CheatSheet

$4.8 Trillion in Tax Cuts? These States Are the Big Losers (and Winners) in Trump’s Tax Plan

Megan Elliott October 01, 2017

House Speaker Paul Ryan and President Donald Trump attend a meeting. Ryan is part of the group working on a federal tax reform plan. | Mark Wilson/Getty Images

House Speaker Paul Ryan and President Donald Trump attend a meeting. Ryan is part of the group working on a federal tax reform plan. | Mark Wilson/Getty Images

The White House and Congressional Republicans are gearing up to overhaul America’s famously complex tax code and “make taxes simpler, fairer, and lower for hard-working American families.” But if the legislation that eventually reaches Congress looks anything like the ideas floated by the Trump administration so far, average Americans might not have much to celebrate. That’s the conclusion of a report from the Institute on Taxation and Economic Policy. However, some states are more affected than others.

Proposals to streamline tax brackets, eliminate the alternative minimum tax, and get rid of many itemized deductions would result in $4.8 trillion in total tax savings through 2027. But 61.4% of all those savings would go to the top 1% of taxpayers, the organization concluded, and 14% of middle-income taxpayers would end up paying more in taxes, not less.

A tax cut for the richest Americans?

In addition to disproportionately benefiting the rich — who would receive tax cuts equivalent to 6.9% of their income, compared to 1.4% for the middle 20% — the suggested tax reforms would also benefit some states more than others. Generally, states with more rich people win big, while those with poorer people lose, though the possible elimination of deductions for state and local taxes makes the “picture somewhat more complicated,” according to the institute.

Which states will lose and benefit the most? Let’s take a look at the biggest losers first.

The tax reform losers

The institute ranked all 50 states and the District of Columbia based on the share of the tax cuts they’d receive relative to their share of the total U.S. population. It also looked at how different groups in each state would fare in 2018 if tax reform happens. Many, but not all, of the states that would get a smaller piece of the tax cut pie backed Trump in the 2016 election. Here are the seven that would get the worst deal.

7. Maine

Lubec, Maine | Don Emmert/AFP/Getty Images

Lubec, Maine | Don Emmert/AFP/Getty Images

Share of tax cuts relative to share of population: 71%; Average tax cut: $1,570

Overall, Maine would get a smaller share of the total proposed tax cuts than its share of the population. However, the tax cuts would be somewhat more equally distributed among different income groups in this state than they are in the U.S. in general. The richest 1% would get about 34% of all the tax cuts in Maine, while nationwide more than 61% of the cuts would go to the top sliver of the population. Fifteen percent of all the cuts would go to the bottom 60%, compared to 10% nationwide.

6. Oregon

A view of Oregon’s Mount Hood | Craig Mitchelldyer/Getty Images

A view of Oregon’s Mount Hood | Craig Mitchelldyer/Getty Images

Share of tax cuts relative to share of population: 69%; Average tax cut: $1,550

The richest 1% of taxpayers in Oregon would save $71,200 a year on their taxes if Trump’s various proposals are enacted, the institute estimated. The poorest 20% would save $110, while middle-income taxpayers would get an extra $740 in their pockets. Overall, the wealthiest 20% would get just over 70% of all the tax cuts.

5. New Mexico

Albuquerque, New Mexico | iStock.com/alex grichenko

Albuquerque, New Mexico | iStock.com/alex grichenko

Share of tax cuts relative to share of population: 67%; Average tax cut: $1,790

Middle-income taxpayers in New Mexico would save an estimated $580 a year if the administration’s tax reform proposals become reality. The richest 1%, who earn more than $1.2 million on average, would save $73,070. The poorest 20% would get an extra $80 a year.

4. Kentucky

A farm outside of Lexington, Kentucky | Jeff Haynes/AFP/Getty Images

A farm outside of Lexington, Kentucky | Jeff Haynes/AFP/Getty Images

Share of tax cuts relative to share of population: 66%; Average tax cut: $1,590

In Kentucky, middle-income taxpayers would save $640 a year if Trump’s tax changes become law — 1.4% of their total pre-tax income. The top 1%, on the other hand, would get an extra $68,550 per year, on average, equivalent to 5.2% of their total pre-tax income.

3. Arkansas

Little Rock, Arkansas | iStock.com/csfotoimages

Little Rock, Arkansas | iStock.com/csfotoimages

Share of tax cuts relative to share of population: 66%; Average tax cut: $1,600

Close to half of all Trump’s tax cuts would go to the richest 1% of Arkansans. This group would get to keep 6% more of their pre-tax income per year, or an average of $80,800. The middle 20% of taxpayers would get 1.3% of their income back, an average of $570 per year.

2. West Virginia

A state park in West Virginia | iStock.com

A state park in West Virginia | iStock.com

Share of tax cuts relative to share of population: 61%; Average tax cut: $1,380

The middle 20% of West Virginia taxpayers, who earn an average of $41,200 a year, would get an extra $500 a year in their pocket under Trump’s tax proposals. That’s 7.2% of all tax cuts in the state. Nearly three-quarters of all tax cuts in West Virginia would go to the top 20%.

1. Mississippi

Welcome to Mississippi. | iStock.com/Meinzahn

Welcome to Mississippi. | iStock.com/Meinzahn

Share of tax cuts relative to share of population: 53%; Average tax cut: $1,290

Fifty bucks. That’s how much the poorest 20% of people in Mississippi would save on their taxes under Trump’s proposals. Overall, the people at the bottom of the economic ladder would get less than 1% of all the tax cuts going to Mississippi, while the wealthiest 1% of taxpayers in the state would get 47.8% — equivalent to an average savings of $62,390 on their 2018 taxes. The middle 20% would get 13% of the tax cut, saving an average of $850 a year.

The tax reform winners

The following seven states would get a greater share of tax reform savings relative to their total population.

7. Florida

A beach in Boca Raton, Florida | iStock.com/ddmitr

A beach in Boca Raton, Florida | iStock.com/ddmitr

Share of tax cuts relative to share of population: 146%; Average tax cut: $3,160

Florida would get a disproportionate share of total tax cuts, according to the institute’s estimates. The bottom 60% of taxpayers in the Sunshine State would get 5.5% of all the tax cuts. Just under 8% would go to people in the fourth income quintile, and the remaining 86.6% would go to the top 20% of Floridians.

6. South Dakota

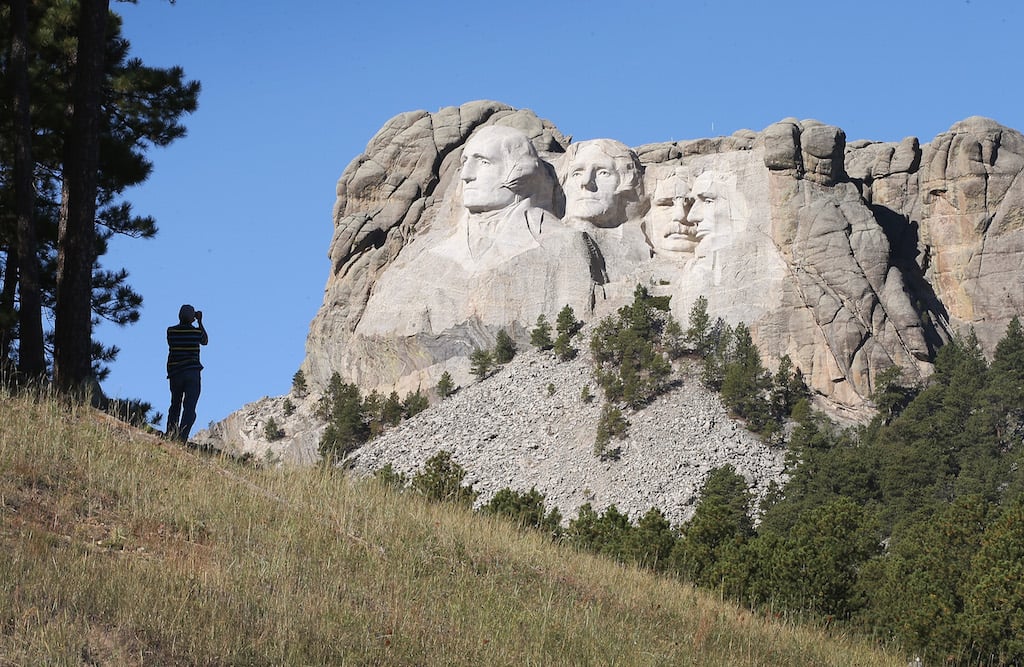

Mount Rushmore National Memorial in South Dakota | Scott Olson/Getty Images

Mount Rushmore National Memorial in South Dakota | Scott Olson/Getty Images

Share of tax cuts relative to share of population: 150%; Average tax cut: $3,530

The bottom three-fifths of South Dakota taxpayers, who earn an average of $59,300 per year, would receive an estimated $410 under Trump’s tax proposals. The richest 1%, who make an average of $1.77 million, would see their taxes fall by $203,110, or 11.5% of their pre-tax income.

5. Massachusetts

Harvard University in Cambridge, Massachusetts | Jorge Salcedo/Shutterstock

Harvard University in Cambridge, Massachusetts | Jorge Salcedo/Shutterstock

Share of tax cuts relative to share of population: 157%; Average tax cut: $3,380

People in Massachusetts may have overwhelmingly backed Hillary Clinton for president in 2016, but the state still would come out ahead when it comes to Trump’s tax proposals. Most of the gains would go to the top 1%, though, who would save an average of $215,670 on their taxes. Middle-income taxpayers, who earn $60,800 per year on average, would get $1,150 in tax savings.

4. North Dakota

Fargo, North Dakota | iStock.com/Ben Harding

Fargo, North Dakota | iStock.com/Ben Harding

Share of tax cuts relative to share of population: 163%; Average tax cut: $3,570

More than half of the $1.3 million in tax cuts for North Dakota would go to a handful of the state’s richest residents, who each would receive an average savings of $187,660. The middle 20%, who earn $58,600 per year on average, would get 4.4% of the savings, or roughly $800 each.

3. District of Columbia

Washington Monument | iStock.com/SeanPavonePhoto

Washington Monument | iStock.com/SeanPavonePhoto

Share of tax cuts relative to share of population: 169%; Average tax cut: $3,520

Not only does D.C. get more than its share of tax cuts relative to the population, but the wealthiest individuals get an extra large share of that pie. Nearly 70% of all the tax cuts would go to the district’s richest 1%, who each would save an average of $245,770 a year. Interestingly, the bottom 15% of the top 20% of D.C. taxpayers would actually pay more under Trump’s tax proposals — an additional $600 a year on average.

2. Connecticut

Lighthouse Point Park in Connecticut | iStock.com/enfi

Lighthouse Point Park in Connecticut | iStock.com/enfi

Share of tax cuts relative to share of population: 176%; Average tax cut: $3,960

Connecticut, home of bankers and hedge fund millionaires, would make out pretty well if Trump’s various tax reforms become law. The state would get a disproportionate share of the total cuts relative to its population, and the richest 1% would get close to 63% of all the benefit. People in this group would save an average of $253,050 per year on their taxes. The middle 20%, who earn $62,300 on average, would get $720 a year, or 3.7% of all the cuts.

1. Wyoming

Sunset at Teton Range | iStock.com/SeanXu

Sunset at Teton Range | iStock.com/SeanXu

Share of tax cuts relative to share of population: 213%; Average tax cut: $5,030

Wyoming may have a small population, but it’s the big winner when it comes to tax cuts. The $1.38 million the state would save on taxes in 2018 works out to a little over $5,000 per person. But the state’s poorest wouldn’t see nearly that much. The bottom 20% of taxpayers would get an extra $110 per year, and the middle 20% would get a tax savings of $940. The top 1%, meanwhile, would get to keep 10% more of their income, or $308,540 on average.