THe Washington Post

Assisted-living homes are rejecting Medicaid and evicting seniors

Christopher Rowland, The Washington Post – April 6, 2023

Shirley Holtz, 91, used a walker to get around. She had dementia and was enrolled in hospice care. Despite her age and infirmity, Holtz was evicted from the assisted-living facility she called home for four years because she relied on government health insurance for low-income seniors.

Holtz was one of 15 residents told to vacate Emerald Bay Retirement Community near Green Bay, Wis., after the facility stopped accepting payment from a state-sponsored Medicaid program. And Emerald Bay is not alone. A recent spate of evictions has ousted dozens of assisted-living residents in Wisconsin who depended on Medicaid to pay their bills – an increasingly common practice, according to industry representatives.

The evictions highlight the pitfalls of the U.S. long-term care system, which is showing fractures from the pandemic just as a wave of 73 million baby boomers is hitting an age where they are likely to need more day-to-day care. About 4.4 million Americans have some form of long-term care paid for by Medicaid, the state-federal health system for the poor, a patchy safety net that industry representatives say pays facilities too little.

Residents of assisted-living facilities – promoted as a homier, more appealing alternative to nursing homes – face an especially precarious situation. While federal law protects Medicaid beneficiaries in nursing homes from eviction, the law does not protect residents of assisted-living facilities, leaving them with few options when turned out. In Wisconsin, residents who entered facilities on Medicaid, as well as those who drained their private savings after moving in and subsequently enrolled in Medicaid, have been affected.

“It’s a good illustration of how Medicaid assisted-living public policy is still in its Wild West phase, with providers doing what they choose in many cases, even though it’s unfair to consumers,” said Eric Carlson, a lawyer and director of long-term services and support advocacy at the nonprofit group Justice in Aging. “You can’t just flip in and out of these relationships and treat the people as incidental damage.”

The U.S. government does not monitor or regulate assisted-living facilities, and no federal data is available on the frequency of evictions. In Wisconsin, The Washington Post counted at least 50 since the fall based on statements by operators and nonprofit and government Medicaid agencies. But evictions have become so common that some states, including New Jersey, have enacted policies to curb them.

Emerald Bay did not explain why it stopped participating in Medicaid. But advocates, family members and the nonprofit that managed the facility’s Medicaid contract contend the motivation was financial: Medicaid reimbursement is lower than full private pay rates.

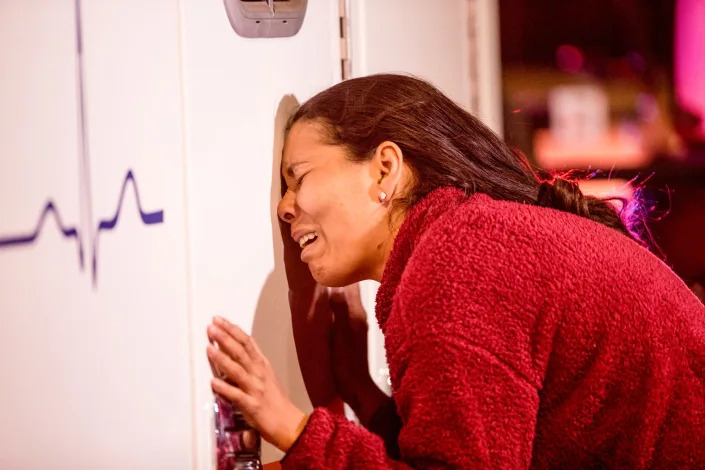

Family members said they were upset and angry. Holtz spent her entire savings paying out of pocket with the understanding that she would be permitted to stay once she qualified for low-income insurance, her relatives said. Ann Marra, Holtz’s daughter, said her mother – who worked much of her life as a professional secretary and raised her family in Algoma, a small town on Lake Michigan – deserved better treatment.

Marra feared the eviction would affect her mother’s mental health.

“It’s cruel, heartless and sad,” she said.

After a stressful search, Holtz’s family moved her on March 13 to an assisted-living facility that still honors state Medicaid. Emerald Bay’s operator, Baka Enterprises, did not respond to requests for comment.

Advocates for assisted-living residents worry that pandemic-induced economic conditions are contributing to the problem in pockets of the country. Profits in assisted-living facilities are threatened by a shortage of staff and big spikes in labor costs, inflation that is jacking up the costs of goods, and higher interest rates. Meanwhile, occupancy rates continue to lag behind pre-pandemic peaks.

The industry blames evictions on insufficient Medicaid funding. Reimbursements, made under federal waivers that allow states to spend Medicaid dollars for elderly care outside of nursing homes, are not keeping up with rising costs, industry representatives said.

“Chronic Medicaid underfunding is not sustainable and is limiting participation as well as driving many providers out of the waiver program, reducing access to care options,” said LaShuan Bethea, executive director of the National Center for Assisted Living trade group.

The gap in pay rates between Medicaid and the full amount charged to families paying out of pocket varies among states. While private pay rates are often $5,000 a month or more, Medicaid in many states pays only about $3,000 a month, said Paul Williams, vice president of government relations at Argentum, a trade association representing assisted-living facilities.

Operators “have tried to hold off [canceling Medicaid contracts] as long as they can, hoping the reimbursement will be increased to help them afford inflation factors,” Williams said. “Hope has diminished in some states of that happening, and they’re saying, ‘I cannot do this anymore.'”

In 2020, about 18 percent of 818,000 residents in U.S. assisted-living facilities were supported by Medicaid payments, according to federal data, a ratio that has remained stable for at least a decade.

In Wisconsin, at least four facilities have canceled Medicaid managed-care contracts in recent months. In addition to Emerald Bay’s 15 residents, Cedarhurst of Madison had 28 residents who were Medicaid beneficiaries when it terminated its contract last year. Residents found out they were being evicted after being called to a group meeting in late fall, said one of those told to leave, Elizabeth Burnette.

“Residents were in tears to hear they had to find another place to live,” Burnette, 80, said. “Most of us are incapacitated in some way, with walkers and in wheelchairs or mobile beds.”

Cedarhurst operates the facility, which is owned by a Massachusetts-based real estate investment trust, Diversified Healthcare Trust. Going to 100 percent private pay at the Madison site was a “tough decision” made in conjunction with Diversified Healthcare, Cedarhurst spokeswoman Christie Schrader said.

Cedarhurst became the facility’s operator in November 2021.

“When we took over management, we inherited Medicaid residents with special cases who required advanced care that we do not offer at our communities,” Schrader said. “Therefore, we believed it was in the residents’ best interest to aid them in finding alternative placement which could care for them in the way they deserve.”

The lobbying and trade group in Wisconsin that represents the long-term care industry said assisted-living operators recognize evictions are highly stressful for residents and their families.

“Not only is it traumatic for the resident and the family, it’s also traumatic for the facility. It really is,” said Rick Abrams, president and CEO of the Wisconsin Health Care Association/Wisconsin Center for Assisted Living. “This is the residents’ home. Everyone understands that.”

He said evictions usually occur when an assisted-living facility and one of the state’s nonprofit Medicaid managed-care organizations cannot agree on the monthly rates for care of an elderly person. Written notices given to residents in the recent evictions stated little about the rationale.

HarborChase of Shorewood, outside Milwaukee, had six Medicaid residents when it said it was ending its Medicaid contracts in January, according to managers of the state’s nonprofit Medicaid managed-care organizations.

“With the new year comes necessary changes,” Karin Bateman, chief operating officer of Vero Beach, Fla.-based Harbor Retirement Associates, HarborChase of Shorewood’s parent company, wrote in a three-paragraph letter to residents on Jan. 6 that informed them that the facility would no longer accept Medicaid. “Our 60-day notice of Medicaid termination gives you time to plan accordingly.”

Harbor Retirement Associates did not respond to requests for comment.

The evictions carry an especially harsh sting for residents who enter assisted-living facilities paying full rates out of pocket with the understanding that, once their nest egg has been spent down, they can remain in the facility under Medicaid. Such arrangements are common across the country and are discussed with families by marketing staff, according to elder-law attorneys and industry experts.

But facilities may have strict limits on the number of beds they designate as Medicaid-eligible, or they can back out of state Medicaid contracts completely. Such caveats may be buried in the fine print of resident agreements or are not addressed at all in the contracts, according to contract provisions in the Wisconsin cases reviewed by The Post. Families often sign such contracts in a time of stress, as they are seeking a safe place for a parent who can no longer remain in their own home.

“This is how people are getting screwed, by promises that the place will take [Wisconsin Medicaid] if they stay for two years. Then they either sell to another company, or change their minds and opt out of the program entirely, which you really can’t stop them from doing. At that point, the family has used up their funds,” said Carol Wessels, an attorney specializing in elder law in Mequon, Wis.

Family members are often left feeling betrayed.

“It’s appalling to say the least,” said Megan Brillault, whose mother, Nancy Brillault, was evicted from HarborChase of Shorewood after spending most of her $120,000 savings. “They said, ‘Here, let us take your money, all your life savings, and you can live here forever,’ and 10 months later they’re saying, ‘We miscalculated, and we are no longer taking Medicaid beds.'”

Megan Brillault provided an email to The Post in which a HarborChase representative said Nancy could transition to Medicaid after paying private-pay rates for one year. The residency contract did not address the issue, said Brillault, a lawyer.

Medicaid pays for nursing home care directly. It’s an entitlement – if a low-income person qualifies, the state must fund a nursing home bed. Medicaid pays all costs in nursing homes, including room and board, as well as care.

Assisted living is different. At those facilities, Medicaid money can be used to reimburse only the cost of care, such as bathing and dressing, and not room and board, although some states offer supplemental payments to help with rent and food.

With the overwhelming majority of residents paying privately, the median operating profit for U.S. assisted-living facilities in 2019 was 29 percent before deductions for interest and rent payments, according to the National Investment Center for Seniors Housing & Care.

Kate McEvoy, executive director of the National Association of Medicaid Directors, said states want to give elderly people options outside of nursing homes but are squeezed between restrictions on how Medicaid money can be used and the high costs of assisted living.

“This has been a challenge in what has primarily been a proprietary, market-driven model,” she said.

In the eviction notice emailed to Holtz’s family in Wisconsin, Baka Enterprises, Emerald Bay’s operator, said it had decided to terminate its contracts with the state’s Medicaid program that covers services for the elderly. It did not provide a reason, but cited a provision of its contract with residents that allowed it to discharge them if they could not afford private-pay rates and the facility did not have designated Medicaid beds.

Kris Holtz, Shirley Holtz’s son, said he was not aware of the provision when he moved his mother into Emerald Bay. Shirley Holtz paid private rates for 26 months before qualifying for Medicaid. She lived at Emerald Bay for another two years at the Medicaid rate before receiving the eviction notice, he said.

The Emerald Bay Medicaid contract was managed by a nonprofit called Lakeland Care. “In the end, Emerald Bay asked us to pay the full private-pay rate for these members, which we are unable to do as a Medicaid-funded agency,” Lakeland Care’s chief executive officer, Sara Muhlbauer, said in a written statement to The Post.

Experts say moving elderly people out of familiar surroundings can induce a condition called “transfer trauma” that accelerates decline. Shirley Holtz’s relatives detected rapid changes after the eviction, said Marra, her daughter. Her mother lost 15 pounds, she said, and quickly stopped using her walker.

On Monday, three weeks after moving out of Emerald Bay and into the new facility, Shirley Holtz died. “The move was a huge factor in her decline,” Marra said in a text.

Even as she mourned, Marra texted an expletive to describe the U.S. long-term care system, punctuated by a red-faced frown emoji. “Kinda angry right now,” she said.