rep. Don Beyer: One of the worst parts of Scott Pruitt’s scandal-ridden tenure at the EPA is the way he has brought in staff from industry – or simply friends without qualifications – to oversee career EPA workers dedicated to environmental protection. One of them is named Albert Kelly.

The congressmen urged the inspector general to investigate Kelly’s “fitness to manage the EPA Superfund program and whether his appointment followed appropriate procedures, given the serious findings and disciplinary action by the FDIC.”

While Kelly served as president, CEO and chairman of the family-owned SpiritBank, the bank provided Pruitt with four loans in 2003 and 2004, totaling nearly $1 million. As longtime friends, Kelly helped Pruitt get financing for a mortgage and to buy a minor league baseball team.

Last May, Pruitt returned the favor to Kelly with an announcement that he would be appointing the former banker to head a new Superfund task force, The Intercept reported in December. The task force looked into reprioritizing and streamlining procedures for remediating more than 1,300 Superfund sites.

Two people who helped Scott Pruitt buy an Oklahoma City house now hold top jobs at the EPA

The task force in June 2017 issued a nearly three dozen-page report containing 42 recommendations, all of which Pruitt immediately adopted, according to the Associated Press.

Beyer and Connolly want the inspector general to investigate whether Kelly violated EPA policy by failing to document the meetings of the Superfund Task Force and to properly record its activities.

The creation and retention of records related to the task force and providing the public with access to the records is required under the Federal Records Act and the EPA’s Records Management Policy.

“Transparency and public accountability on such matters have been recurring problems for Administrator Pruitt’s team, and in this case may have included the violation of regulations or even federal law,” the lawmakers wrote.

Help protect the planet with a $100 investment.

Investors have moved trillions of dollars into green and sustainable investing.

Help protect the planet with a $100 investment.

Posted by Aspiration on Tuesday, April 17, 2018

We need an economy that works for all of us, and not just a privileged few.

America is splitting between rich and poor

We need an economy that works for all of us, and not just a privileged few.

Posted by act.tv on Tuesday, April 24, 2018

Mother Jones; Getty Images

Mother Jones; Getty Images

Alcohol can cause cancer. That’s the takeaway from Mother Jones senior reporter Stephanie Mencimer’s blockbuster piece that weaves together her own breast cancer diagnosis and the disturbing history of the alcohol industry downplaying the carcinogenic effects of drinking. For Bite podcast, host Kiera Butler caught up with Stephanie to talk about drinking during her teen years in Utah, how the liquor industry courts women, and why doctors still aren’t warning patients about the dangers of booze.

Mother Jones: How did you discover the link between drinking and cancer?

Stephanie Mencimer: I was diagnosed with lobular invasive carcinoma in April last year, and it came as a bit of a shock. I don’t think anyone gets cancer and thinks, “Yeah, I saw that coming.” Being a journalist, I thought, “Well, I wonder why this is happening to me.” It wasn’t because I was angry or bitter or anything, but I was just curious to know where I fit in the bigger picture. What are the risk factors for this disease that I now have? I started just Googling, of course, and I looked at all the risk factors. I went down the list, and the biggest risk factor was age. The average age of a breast cancer diagnosis is 62.

There are more than 100 studies over several decades that all come to the same conclusion that alcohol contributes to breast cancer.

That was a lot older than I was at the time. I didn’t think that was my risk factor. Taking hormone replacement therapy after menopause was also a big one, and I hadn’t hit menopause yet and had never taken those drugs. As I went through the list, there were a couple other things in there, like how early you start your period as a kid and how late you got to menopause and all that stuff. Then there was this one that really stuck out, and it was alcohol consumption.

I had no idea that alcohol was something that contributed to breast cancer. I was interested to know why I didn’t know. It wasn’t so much that I thought, “Oh, this has to be it. This is what caused my cancer.” I just wanted to know why I never found out about it until I got cancer and how is that possible. That’s what set me on the course of this research.

MJ: I think it’s really important to point out that the story that you wrote is not a health trends story. We’re so used to hearing, “Coffee is good for you. Now it’s bad for you. Eggs are bad for you. Now they’re good for you.” This is actually a case where there’s this really robust body of research over years and years that shows unequivocal results. What does the science say about the correlation between drinking and cancer right now?

SM: As you said, the science is really clear. There are more than 100 studies over [several decades] that all come to the same conclusion that alcohol contributes to breast cancer. It’s the most common cancer among women except for [skin] cancer. Alcohol contributes to about 15 percent of those [cases]. In real numbers, that’s quite a few, about 35,000 cases in a year.

There is a pretty clear biological mechanism for why alcohol is carcinogenic. It really does some pretty serious damage to the DNA in your cells, especially in places like your mouth where it can work with enzymes there to really mess up the cells and the DNA in your mouth and your esophagus. Then for breast cancer, there is a double whammy. Alcohol raises estrogen levels in the body, and estrogen weirdly enough is kind of carcinogenic. It causes the cells in your breast tissue to reproduce or replicate faster. That creates more opportunities for tumors to develop.

MJ: Your particular history of drinking got you thinking even more about this.

It was like, “Let’s mix a bunch of awful stuff from our parents’ liquor cabinets, whatever we can get ahold of, and pour it in, call it a Slurpee, and drink it with a straw.”

SM: I had my first beer when I was 13. Which is kind of weird because I grew up in Utah where people are known for not drinking. But I wasn’t Mormon, and the culture around being a non-Mormon in Utah involved lots of alcohol. The person who gave me my first beer was actually my dad. We were out pheasant hunting. I remember it really vividly, getting in the car, and it was cold outside. He was like, “Here, have a Mickey’s Big Mouth.” That was kind of the attitude that people had toward alcohol around me from a pretty young age. I can’t say that I continued to drink a lot of beer at 13, but by the time I was 15, in high school, we were drinking a lot.

Maybe everybody’s like that, but I think that we were trying as this non-Mormon group of kids to not be like the missionaries in Utah. We really pounded stuff, and it wasn’t really like the kind of social drinking that you do when you’re older. It was like, “Let’s mix a bunch of awful stuff from our parents’ liquor cabinets, whatever we can get a hold of, and pour it in, call it a Slurpee, and drink it with a straw.” That set off my years of drinking. I don’t know if I ever drank quite as much as I did when I was in high school when I was an adult. I thought about that when I got cancer and discovered that alcohol was a carcinogen and thought, “Wow, I’ve been exposed to this substance for a really long time.”

MJ: It sounds like from your piece that for women and breast cancer, that early drinking period is particularly important and particularly detrimental.

SM: Breast tissue doesn’t fully mature until a woman gets pregnant. You have a lot of cells that reproduce pretty quickly and robustly for those years, however long it is. If you never get pregnant, that in itself is a risk for breast cancer. There’s some evidence that suggests that it’s because those breast cells never mature fully, and it makes them really vulnerable to carcinogens.

Researchers had data from women who were exposed to radiation from the nuclear bomb in Nagasaki. Women who had been under the age of 20 who were exposed to radiation had way more breast cancer than women who were over 40. The researchers deduced that this was a vulnerable time for breast tissue for women. If you start drinking when you’re quite young before you’ve had children and doing a lot of it, actually, it can cause benign breast disease first, which I don’t think people really realize. Anyone who’s ever had to deal with a mammogram that involves dense breast tissue, well, alcohol can make that happen. Even though you don’t have cancer, it can still make it harder for mammograms to do their job to pick up on the tumors. It works in a whole bunch of insidious ways for younger women that I think is really powerful.

MJ: The most disturbing piece of this is that you found that the alcohol industry is actually working hard to downplay this science. Can you tell me a little more about that?

Instead of talking about the risks that come along with alcohol, they have really pushed hard to market alcohol as a health product.

SM: Instead of talking about the risks that come along with alcohol, they have really pushed hard to market alcohol as a health product, which is kind of ironic. It’s a really audacious marketing strategy to take something that kills almost 90,000 people a year, and that includes cancer but like also car crashes and accidents and things like that, to take that and say, “Hey, this is actually something you should drink every day because it’s good for you, and it might protect you from heart disease or from dementia.”

MJ: And they’ve actually tried really hard to get women into drinking more.

SM: Per capita alcohol consumption in the United States peaked in about 1981 or 1982. The industry then really got hammered because there were a lot of drunk driving tests that came along with that. Public health people pushed back and passed a bunch of laws to enforce underage drinking laws, to raise the legal drinking limit to 21. There was a lot of fetal alcohol syndrome work back then in the ’80s, and it was pretty effective so that by the mid-’90s, per capita alcohol consumption in the US had really plummeted. I think by like ’97, you can see it’s a real dip. People really just weren’t drinking as much at that point.

There’s just more of a culture of drinking, I think, for men than there was for women. The industry looked at all that and was like, “Wow, here’s a growth market.”

The industry was trying to figure out what to do about it, because they were losing money. They’re not selling as many products, and so I think that what happened is they looked at the data. Historically, women have always drunk a lot less than men. We metabolize it differently. It affects us more. There’s just more of a culture of drinking, I think, for men than there was for women. The industry looked at all that and was like, “Wow, here’s a growth market.” They set about to really push drinking on women. They came up with products for them, special types of like alcopops, sweetened malt beverages. Because women, I guess historically, don’t like the taste of beer. They created these things they marketed to young women.

It was quite a concerted effort to get women to drink more like men, and it worked. Today, [teen] girls are more likely to drink than the boys are, and that’s true of college students, too.

MJ: You have this whole part of your story where you talk about when you were diagnosed, you were sent to go meet with a nutritionist who was going to give you this anti-cancer diet.

SM: That was one of the more depressing moments of my cancer treatment, when I learned all the things that I was supposed to do to keep it from coming back. This very nice nutritionist gave me a list of things that I should do and not do; I needed a spreadsheet to really keep track of it all. I was supposed to eat cruciferous vegetables four to five times a week. I was supposed to have tofu or some sort of natural soy three times a week. She wanted me to eat 30 grams of fiber a day, which is almost impossible to do even if you’re eating a lot of lettuce because it’s a really high number, so she said, “Beans, you have to eat all these beans in order to hit that target.”

After an hour of this conversation about all the ways I should modify my diet to fight cancer, not once did she ever bring up alcohol. I talked to an oncology researcher who said, “That’s really funny because there’s a lot more data about why you shouldn’t drink alcohol than there is about eating tofu or broccoli as part of your anti-cancer diet.”

MJ: How do we compare in the United States to other countries when it comes to how much people know about this connection between alcohol and cancer?

SM: Other countries are actually doing quite a bit more than we are. One of the most interesting things I’ve found was that when the tobacco wars were really heating up, there was money that went into campaigns to do counter-advertising to combat the tobacco industry’s marketing, especially toward young people. There were ads about smoking, like the Marlboro man coughing and dying of cancer and those sorts of things, and ads that showed what smoking really did to people to make it look less sexy to counter what the tobacco industry was doing.

In England, and also in Australia, some of the cancer groups there have started doing the same thing around alcohol. They’ve run some ads where there’s a great one where they have a guy drinking a beer, and in the bottom of the glass is a tumor. It shows him sipping away at this glass, and the narrator goes on about why alcohol causes cancer, and then the guy swallows the tumor. His little kids are running around in the background.

Here in the United States, cancer groups actually join up with the alcohol industry to raise money. I found a whole bunch of places, like at Georgetown Hospital here in D.C. They have a wine and women fundraiser for their Lombardi Cancer Center. Breast cancer especially—a lot of the charities raise money through craft brew events or wine events. That’s not happening so much overseas. Other countries are doing things that will help prevent cancer by reducing alcohol consumption, like really basic stuff like raising taxes on booze, which in the United States, not only have we not raised alcohol taxes in a really long time—in the tax bill this year, they just slashed them even further. Our alcohol taxes now are lower than they were in the 1950s.

Our alcohol taxes now are lower than they were in the 1950s.

MJ: What does the science say about men’s drinking and their cancer risk?

SM: Men don’t get off the hook on this one. Alcohol for men causes more than 50 percent of all mouth and lip and throat and esophageal cancer. It causes 16 percent of all colon cancer in men, and that’s the big one because there are a lot of colon cancers. Men don’t get breast cancer like women do, and because it’s hormone related, it’s not really such an issue for them, but it’s still a problem. Esophageal cancer isn’t that common, but it’s pretty astonishing that 50 to 55 percent of all those cancers are caused by drinking. I really don’t think people appreciate that, and it’s especially true for men.

MJ: One thing that as I talk about your piece with my friends and my colleagues, we can’t shake this chilling feeling that for many of us, the damage has already been done. For me, for example, I’m 38. I had my baby right before I turned 36, at which point I had been drinking alcohol since college. Even if I quit drinking right now, would it even have any effect on my cancer risk?

SM: There is good news on that front. It’s like smoking. If you quit, your risk starts to go down. There hasn’t been as much research on this, and I imagine this would be some place that people are going to start digging into now that it’s so clear that alcohol causes cancer. Your risk will definitely go down. If you figure that things like breast cancer don’t start to show up in people a lot of times till you’re 70 years old, that gives you another 30-some years of drinking that could still give you cancer.

I don’t think that anyone is really recommending prohibition or don’t drink at all, but the government recommendations and sober scientists, they’ll say, “If you don’t drink, don’t start, but if you do drink, you should stick to the guidelines,” which say that if you have only one drink a day or less, that you’re probably going to be fine. I think that we don’t all just live to prevent cancer. I don’t want to be a total killjoy. One drink a day probably isn’t going to make your life that much shorter, but don’t have seven drinks on Saturday. I think that if people stayed within that guideline, they’d be in pretty good shape. They’d certainly be better off than they are now.

MJ: Right. One of your sources was somebody who talks to college kids about the risks of binge drinking, and she observed that she would talk to these kids, and then she would see them going out that same night and getting wasted. It seems we need to change how we’re talking to our kids about it from a much earlier age.

One of the reasons that doctors don’t like to talk about it is that doctors like to drink. There are quite a few wine companies that are owned by doctors.

SM: I think a big part of that is going to be up to the medical profession because in my experience, even going through cancer treatment—and I see my oncologist every three months—they just never talk about alcohol. Part of that is because the industry has really targeted doctors with the message that alcohol can reduce heart attacks. They distribute studies to doctors to make sure they see all that stuff about red wine, but the doctors really haven’t gotten the message that alcohol is carcinogenic.

Especially for young women, it’s such a big deal. I think that the American Society of Oncologists is trying to remedy this problem because they did a study about how few people really understand the risk of alcohol and cancer. They put out a paper saying, “Here’s all the evidence. Here’s why we need to talk to our patients about this.” They also said that one of the reasons that doctors don’t like to talk about it is that doctors like to drink. There are quite a few wine companies that are owned by doctors.

People will listen to their doctors, even if you’re a teenager or a college student. If your doctor says, “Look, this is going to give you breast cancer if you don’t cut way back,” I think that people are not stupid. They will take that into consideration and make some changes.

Mother Jones was founded as a nonprofit in 1976 because we knew corporations and the wealthy wouldn’t fund the type of hard-hitting journalism we set out to do.

Today, reader support makes up about two-thirds of our budget, allows us to dig deep on stories that matter, and lets us keep our reporting free for everyone. If you value what you get from Mother Jones, please join us with a tax-deductible donation so we can keep on doing the type of journalism that 2018 demands.

By David Dayen April 23, 2018

Donald Trump speaks during an event at the White House in this December 7, 2017 file photo. Trump tweeted on December 8 that fines and penalties against Wells Fargo would not be dropped, and could actually be “substantially increased.” (AP Photo / Evan Vucci)

Donald Trump speaks during an event at the White House in this December 7, 2017 file photo. Trump tweeted on December 8 that fines and penalties against Wells Fargo would not be dropped, and could actually be “substantially increased.” (AP Photo / Evan Vucci)

In January, Wells Fargo announced a one-time benefit from the Tax Cuts and Jobs Act of $3.89 billion. With the 40 percent cut in the corporate-income tax, Wells could write down the cost of its deferred tax liabilities—money it owed down the road to the government. So with the stroke of a pen, Donald Trump made Wells Fargo $3.89 billion richer.

The benefits didn’t end there. In the first quarter of this year, Wells Fargo enjoyed a drastically reduced effective income-tax rate of 18.8 percent, down from 27.5 percent a year earlier. That produced a $636 million savings, on top of the $3.89 billion. Wells Fargo’s Q1 income would have declined year-over-year were it not for the tax law.

When you put Wells Fargo’s ongoing tax bounty against Friday’s $1 billion fine from the Consumer Financial Protection Bureau and Office of the Comptroller of the Currency for scamming customers on mortgage and auto loans, the penalty looks more like a kickback, worth 22 percent of what Wells Fargo has been gifted in tax savings so far. Over time that $1 billion will constitute a smaller and smaller percentage of the tax perk, more like a tip to the Trump administration—a thank-you for its generous support.

The Trump administration gets something out of it too. The Consumer Financial Protection Bureau, under the misdirection of anti-regulatory zealot Mick Mulvaney, had been criticized for not recording a single enforcement action in the 135 days since Mulvaney took over. The Wells Fargo fine, an outgrowth of a defensive tweet from the president in response to media reports that the case would be tossed out altogether, is intended to be the exception that disproves the rule. “We have said all along that we will enforce the law,” Mulvaney got to say in a statement. “That is what we did here.”

Except that doesn’t seem to be what Mulvaney did, because “enforcing the law” would have meant sending a criminal referral to the Justice Department for sanction against individual Wells Fargo executives. Instead, the bureau, along with the bank regulators at the OCC, settled for another fine, paid by shareholders instead of executives, ensuring that nobody in charge at Wells Fargo will see the inside of a jail cell for crimes that include what amounts to grand theft auto. Critics of the Obama administration’s approach to corporate crime fumed at a series of weak fines that created no accountability in the banking sector. The Trump administration’s alternative of one marginally bigger fine does not represent an advance.

It’s important to understand just what Wells Fargo did in this case, as described in the consent order. Regulators identified two violations: Wells Fargo charged “rate lock” extension fees to borrowers who wanted to keep their initial interest-rate quote for a mortgage, when the delays were of Wells Fargo’s own making; and the bank “force-placed” auto insurance on borrowers’ loans without telling them, in many cases causing loan defaults and repossessing the vehicles.

We’ve known about the auto-insurance abuses since at least last July, and the rate-lock extension fees since Wells Fargo self-reported last October. The CFPB had already been investigating this before Mulvaney entered the office. “Investigations that take many months or even years, and that are just now being finalized, are due to the aggressive work my team did to bring predatory behavior to light,” said his predecessor, Richard Cordray, who’s now running for governor of Ohio. “To suggest this is the work of Mulvaney, who has done nothing but throw sticks in the spokes of a talented, hardworking CFPB team of devoted public servants, is preposterous.”

The consent order unveils a significant amount of information about how Wells Fargo went about overcharging customers. On the mortgage issue, Wells Fargo brokers sold a policy that would lock in interest rates when delays were caused by borrowers. But the CFPB found internal communications showing that they were not training loan officers correctly on what to tell borrowers about the rate-lock policy. And indeed, the policy was inconsistently applied, with borrowers paying in cases where Wells Fargo was to blame for delays in mortgage processing. An extra quarter-percent in an interest rate can translate into paying thousands of dollars more over the life of a loan, giving borrowers incentives to lock in rates. Charging borrowers these rate-lock fees when Wells Fargo was responsible for the delay amounts to theft.

The auto-insurance scam was even worse. All car owners must have insurance attached to the vehicle. Wells Fargo worked out a plan with auto-loan customers whereby, if the borrower did not obtain insurance, the bank could automatically place it and charge the premiums through the loan payment. It turned out that Wells Fargo executed this force-placed auto insurance 2 million times since 2005, including hundreds of thousands of instances where the borrower already had auto insurance. Numerous other times, the borrower obtained the required insurance but Wells Fargo never canceled the force-placed policy. Even if Wells Fargo eventually canceled the policies, it failed to refund borrowers for unnecessary or duplicative insurance.

The CFPB has documentation that Wells Fargo knew about high cancellations of auto insurance placed on borrowers in error. It knew that the system for force-placing insurance was inadequate and led to hundreds of thousands of unnecessary insurance policies. Furthermore, borrowers who were unaware of the extra insurance premium got behind on payments as a result. Between 2011 and 2016, at least 27,000 car owners went into default and lost their vehicles because of a scam operation Wells Fargo ran. It’s really just stealing cars.

So the CFPB knows who received the briefings that Wells Fargo was stealing cars and ripping off mortgage borrowers. It has names on internal documents of executives who were discussing these issues. It is aware of who turned a blind eye to this scheme that impoverished people and took their cars away. Isn’t that enough to refer to the Justice Department to investigate violations of criminal laws involving theft and fraud? The CFPB cannot make its own criminal cases, but it has every authority to make a criminal referral. The bureau declined to comment on whether it did refer the case to the Justice Department.

Critics of the culture of no accountability on Wall Street have clamored for this level of justice since the financial crisis. Nobody was demanding a relatively higher fine, even one that could be termed as the largest fine in the CFPB’s history. The belief is that the only way to truly hold top bankers accountable would be to make them feel the consequences of their actions. That’s what happened to a small degree earlier this year, when the Federal Reserve relieved Wells Fargo board members of their jobs. And the OCC’s consent order with Wells Fargo gives that agency the power to fire executives or board members in the future, a direct consequences of the Fed’s bold action.

But the real sanction for criminal activity should be a criminal sentence. Wells Fargo merely had to pay back some of its tax benefits. It even booked this charge in the first quarter, retaining a net profit of $4.7 billion. And the CFPB may not be able to bring a case like this in the future, as a bipartisan bill in Congress would strip it of oversight of certain insurance products, like car insurance sold by a financial company.

If this is what’s considered “enforcing the law,” then the law only technically still exists.

MOST POPULAR

TRUMP IS DISCARDING LAWS AND ASSEMBLING A WAR CABINET. WHAT COULD GO WRONG?

Get unlimited access to The Nation for as little as 37 cents a week! SUBSCRIBE

David Dayen is the author of Chain of Title: How Three Ordinary Americans Uncovered Wall Street’s Great Foreclosure Fraud, which won the Studs and Ida Terkel Prize.

Adam Peck April 24, 2018

Last week, U.S. Trade Representative Robert Lighthizer joined the cabal of cabinet-level officials from the Trump White House who have to defend themselves against charges of misusing taxpayer dollars for his own benefit.

The New York Post discovered that Lighthizer had authorized nearly $1,000,000 in spending to renovate two of his Washington, DC offices on the taxpayer’s dime. That figure included a 30-inch, $859 plaque emblazoned with the words “Executive Office of the President,” 90 office chairs billed at $600 apiece, and a $3,500 antique desk for himself.

Lighthizer, Donald Trump’s top general in his Great Trade War of 2018, defended the exorbitant spending in the most Republican way imaginable: he blamed President Obama.

“The furniture purchases are the culmination of a longtime, planned project that began under the Obama Administration to replace two-decade-old furniture,” read a statement issued by Lighthizer’s office. “Laughable,” was what one former Obama administration official said in response. Combined, the past two Trade Representatives spent less than half of what Lighthizer’s office spent during the same period of time.

But Lighthizer’s spending got us thinking. Donald Trump filled his cabinet with a who’s who of multi-millionaires (and the occasional billionaire) and yet several of them have spent hundreds of thousands of taxpayer dollars for private flights overseas, lavish furniture for their offices and residences, and the occasional soundproof phone booth.

Here’s a quick look at the creative and extravagant ways these millionaires have spent your money (so far).

EPA Administrator Scott Pruitt has been dogged by similar accusations of exorbitant spending for months. His office shelled out over $40,000 for the purchase and installation of a soundproof phone booth for his office, more than $2,000 for two desks for his office (after his initial request for $70,000 was denied), and an additional $2,460 to repair the door to his deeply discounted apartment, which was busted down after his security detail grew concerned he was unconscious and in need of medical attention. Turns out he was taking a nap.

Pruitt also spent more than $150,000 on first class flights, an expenditure he defended by claiming to be the target of constant, unnamed threats. “Look, there have been incidents on planes. There have been incidents in airports, and those incidents, you know, occurred, and they are of different types,” Pruitt eloquently told CBS News earlier this year. “These threats have been unprecedented from the very beginning, and the quantity and type are unprecedented.” It’s unclear just how recognizable Scott Pruitt thinks he is to the general public, though judging by how many of you didn’t realize the photo above is a stock image of “caucasian politician” and not, in fact, Scott Pruitt, the answer is: not very.

What’s not included in this total are things like questionable salary expenses. Take Consumer Financial Protection Bureau Director Mick Mulvaney. From his days in Congress, Mulvaney has sought to abolish the CFPB, arguing the agency tasked with protecting taxpayers from predatory financial institutions is a federal boondoggle. During the most recent budget process, he submitted a request for zero dollars for the agency, arguing it was their duty to be “responsible stewards of taxpayer dollars.” Instead, he hired at least eight people to work at the CFPB, half of whom have annual salaries in excess of $250,000, more than $100,000 above the top salary allowed under the federal government pay scale.

Reuters April 24, 2018

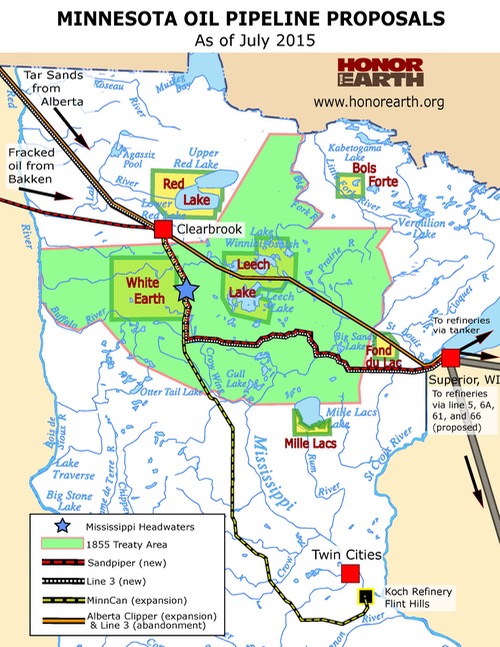

Toronto, April 24 (Reuters) – Shares of Canadian pipeline operator Enbridge Inc dropped more than 4 percent on Tuesday after a Minnesota judge agreed the Line 3 oil pipeline replacement project was needed, but rejected the company’s preferred route.

Enbridge has proposed a C$8.2 billion ($6.4 billion)replacement of its existing Line 3 export pipeline, which extends from Alberta into Wisconsin, doubling capacity on the line to 760,000 barrels per day.

But the project has run into opposition in Minnesota from the state, along with Native American tribes and environmental activists who have questioned whether the replacement is needed.

Administrative Law Judge Ann O’Reilly, of the Minnesota Office of Administrative Hearings for the Public Utilities Commission ruled late on Monday that Enbridge should be issued permission for the replacement, but said the company should use its existing right of way, adding hurdles to the project’s construction.

Under the judge’s recommended route, the existing pipeline would need to be removed and the new one put in its place. Enbridge had asked to leave its current Line 3 in the ground and lay new pipe, at times following a new corridor in the state.

The company said in a statement that it was pleased the judge had supported the project and said it would review her recommendations on routing.

The latest obstacle to Line 3 comes as work has been halted on Kinder Morgan Canada’s Trans Mountain expansion pending a May 31 decision on whether the project, which faces opposition in the Canadian province of British Columbia, will go ahead.

Canada’s oil producers, meanwhile, are desperate for new export pipelines, as rising production and tight capacity on existing pipelines and via rail has led to Canadian crude trading at a wide discount to the West Texas Intermediate benchmark.

Shares of Enbridge were down 4.72 percent at C$37.94 on Tuesday morning.

($1 = 1.2827 Canadian dollars) (Reporting by Julie Gordon in Toronto; Editing by Dan Grebler)

Steve Karnowski, Associated Press April 23, 2018

Photo: Richard Tsong-Taatarii, AP. In this Aug. 21, 2017, file photo, automated welding takes place as sections of the replacement Enbridge Energy Line 3 crude oil pipeline are joined together in Superior, Wis. An administrative law judge … more

Photo: Richard Tsong-Taatarii, AP. In this Aug. 21, 2017, file photo, automated welding takes place as sections of the replacement Enbridge Energy Line 3 crude oil pipeline are joined together in Superior, Wis. An administrative law judge … more

MINNEAPOLIS (AP) — Minnesota regulators should approve Enbridge Energy’s proposal for replacing its aging Line 3 crude oil pipeline only if it follows the existing route rather than company’s preferred route, an administrative law judge recommended Monday.

The proposal has drawn strong opposition because Enbridge’s preferred route would carry Canadian tar sands crude from Alberta across environmentally sensitive areas in the Mississippi River headwaters region where American Indians harvest wild rice and hold treaty rights.

Administrative Law Judge Ann O’Reilly’s recommendation that the Public Utilities Commission should order that the replacement follow the existing route sets up further disputes, however, because the existing line crosses two Ojibwe reservations where tribal governments have made it clear that they won’t consent and want the old line removed altogether.

O’Reilly wrote that Enbridge has established that the project is needed, but that the negative consequences to Minnesota of the company’s more southerly preferred route outweigh the benefits. The cost-benefit analysis shifts in favor of approving the project if Enbridge builds the pipeline in Line 3’s existing trench, she said.

Hundreds of people are fighting for and against a proposed oil pipeline that could run through Minnesota.

The judge noted that Enbridge’s easements with the federal government that allow the company to run six pipelines through the two reservations, including Line 3, expire in 2029, and the commission can’t require the tribes to consent to replacing Line 3 within their reservations. But she said commission approval of in-trench replacement would likely encourage Enbridge and the tribes to “accelerate discussions that must inevitably occur prior to 2029” anyway.

The commission is expected to make its final decision in June. O’Reilly’s recommendations aren’t binding on the commission, but they’re the product of an extensive public hearing and comment process and voluminous filings, so they’ll be hard for the commissioners to disregard. Commission Chair Nancy Lange acknowledged at a hearing last month that whatever the commission decides, the dispute is likely to end up in court.

Enbridge said the project is necessary to ensure the reliable delivery of crude to Midwestern refineries.

“Enbridge is pleased that the Administrative Law Judge has listened to the extensive evidence that there’s need for this safety-driven maintenance project,” the company said in a statement. “We will be taking time to review in more detail the recommendation that we use the existing right-of-way, and will have additional comments to follow.”

Environmental and tribal groups — including the Sierra Club, Greenpeace USA and Honor the Earth — said there’s no good reason to allow Enbridge to build the project, regardless of what route it takes.

If the project is approved, some opponents have threatened a repeat of the protests in North Dakota near the Standing Rock reservation that delayed work for months on the Dakota Access pipeline, in which Enbridge owns a stake. Similar concerns over the role of tar sands oil in climate change, and indigenous rights, have fueled opposition to Kinder Morgan’s proposal to expand its Trans Mountain pipeline from Alberta to an export terminal in British Columbia.

Calgary, Alberta-based Enbridge says the existing line, which was built in the 1960s, is subject to corrosion and cracking and can run at only half its original capacity because of its accelerating maintenance needs. The Jobs for Minnesotans coalition of business, labor and community leaders backs the project, saying it will create 8,600 well-paying jobs with a total economic impact on the state of $2 billion.

Line 3 carries crude oil 1,097 miles (1,765 kilometers) from Hardisty, Alberta, through North Dakota and Minnesota to Enbridge’s terminal in Superior, Wisconsin. Enbridge says the replacement would restore its original capacity of 760,000 barrels per day. Enbridge wants to shift much of the last half of the current 282-mile (454 kilometer) route in Minnesota into a more southerly, 337-mile (542 kilometer) corridor to Superior. Enbridge estimates the overall cost at $7.5 billion, including $2.6 billion for the Minnesota segment.

Enbridge has already begun work in Canada and Wisconsin. Construction sites near Superior have been the scene of protests and several arrests.

“We urge the PUC to listen to the voices of thousands of Minnesotans who have marched, submitted public comment, and testified against Line 3 and reject this dangerous pipeline once and for all,” Margaret Levin, director of the Sierra Club’s Minnesota chapter, said in a statement.

Tara Houska, national campaigns director of Honor the Earth, said the tribes have made it “crystal clear” that a new line is not acceptable to them.

“Tar sands pipelines carry too much environmental and economic risk to move forward, especially since all these pipelines cross Indigenous lands,” Rachel Rye Butler, tar sands campaigner for Greenpeace USA, said in a statement.

By Saqib Shah, Orig. Pub. by The Sun April 23, 2018

Modal Trigger. The Ocean Cleanup.

Modal Trigger. The Ocean Cleanup.

The first-ever machine to clean up the planet’s largest chunk of ocean plastic is due to set sail.

It’s heading to the Great Pacific Garbage Patch, halfway between California and Hawaii, where it will commence collecting the 1.8 trillion pieces of plastic rubbish amassed there by ocean currents.

The system uses a combination of huge floating nets (dubbed “screens”) held in place by giant tubes, ironically made out of plastic, to suck stubborn waste out of the water.

It will then transfer this debris to large ships that will take it to shore for recycling.

The beginnings of this intricate system will launch from San Francisco Bay within weeks and will start working by July, with plans to keep extending it thereafter.

Modal Trigger. The Ocean Cleanup.

Modal Trigger. The Ocean Cleanup.

Ultimately, Ocean Cleanup (the Dutch non-profit behind the project) aims to install 60 giant floating scoops, each stretching a mile from end to end.

Fish will be able to escape the screens by passing underneath them, while boats will visit to collect the waste every six to eight weeks.

The ambitious system is the brainchild of Dutch teen prodigy Boyan Slat, who presented his ocean cleaning machine at a Tedx talk six years ago.

Despite skepticism from some scientists, Slat dropped out of unit to pursue the venture, raising $2.2 million from a crowd-funding campaign, with millions more brought in by other investors.

Modal Trigger. The Ocean Cleanup.

Modal Trigger. The Ocean Cleanup.

Slat commented: “The cleanup of the world’s oceans is just around the corner.”

“Due to our attitude of ‘testing to learn’ until the technology is proven, I am confident that – with our expert partners – we will succeed in our mission.”

The Garbage Patch (GPGP) spans 617,763 sq miles – which is bigger than France, Germany and Spain combined and contains at least 79,000 tons of plastic, according to recent research.

The majority of it is made up of “ghost gear”: parts of abandoned and lost fishing gear, including nets and ropes, often from illegal fishing boats.

The majority of it is made up of “ghost gear”: parts of abandoned and lost fishing gear, including nets and ropes, often from illegal fishing boats.

Ghost gear kills more than 100,000 whales, dolphins and seals each year, with many of the sea creatures drowned, strangled or mutilated by the plastic, claim scientists.

The GPGP isn’t the only floating mass of junk in our oceans.

It’s technically known as the eastern Pacific Garbage Patch because there is another collection of waste in the western Pacific.

Similar accumulations can also be found in the oceans’ four other circular currents, or gyres, with one patch each in the South Pacific and Indian Ocean and two in the Atlantic.