The Nation

How the Tax Bill Will Doom Republicans This November

New analysis shows Democrats should enthusiastically bash the legislation.

By Sean McElwee and Colin McAuliffe January 8, 2018

Congressmen celebrate after House Speaker Paul Ryan and Senate Finance Committee Chairman Orrin Hatch sign the final version of the GOP tax bill on December 21, 2017. (AP Photo / Andrew Harnik)

Congressmen celebrate after House Speaker Paul Ryan and Senate Finance Committee Chairman Orrin Hatch sign the final version of the GOP tax bill on December 21, 2017. (AP Photo / Andrew Harnik)

Republicans claim to be confident their tax bill will lead to victory at the ballot box this fall during the midterm congressional elections. “[House minority leader Nancy] Pelosi did all she could to thwart tax reform because she believed its failure would actually help her regain power, not the other way around,” a spokesperson for the National Republican Congressional Committee recently told Vice News.

Should Trump-state Senate Democrats who voted against the tax bill, like Claire McCaskill (Missouri), Joe Manchin (West Virginia), Joe Donnelly (Indiana), and Jon Tester (Montana), really fear electoral backlash?

Absolutely not, according to our analysis. In fact, they should highlight their opposition to Trump’s tax bill even in these red states.

Most polling about the bill has been national, and it suggests broad unpopularity. Our analysis of exclusive national data to model state support for the tax bill suggests that Democrats have little to fear from the GOP law and should embrace progressive policies to mobilize opposition.

To test support for Republican tax ideas, we use a statistical technique called Multilevel Regression and Poststratification (MRP). With this method we can estimate support for GOP ideas at the state level using national survey data. MRP uses both geographic data (i.e., income, education, and religiosity of a state) as well as individual-level data (race, gender, and education of an individual) to estimate support. Academic research has shown that these estimates are incredibly accurate, and they have been used to study policy adoption. We applied this technique to a survey of registered voters about tax policy completed by the Global Strategy Group for Not One Penny in early 2017.

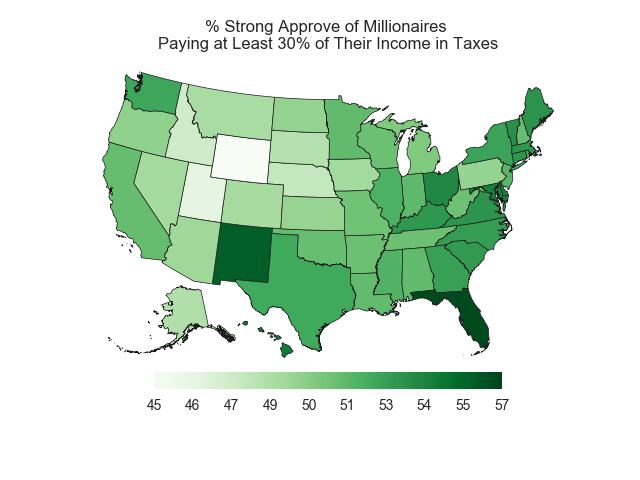

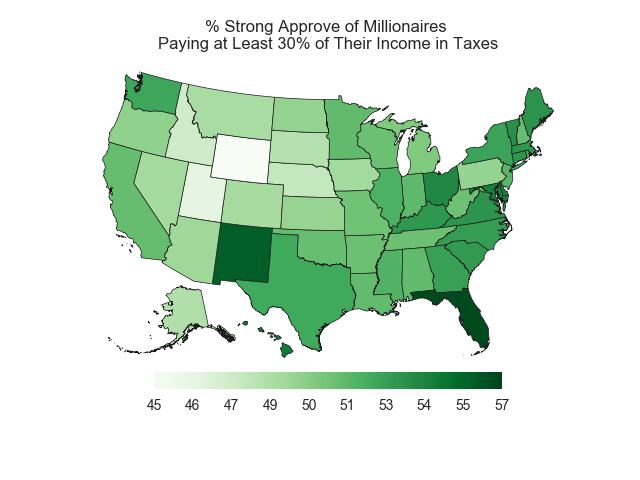

To begin, we explored support for populist economic policies, such as the “Buffett Rule” and higher taxes on the top 1 percent. The Buffett Rule would require all millionaires to pay at least 30 percent of their income in taxes. This turned out to be universally popular: strong support is upward of 40 percent even in the least supportive states, and most states hover near 50 percent strong approval.

If we combine voters who either “strong(ly)” or “somewhat” approve, support for the Buffet Rule is upward of 80 percent in most states. Even in tax-averse Texas, a Democrat like Representative Beto O’Rourke, who is challenging Senator Ted Cruz, could safely campaign on higher taxes on millionaires because an estimated 75 percent of registered voters in Texas favor that position.

College-educated whites are generally less supportive of the Buffet Rule, but again a majority agree with the rule and more than 40 percent strongly agree in most states.

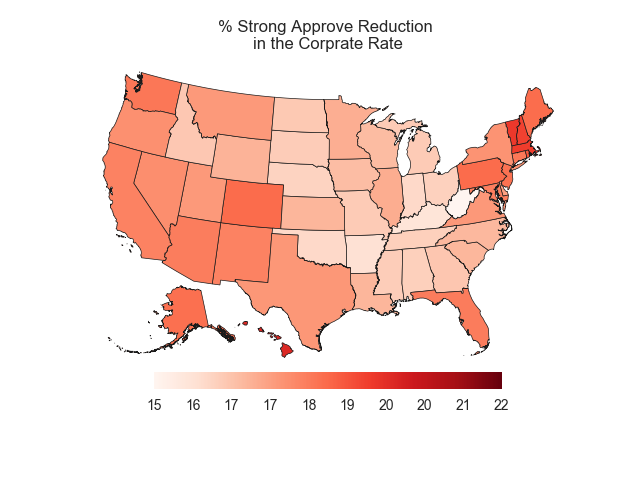

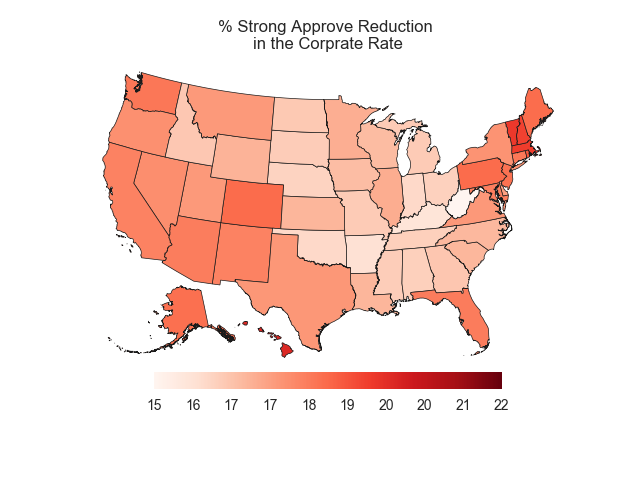

On the other hand, strong support for a corporate tax cut does not exceed 25 percent in any state. Ironically, the highest support (relatively speaking) for corporate cuts tends can be found in high-income (and more heavily taxed) blue states with well-educated populations. The state that appears to be least enthusiastic about corporate tax cuts: West Virginia, where conservative Democrat Joe Manchin will face reelection this fall after opposing the GOP tax bill. Trump carried that state by over 40 points in 2016.

On the other hand, strong support for a corporate tax cut does not exceed 25 percent in any state. Ironically, the highest support (relatively speaking) for corporate cuts tends can be found in high-income (and more heavily taxed) blue states with well-educated populations. The state that appears to be least enthusiastic about corporate tax cuts: West Virginia, where conservative Democrat Joe Manchin will face reelection this fall after opposing the GOP tax bill. Trump carried that state by over 40 points in 2016.

Richard Ojeda is a Democrat running in West Virginia’s third district, where Trump won by 49 points. He tells us that, despite any temporary paycheck boost from the tax cut, “in five years people are going to be up in arms” because the working-class provisions will phase out. He said he’ll campaign on making sure that the working-class tax cuts remain permanent, because “most of my district is living paycheck-to-paycheck.” He warned that Democrats have been too focused on wooing donors, and says “when the Democrats becomes the party of working families, we will win.”

Meanwhile, while many tax-averse Republicans living in the suburbs of blue states may support corporate rate cuts, electoral backlash against Democrats who voted against the Trump tax cuts in these states seems unlikely. The Tax Cuts and Jobs Act repeals or caps many of the itemized deductions that affluent and well-educated blue-state Republicans rely on.

Mikie Sherrill, who is running in a New Jersey House district that Trump won by less than a point, told us, “This tax bill targets the middle class in New Jersey.” Sherrill cited the elimination of the state- and local-tax deductions that will disproportionately impact New Jersey residents, and added that her incumbent Republican opponent, Representative Rodney Frelinghuysen, “stands with his political bosses in DC instead of with us.”

Elizabeth Juviler, an organizer for “NJ 11th For Change” and member of Governor-elect Phil Murphy’s transition, said the tax bill will be a major issue in that race even though Frelinghuysen ultimately voted against final passage of the legislation, because he voted for a House budget resolution that was seen as a key procedural step towards getting the tax bill passed.

“He loaded the gun and passed it on to Paul Ryan and Mitch McConnell and then tried to claim he had nothing to do with it,” Juviler said. “He really betrayed the district with that vote and there are a lot of people here, including Republicans, who started working to replace him that very day.”

How the GOP turned tax cuts into a losing issue

Our state-by-state results may seem unsurprising: After all, the tax bill is very unpopular nationally. But the fact that even in North Dakota higher taxes on the top 1 percent of earners play well, and corporate tax cuts play poorly, tells you a lot about the current political climate.

In his famous paper on the Bush tax cuts, “Homer Gets a Tax Cut,” Larry Bartels argued that the key to Bush’s success was the extent to which voters failed to connect tax policy to economic inequality, as well as voters’ lack of knowledge about the distributional effects of the legislation. So far, Democrats have done a reasonably good job messaging the GOP tax bill: Voters don’t think they will benefit, but do think the rich will. Recent polling from Quinnipiac suggests that 61 percent of voters believe the tax plan benefits the rich at the expense of the middle class, and only 34 percent disagree. (The rest don’t know.)

The Not One Penny survey asks respondents their opinion of the statement: “I do not mind if the wealthiest Americans get a bigger tax cut than I do, as long as I also get some kind of a tax cut.” Only 10 percent of respondents “strongly agree” with this sentiment, while 32 percent “somewhat disagree” and 35 strongly disagreed. While Republicans have claimed that voters will fall in love with their tax bill when they see their paychecks, our analysis suggests this is dubious as long as people believe the rich are benefiting more.

In other data from the Not One Penny survey, we also see that voters reject “trickle-down economics.” Specifically, respondents were asked whether “Lowering taxes on the highest-earning Americans will help grow the economy.” Only 9 percent of registered voters “strongly agreed” with this statement, and only 19 “somewhat” agreed. By contrast, 40 percent “strongly” disagreed and 32 percent “somewhat” disagreed. To put that in context, about the same share of Americans believe in trickle-down economics (28 percent) as believe that aliens have visited earth in modern times (26 percent).

Beyond opposing conservative tax principles, voters are sold on a more progressive model for the economy. A whopping 60 percent “strongly” agree that “making sure the wealthiest Americans pay their fair share in taxes will help grow the economy,” and another 28 percent “somewhat agree.” Only 2 percent “strongly disagreed” with the statement. Bryan Bennett, polling adviser for Not One Penny, said, “Our polling illustrates that the public strongly opposes tax cuts for themselves if the wealthy get most of the benefit, which is exactly what the GOP tax law passed by Congress will do.”

Over the last few decades, Democrats have managed to gain an upper hand on messaging around trickle-down economics, likely thanks in part to the huge failures of trickle-down in practice. In Oklahoma, schools are open for only four days a week because of budget cuts caused by massive tax cuts. Democrats have won multiple special elections in deep-red Oklahoma state legislative districts.

In Louisiana, Bobby Jindal’s tax cuts crushed the state’s prized higher-education system and have done so much damage to the public defense system that the state is in violation of the Constitution. Democratic Governor John Bel Edwards rode hatred of Jindal’s disastrous governorship to a safe 56 percent to 43 percent victory over David Vitter in a state Trump won by 20 points.

In Kansas, ground zero for the Republican Party’s radical tax-cut agenda, schools are so underfunded it’s also literally a violation of the Constitution. Moderate Republicans have primaried the extreme allies of Brownback and then worked with Democrats to begin reversing his tax cuts. Even as Trump won the state by 21 points, Democrats picked up 12 seats in the state legislature.

Far from being an electoral winner, the GOP’s radical tax cuts have jeopardized the party’s governing majorities in even the reddest states. Our results suggest this will likely play out similarly in 2018, but this time the Republican Party’s House and Senate majorities are at risk nationally.

Get unlimited access to The Nation for as little as 37 cents a week! SUBSCRIBE

Sean McElwee is a researcher and writer based in New York City.

Colin McAuliffe is a New Jersey based data scientist who researches policy and public opinion.

While most offshore wind farms are located close to the coast, an ambitious plan by a Dutch energy firm involves the creation of what would be the world’s biggest wind farm featuring a central man-made island as the power hub. TenneT

While most offshore wind farms are located close to the coast, an ambitious plan by a Dutch energy firm involves the creation of what would be the world’s biggest wind farm featuring a central man-made island as the power hub. TenneT The wind farm could provide power to the Netherlands, U.K., Norway, Denmark, Germany, and Belgium. TenneT

The wind farm could provide power to the Netherlands, U.K., Norway, Denmark, Germany, and Belgium. TenneT

Congressmen celebrate after House Speaker Paul Ryan and Senate Finance Committee Chairman Orrin Hatch sign the final version of the GOP tax bill on December 21, 2017. (AP Photo / Andrew Harnik)

Congressmen celebrate after House Speaker Paul Ryan and Senate Finance Committee Chairman Orrin Hatch sign the final version of the GOP tax bill on December 21, 2017. (AP Photo / Andrew Harnik)

On the other hand, strong support for a corporate tax cut does not exceed 25 percent in any state. Ironically, the highest support (relatively speaking) for corporate cuts tends can be found in high-income (and more heavily taxed) blue states with well-educated populations. The state that appears to be least enthusiastic about corporate tax cuts: West Virginia, where conservative Democrat Joe Manchin will face reelection this fall after opposing the GOP tax bill. Trump carried that state by over 40 points in 2016.

On the other hand, strong support for a corporate tax cut does not exceed 25 percent in any state. Ironically, the highest support (relatively speaking) for corporate cuts tends can be found in high-income (and more heavily taxed) blue states with well-educated populations. The state that appears to be least enthusiastic about corporate tax cuts: West Virginia, where conservative Democrat Joe Manchin will face reelection this fall after opposing the GOP tax bill. Trump carried that state by over 40 points in 2016. The Polar Pioneer oil drilling rig arrives aboard a transport ship, following a journey across the Pacific, in view of the Olympic Mountains in Port Angeles, Wash. on April 17, 2015. Photo by Daniella Beccaria/seattlepi.com/File/AP

The Polar Pioneer oil drilling rig arrives aboard a transport ship, following a journey across the Pacific, in view of the Olympic Mountains in Port Angeles, Wash. on April 17, 2015. Photo by Daniella Beccaria/seattlepi.com/File/AP Elected dictator: Donald Trump at the White House with Vice-President Mike Pence. Photograph by Jim Lo Scalzo/EPA

Elected dictator: Donald Trump at the White House with Vice-President Mike Pence. Photograph by Jim Lo Scalzo/EPA François Fillon, who warned that ‘extremism can bring only misery and division to France’.

François Fillon, who warned that ‘extremism can bring only misery and division to France’.

Rising sea levels will be especially dangerous for coastal towns and cities. Jeff J Mitchell/Getty Images

Rising sea levels will be especially dangerous for coastal towns and cities. Jeff J Mitchell/Getty Images