🤔🤔🤔🤔

Posted by Roger Pusey on Friday, April 17, 2020

Category: “Dead Skunk in The Middle of The Road”

Issues and events that stink to high heaven

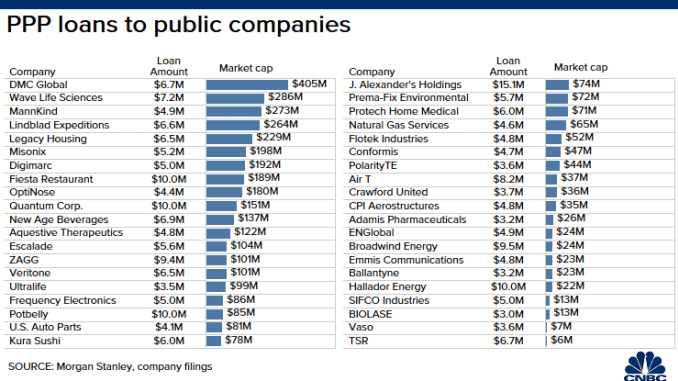

Here are the largest public companies taking payroll loans meant for small businesses

- Hundreds of millions of dollars of Paycheck Protection Program funds have been claimed by large, publicly traded companies.

- In fact, the U.S. government has allocated at least $243.4 million of the total $349 billion to publicly traded companies, according to Morgan Stanley.

- Several of the companies have market values well in excess of $100 million, including DMC Global, Wave Life Sciences and Fiesta Restaurant Group.

Hundreds of millions of dollars of Paycheck Protection Program emergency funding has been claimed by large, publicly traded companies, new research published by Morgan Stanley shows.

In fact, the U.S. government has allocated at least $243.4 million of the total $349 billion to publicly traded companies, the firm said.

The PPP was designed to help the nation’s smallest, mom-and-pop shops keep employees on payroll and prevent mass layoffs across the country amid the coronavirus pandemic.

New virus aid bill includes $251 billion in PPP, $60 billion to small lenders

New virus aid bill includes $251 billion in PPP, $60 billion to small lenders

But the research shows that several of the companies that have received aid have market values well in excess of $100 million, including DMC Global ($405 million), Wave Life Sciences ($286 million) and Fiesta Restaurant Group ($189 million). Fiesta, which employs more than 10,000 people, according to its last reported annual number, received a PPP loan of $10 million, Morgan Stanley’s data showed.

At least 75 companies that have received the aid were publicly traded and received a combined $300 million in low-interest, taxpayer-backed loans, according to a separate report published by The Associated Press.

“I think you’ve seen some pretty shameful acts by some large companies to take advantage of the system,” said Howard Schultz, former Starbucks chairman and CEO. Instead, the government should act “as a backstop for the banks to give every small business and every independent restaurant a bridge to the vaccine. And that is the money and the resources to make it through.”

Statistics released by the Small Business Administration last week showed that 4,400 of the approved loans exceeded $5 million. The size of the typical loan nationally was $206,000, according to the SBA report released April 16.

The SBA awarded the plurality of PPP dollars (13.12%) to the construction industry. Professional, scientific and technical services received 12.65%, manufacturing received 11.96%, health care received 11.65% and accommodation and food services received 8.9%.

Congress approved the first-come-first-served PPP in March as part of the massive $2.2 trillion CARES Act, which at the time promised to ease some of the financial burden for many of the nation’s smallest business owners. But the program ran out of money on Thursday, when the SBA announced that it was “unable to accept new applications for the Paycheck Protection Program based on available appropriations funding.”

The nation’s top lawmakers have in recent weeks worked to expand the small-business funding.

Staffers for Sen. Chuck Schumer and House Speaker Nancy Pelosi have been in talks with the Treasury Department on drafting another bill, which appeared nearly finished by Monday evening.

Schumer, the top Democrat in the Senate, said Tuesday that he believes the chamber will pas an aditional relief bill for small businesses later in the day.

He told CNN he spoke “well past midnight” with Pelosi, White House Chief of Staff Mark Meadows and Treasury Secretary Steven Mnuchin and “came to an agreement on just about every issue.”

By Sunday, deliberations between Republicans and Democrats included setting aside $310 billion more into the PPP. Some $60 billion of that sum would be earmarked for rural and minority groups while $60 billion would go to the Economic Injury Disaster Loan program, a separate relief offered by the SBA for small businesses.

Mnuchin said the deal may include $75 billion in funding for health-care providers and hospitals and $25 billion for Covid-19 testing.

— CNBC’s Lauren Hirsch contributed reporting.

Click here to read more of CNBC’s coronavirus coverage.

George W. Bush in 2005: ‘If we wait for a pandemic to appear, it will be too late to prepare’

Good Morning America

George W. Bush in 2005: ‘If we wait for a pandemic to appear, it will be too late to prepare’

In the summer of 2005, President George W. Bush was on vacation at his ranch in Crawford, Texas, when he began flipping through an advanced copy of a new book about the 1918 flu pandemic. He couldn’t put it down.

When he returned to Washington, he called his top homeland security adviser into the Oval Office and gave her the galley of historian John M. Barry’s “The Great Influenza,” which told the chilling tale of the mysterious plague that “would kill more people than the outbreak of any other disease in human history.”

“You’ve got to read this,” Fran Townsend remembers the president telling her. “He said, ‘Look, this happens every 100 years. We need a national strategy.'”

Thus was born the nation’s most comprehensive pandemic plan — a playbook that included diagrams for a global early warning system, funding to develop new, rapid vaccine technology, and a robust national stockpile of critical supplies, such as face masks and ventilators, Townsend said.

The effort was intense over the ensuing three years, including exercises where cabinet officials gamed out their responses, but it was not sustained. Large swaths of the ambitious plan were either not fully realized or entirely shelved as other priorities and crises took hold.

But elements of that effort have formed the foundation for the national response to the coronavirus pandemic underway right now.

“Despite politics, despite changes, when a crisis hits, you pull what you’ve got off the shelf and work from there,” Townsend said.

When Bush first told his aides he wanted to focus on the potential of a global pandemic, many of them harbored doubts.

“My reaction was — I’m buried. I’m dealing with counterterrorism. Hurricane season. Wildfires. I’m like, ‘What?'” Townsend said. “He said to me, ‘It may not happen on our watch, but the nation needs the plan.'”

Over the ensuing months, cabinet officials got behind the idea. Most of them had governed through the Sept. 11 terror attacks, so events considered unlikely but highly-impactful had a certain resonance.

“There was a realization that it’s no longer fantastical to raise scenarios about planes falling from the sky, or anthrax arriving in the mail,” said Tom Bossert, who worked in the Bush White House and went on to serve as Homeland Security secretary in the Trump administration. “It was not a novel. It was the world we were living.”

According to Bossert, who is now an ABC News consultant, Bush did not just insist on preparation for a pandemic. He was obsessed with it.

“He was completely taken by the reality that that was going to happen,” Bossert said.

In a November 2005 speech at the National Institutes of Health, Bush laid out proposals in granular detail — describing with stunning prescience how a pandemic in the United States would unfold. Among those in the audience was Dr. Anthony Fauci, the leader of the current crisis response, who was then and still is now the director of the National Institute of Allergy and Infectious Diseases.

“A pandemic is a lot like a forest fire,” Bush said at the time. “If caught early it might be extinguished with limited damage. If allowed to smolder, undetected, it can grow to an inferno that can spread quickly beyond our ability to control it.”

The president recognized that an outbreak was a different kind of disaster than the ones the federal government had been designed to address.

“To respond to a pandemic, we need medical personnel and adequate supplies of equipment,” Bush said. “In a pandemic, everything from syringes to hospital beds, respirators masks and protective equipment would be in short supply.”

Bush told the gathered scientists that they would need to develop a vaccine in record time.

“If a pandemic strikes, our country must have a surge capacity in place that will allow us to bring a new vaccine on line quickly and manufacture enough to immunize every American against the pandemic strain,” he said.

Bush set out to spend $7 billion building out his plan. His cabinet secretaries urged their staffs to take preparations seriously. The government launched a website, www.pandemicflu.gov, that is still in use today. But as time passed, it became increasingly difficult to justify the continued funding, staffing and attention, Bossert said.

“You need to have annual budget commitment. You need to have institutions that can survive any one administration. And you need to have leadership experience,” Bossert said. “All three of those can be effected by our wonderful and unique form of government in which you transfer power every four years.”

Bush declined, through a spokesman, to comment on the unfolding crisis or discuss the current response. But his remarks from 15 years ago still resonate.

“If we wait for a pandemic to appear,” he warned, “it will be too late to prepare. And one day many lives could be needlessly lost because we failed to act today.”

John Prine Battling the Coronovirus

We’re Going to Need a Truth Commission Examining Trump’s Coronavirus Response

Esquire

We’re Going to Need a Truth Commission Examining Trump’s Coronavirus Response

All the bungling and temporizing and malfeasance in the administration*’s process needs a full airing.

By Charles P. Pierce March 26, 2020

DREW ANGERERGETTY IMAGES

DREW ANGERERGETTY IMAGES

Return with us now to those thrilling days of yesteryear, courtesy of Politico, back to when we had an actual president who was up to the actual job.

But according to a previously unrevealed White House playbook, the government should’ve begun a federal-wide effort to procure that personal protective equipment at least two months ago.

“Is there sufficient personal protective equipment for healthcare workers who are providing medical care?” the playbook instructs its readers, as one early decision that officials should address when facing a potential pandemic. “If YES: What are the triggers to signal exhaustion of supplies? Are additional supplies available? If NO: Should the Strategic National Stockpile release PPE to states?”

The strategies are among hundreds of tactics and key policy decisions laid out in a 69-page National Security Council playbook on fighting pandemics, which POLITICO is detailing for the first time. Other recommendations include that the government move swiftly to fully detect potential outbreaks, secure supplemental funding and consider invoking the Defense Production Act — all steps in which the Trump administration lagged behind the timeline laid out in the playbook.

Sounds like a handy thing to have lying around during a pandemic, no?

The Trump administration was briefed on the playbook’s existence in 2017, said four former officials, but two cautioned that it never went through a full, National Security Council-led interagency process to be approved as Trump administration strategy. Tom Bossert, who was then Trump’s homeland security adviser, expressed enthusiasm about its potential as part of the administration’s broader strategy to fight pandemics, two former officials said. Bossert declined to comment on any particular document, but told POLITICO that “I engaged actively with my outgoing counterpart and took seriously their transition materials and recommendations on pandemic preparedness.”

And good for you. Of course, the administration*, filled with All The Best People, ignored this document—which was drafted decades ago, in 2016.

An NSC official confirmed the existence of the playbook but dismissed its value. “We are aware of the document, although it’s quite dated and has been superseded by strategic and operational biodefense policies published since,” the official said. “The plan we are executing now is a better fit, more detailed, and applies the relevant lessons learned from the playbook and the most recent Ebola epidemic in the [Democratic Republic of the Congo] to COVID-19.”

The evidence supporting this contention is, of course, everywhere. And I do mean everywhere.

But under the Trump administration, “it just sat as a document that people worked on that was thrown onto a shelf,” said one former U.S. official, who served in both the Obama and Trump administrations. “It’s hard to tell how much senior leaders at agencies were even aware that this existed” or thought it was just another layer of unnecessary bureaucracy.

When this all settles down, we are going to need a truth commission to sort out all the bungling and temporizing and malfeasance that has been such a big part of this administration*’s response to the pandemic. And then maybe another one to sort out how we elected these characters in the first place.

‘The Truth Still Matters,’ Said Judge Amy Berman Jackson.

Esquire

‘The Truth Still Matters,’ Said Judge Amy Berman Jackson. Are We Sure About That?

“The truth still exists,” U.S. District Judge Amy Berman Jackson said on Thursday. “The truth still matters.” She spoke at the sentencing hearing for Roger Stone, career ratfucker and longtime confidante of one Donald Trump. Stone had already been convicted on charges of lying to Congress and witness tampering related to his attempted coverup of his ratfucking activities on Trump’s behalf in 2016. “Roger Stone’s insistence that it doesn’t,” Jackson continued, still referring to the truth, “his belligerence, his pride in his own lies are a threat to our most fundamental institutions, to the foundations of our democracy. If it goes unpunished, it will not be a victory for one party or another. Everyone loses.”

It’s unclear from the court reporting what tone Jackson adopted for that first part. Was she assured? Confident? Defiant? Hopeful, even? Because the argument that the truth still exists and that it still matters in the Year of Our Lord 2020 is no done deal. The jury is very much out. We have strayed very far from our school days, when the world was split into truth and fiction and things like “checks and balances” were almost self-evident. The war on the concept of truth waged for three years now by Donald Trump, American president is beginning to pay real dividends. The president does not subscribe to the concept of objective reality, where there are observable features of the world around us and facts we can consequently all agree on. He believes the truth is whatever you can get enough people to believe, and you’re never guilty if you never admit it. In a polarized political environment and a balkanized media ecosystem, he might just be right.

One thing Jackson gets right is that all this is a threat to democracy. We cannot function as a society—we cannot make rules and policies around how we live, we cannot forge a way forward together—if we cannot agree on basic facts about the world around us. The Enlightenment gave us the tools to discover and verify and spread the truth regardless of what powerful people thought of it, but we have lost our grip on those tools and allowed ourselves to slide back into a tribalist dark age. In this environment, where the powerful say what’s real and their followers believe them, those in power can avoid the kind of accountability for their actions that undergirds a democratic republic. Without checks on their power, they can easily grow it. You need not serve your constituents if they will believe you’re serving them simply because you tell them you are.

And it’s here where Jackson’s statement surely moved towards hope or defiance. If Stone’s villainous lying goes unpunished, she said, “it will not be a victory for one party or another.” Really? Because it seems like one party is winning. The president has declared all negative information about him to be “fake,” and all positive information to be “real.” This is the only basis on which he evaluates information. It’s the attitude of a toddler—perhaps even your three-year-old can more easily process shame and disappointment—but this man has a very good chance of being re-elected to the most powerful office in the world. His Republican Party will very likely retain control of the Senate and all its antidemocratic capabilities. They now believe they have a shot to regain the House of Representatives. Along the way these three years, they’ve stuffed the courts full of judges who will entrench their minority rule for decades.

The president’s attitude towards information—is it good for me, or is it bad for me?—made yet another appearance this week in the matter concerning the United States Director of National Intelligence. We’ve got a new acting director, you see, and it’s a former internet pest whom Trump first saw fit to make ambassador to Germany, and who now will serve as (part-time!) acting head of our intelligence community. Richard Grenell surely got the gig because he will massage the information that comes across his desk until it is sufficiently palatable for The Boss. His predecessor, who also served in an “acting” capacity because the Constitution’s mandate that the Senate advise and consent on major appointments doesn’t matter if you just ignore it, lost the job because he did not adhere to the essential Trumpian mantra: Real News is whatever’s good for Trump.

At least, that’s what The New York Times reported Thursday and what NBC News backed up Friday. Joseph Maguire, the ex-acting chief, made the grave mistake of observing protocol by having his subordinates brief congressional leaders on the evidence that Russia is once again interfering in our elections heading into 2020, and that they once again want Trump to win. This is an exceedingly believable notion, considering Trump has a habit of siding with the Russians on any issue that comes up. He’s fought sanctions against them and slowed their implementation. He opened the door for them to seize control of northern Syria. All this culminated in his extortion of Ukraine, with which Russia is currently at war via proxy forces. Trump has torn up notes of his meetings with Russian President Vladimir Putin and the White House has failed to report their phone calls, leaving the American public to learn of them when the Russians make it public.

But none of this is of interest to the public, in the president’s calculus, including the fact that a geopolitical adversary is set to attack our democracy again this year. The Director of National Intelligence had no business telling the people’s representatives in Congress about it. And why? It “angered Mr. Trump,” the Times reported, “who complained that Democrats would use it against him.” It is entirely irrelevant to him whether the 2020 elections will be free and fair, and whether Americans will be allowed to choose their own leaders without interference. What matters is that he wins, at any cost. This, of course, reflects the larger Republican attitude towards elections, where the ends always justify the means. Voter suppression, voter purges, closing polling stations in Certain Neighborhoods, extreme gerrymandering, foreign interference—anything goes if it keeps you in power. And if you lose, you can just strip the office you lost of it’s powers before a Democrat can get in there and, uh, do the job the public elected them to do.

It’s really no wonder, then, that Trump would rise to control a party that long ago chose to slide towards authoritarianism rather than appeal to any slice of the public outside The Base of white ultraconservative Evangelicals and those who’ve made common cause. But the efficiency with which the president has used weaponized falsehood to erode the pillars of a democratic republic is staggering. The principles of consensus and persuasion that define democratic politics are beginning to falter. The president and his movement do not use words to persuade, but as a rhetorical bludgeon to beat down The Enemies. What they are offering is force.

On The Apprentice, producers would often find themselves scrambling to put an episode together after Trump inexplicably fired someone who’d performed well, because he hadn’t been paying attention before the boardroom. They’d have to reverse-engineer the episode until Trump’s conclusion made sense. Now, one of America’s two major political parties, a large swathe of its media outlets, and increasingly, the actual federal government are all devoted to the same task. Except now, they’re reverse-engineering reality itself to meet the president’s preferences. This will have consequences from a governing standpoint, of course: if you make policy in defiance of the real world, it will eventually catch up to you. But perhaps the more immediate concern is that it may finish off our ability to govern ourselves, to compare our leaders’ words and actions to what we can see and verify around us and hold them to account on that basis. The threat is that we will once again slide into darkness, where all that matters is power and force.

Trump Gives Defense Department Power To Abolish Bargaining For Civilian Unions

HuffPost – Politics

Trump Gives Defense Department Power To Abolish Bargaining For Civilian Unions

Mary Papenfuss, HuffPost February 21, 2020

President Donald Trump has officially granted the Department of Defense the legal authority to abolish the collective bargaining rights of its civilian labor unions representing some 750,000 workers.

Gutting the unions would provide “maximum flexibility,” Trump wrote in a memo published Thursday in the Federal Register, which was first reported by Government Executive.

Trump signed the memo three weeks ago, invoking “national security” to justify granting the Defense Department an exemption from the law giving all federal workers the right to unionize.

“When new missions emerge or existing ones evolve, the Department of Defense requires maximum flexibility to respond to threats to carry out its mission of protecting the American people,” Trump wrote in the memo. “Where collective bargaining is incompatible with these organizations’ missions, the Department of Defense should not be forced to sacrifice its national security mission.”

The 1978 Civil Service Reform Act contains a provision that allows a president to exclude agencies from engaging in collective bargaining with workers via written order in some circumstances, including “an emergency situation.”

Trump’s assault on unions contradicts his frequent claims to his base of supporting voters that he is a champion of the working class. A 2017 White House memo encouraged “eliminating employee unions” as part of a wide-ranging effort to weaken organized labor. Trump’s budget for fiscal 2021 would require federal workers to pay more for a cut in retirement benefits.

It’s not yet clear what Defense Secretary Mark Esper will do.

Labor leaders, workers and politicians have railed against the declaration.

“Denying … Defense Department workers the collective bargaining rights guaranteed to them by law since 1962 would be a travesty — and doing it under the guise of ‘national security’ would be a disgrace,” Everett Kelley, national secretary-treasurer of the American Federation of Government Employees, said at a legislative conference earlier this month, according to The Washington Post. “This administration will not stop until it takes away all workers’ rights to form and join a union — and we will not stop doing everything we can to prevent that from happening.”

Taxpayers Get $3.4 Million Tab So Trump Can Host Super Bowl Party For His Club Members

HuffPost – Sports

Taxpayers Get $3.4 Million Tab So Trump Can Host Super Bowl Party For His Club Members

S.V. Date February 2, 2020

Taxpayers shelled out another $3.4 million to send President Donald Trump to Florida this weekend so he could host a Super Bowl party for paying guests at his for-profit golf course.

The president’s official schedule shows him spending two and a half hours Sunday evening at a “Super Bowl LIV watch party” at Trump International Golf Club in West Palm Beach. Tickets sold for $75 each, but were only available to members of the club — the initiation fee for which reportedly runs about $450,000, with annual dues costing several thousands of dollars more.

“Well, obviously there are no TVs in the White House, so what alternative did he have?” quipped Robert Weissman, president of the liberal group Public Citizen. “He could have saved money by chartering a plane and flying club members to watch the game at the White House.”

In response to a query, White House press secretary Stephanie Grisham defended Trump’s trip and attacked HuffPost: “The premise of your story is ridiculous and false, and just more left-wing media bias on display. The president never stops working, and that includes when he is at the Winter White House.”

Her phrase “Winter White House” refers to Mar-a-Lago, the for-profit resort in Palm Beach that is several miles east of the golf course and that doubled its initiation fee from $100,000 to $200,000 after Trump was elected in 2016. Trump frequently mingles with guests at social events there.

On Saturday, for example, Trump appeared at a dinner at Mar-a-Lago arranged by the “trumpettes,” a group of his female supporters. The dinner did not appear on the president’s publicly released schedule, and in any case was a campaign event, not an “official” one.

When a pool reporter asked the White House on Saturday what work Trump did over the weekend, the reply was that he had calls and “meetings with staff.” The president did not attend a rally on Saturday for Venezuelan leader Juan Guaido, whom the United States and other governments have recognized as the legitimate president of that country. That rally began while Trump was still at his golf course, and attending it could have made him late for the start of the Trumpettes’ dinner.

Trump promised during his presidential campaign that he would separate himself from his businesses if he won. However, he reneged on that vow, as well as on his promise to release his tax returns.

On his most recent financial disclosure form, which was filed last May, Trump claimed he had received $12,325,355 in income from the West Palm Beach golf course over the previous year. It’s unclear how accurate that is, given Trump’s tendency to file widely varying figures to different government authorities.

He told the U.S. Office of Government Ethics in his 2018 financial disclosure, for example, that his Scotland golf courses are worth more than $50 million each, even as he told authorities in the United Kingdom that they had a combined net debt of $65 million.

In any event, money spent at Trump hotels and golf courses flows directly to the president, as he is the sole beneficiary of a trust that now owns his family business. U.S. taxpayers have been the source of at least a few million dollars that have gone to the Trump Organization in the form of hotel rooms, meals and other expenses for Secret Service agents and other government employees who have stayed on-site with Trump in Florida, New Jersey, Scotland and Ireland.

“When Donald Trump announced that he would break decades of precedent and hold onto his business, many were afraid it was to find ways to keep making money on the side of his work as president,” said Jordan Libowitz with the group Citizens for Responsibility and Ethics in Washington. “Turns out the presidency is more like a thing he does on the side to help make money for his business.”

This weekend’s trip to Mar-a-Lago was Trump’s 28th to the property since becoming president. Saturday’s and Sunday’s golf outings at the West Palm Beach club brings his total to 79 days there since taking office and 244 total golf days at properties that he owns.

Taxpayers’ total tab for his golf hobby, meanwhile, climbed to $130.4 million.

That figure and the $3.4 million for each Mar-a-Lago trip are based on a HuffPost analysis that included the costs of Air Force transportation, Coast Guard patrols, Secret Service security and other expenses, as detailed in a January 2019 report from the Government Accountability Office of Trump’s first four visits to Mar-a-Lago in early 2017.

Trump frequently criticized former President Barack Obama for golfing too much and promised during his campaign that he would be too busy to take any vacations at all, let alone play golf. Instead, he is on pace to play more than twice as much golf as Obama did ― at a cost three times that of Obama’s, because he insists on playing so many rounds at his courses in Florida and New Jersey, which require expensive flights on Air Force One. Obama mostly played golf at military bases within a short drive of the White House.

“Trump is and always has been a con man. In 2016, he said that, unlike Obama, he’d never golf and he’d never take personal trips outside the White House,” said former Rep. Joe Walsh (R-Ill.), who is challenging Trump for the 2020 Republican nomination. “In addition, Trump is using taxpayer money to personally enrich himself because virtually all of his travel is to Trump properties. That is the swamp Trump pledged to drain. Trump is the swamp.”

Here’s how we’ll pay for Trump’s trillion-dollar deficits

Yahoo – Business

Here’s how we’ll pay for Trump’s trillion-dollar deficits

Who will pay for America’s trillion-dollar deficits?

Taxes are going up. Maybe not soon, but the mushrooming national debt will eventually leave Washington no choice but to hike taxes. And the longer we wait, the more it will hurt.

The Congressional Budget Office recently forecast annual federal deficits of more than $1 trillion for 2020, and each of the next 10 years. By 2030, CBO says, the deficit will hit $1.7 trillion. Economists generally think a fiscal deficit of around 3% of GDP is healthy and manageable. U.S. deficits over the next decade will average 4.8% of GDP.

Annual deficits spiked during the Great Recession, when tax receipts plunged and stimulus spending soared. The $1.4 trillion deficit in 2009, at the nadir of the recession, was the worst on record.

Deficits fell sharply as the economy recovered, however, and hit a post-recession low of $442 billion in 2015. Then they ticked up again, mostly because of runaway health spending on Medicare and Medicaid. Then came the Trump tax cuts, which went into effect in 2018.

Those tax cuts pushed corporate tax revenue to the lowest levels ever as a portion of federal revenue. Tax revenue from individuals has gone up slightly, because of economic growth. But it would have gone up more without the Trump tax cuts, or with cuts limited to middle- and lower-income workers, say. The twin effect of depressed federal revenue and health care costs growing faster than the economy are driving those trillion-dollar deficits.

This isn’t a crisis today, even though some economists thought it would be by now. But widening deficits at this level aren’t sustainable, either, because they’ll crowd out private investment and depress productivity. Growing interest payments on all that debt will leave less and less for highways, airports and everything else taxpayers expect after mandatory health and retirement spending.

Will Americans tolerate the sharp cuts in social programs and defense that are one way to close this gaping budget gap? Eh, maybe, a little, possibly. But tax hikes will be part of the prescription too, and the Brookings Institution’s Hamilton Project recently published a comprehensive list of the soundest options. Here are five types of tax hikes that would reduce Washington’s indebtedness:

A new inheritance tax. The average tax rate on income is 15.8%. On inherited wealth, it’s just 2.1%. The estate tax is meant to limit the growth of family dynasties and an American aristocracy, but it’s so weak and riddled with loopholes that it barely raises any revenue at all any more. A new inheritance tax would tax wealth received by an heir as normal income. There’d be an exemption threshold, so those subject to the tax would probably be paying at the top rate of 37%. At an exemption threshold of $2.5 million, this tax would raise $34 billion per year, according to the Tax Policy Center. At a lower threshold of $1 million, it would raise $92 billion. That’s a start.

A wealth tax. Policymakers and politicians have gotten interested in wealth taxes because the richest families in America earn most of their money from investing, rather than working. And there are several ways to defer and sharply reduce taxation on investments, which leaves the wealthy paying lower tax rates than ordinary working stiffs. Democratic presidential candidates Bernie Sanders and Elizabeth Warren both favor a wealth tax to fund programs such as free college and government-paid health care.

The Hamilton Project proposes four types of wealth taxes that vary by the type of assets taxed and the exact method of taxation. Starting thresholds range from $8.25 million in net worth to $25 million. But each tax would raise a hefty $300 billion per year or so, and each would cut the estate tax provision that eliminates capital gains taxes on profitable investments passed on to heirs. There’s one crucial catch: Some experts think a wealth tax could be unconstitutional, which basically guarantees a legal challenge.

A value-added tax. This is the mother of all taxes, the quickest way to raise vast sums if ever needed. All developed nations except the United States have a VAT, which is a tax levied at various levels of production for goods and services. Prices typically rise and consumers end up paying much of the tax, but businesses adjust, which helps make this an efficient tax. There would need to be provisions protecting low-income consumers, small businesses and other vulnerable parties. But many other nations have devised proven protections. A 10% VAT would raise around $1 trillion per year and “provide an enormous pool of resources to address social and economic problems,” according to the Hamilton Project report. Some of that money could be spent on economic stimulus programs, to assure rising prices don’t cause a recession.

A financial transaction tax. Sanders and Warren like this tax, too, which would put a fee of 10 basis points, or 0.1%, on trades of stocks, bonds and derivatives. There are concerns about unintended consequences, such as higher costs on ETFs and mutual funds held by mom and pop investors, and a new incentive to move money offshore. So the Hamilton Project recommends a 4-year phase-in period, with the tax starting at 2 basis points and regulators monitoring markets closely for negative repercussions. They could make changes if problems crop up. Hong Kong, France, Italy and the United Kingdom impose similar taxes, with no obvious drawbacks. It could raise $60 billion per year once fully implemented.

Higher corporate taxes. The trick here is to capture more revenue from the corporate sector without driving corporate money overseas or wrecking incentives to do business in the United States. One approach would be to work with other developed countries to establish provisions that make tax rates comparable among nations and prevent the kind of profit shifting corporations have practiced during the last 20 years, to take advantage of low rates in places like Ireland and Luxembourg. Raising the corporate tax rate might work, from the new level of 21% set by the Trump tax cuts to 25%, say, or 28%. But that would have to be paired with other tax incentives for things like new investment and research and development, to assure businesses stayed put in the United States. A well-designed set of corporate tax reforms could raise $110 billion per year, while boosting economic growth by stimulating investment. Makes you wonder what they’re waiting for in Washington.

Rick Newman is the author of four books, including “Rebounders: How Winners Pivot from Setback to Success.”

Read more:

U.S. farm bankruptcies hit an eight-year high

Reuters – Business News

U.S. farm bankruptcies hit an eight-year high: court data

P.J Huffstutter January 30, 2020

CHICAGO (Reuters) – U.S. farm bankruptcy rates jumped 20% in 2019 – to an eight-year high – as financial woes in the U.S. agricultural economy continued in spite of massive federal bail-out funding, according to federal court data.

According to data released this week by the United States Courts, family farmers filed 595 Chapter 12 bankruptcies in 2019, up from 498 filings a year earlier. The data also shows that such filings – known as “family farmer” bankruptcies – have steadily increased every year for the past five years.

Farmers across the nation also have retired or sold their farms because of the financial strains, changing the face of Midwestern towns and concentrating the business in fewer hands.

“I just had a farmer contact me last week, telling me he can’t get financing for his inputs this year and he doesn’t know what to do,” said Charles E. Covey, a bankruptcy attorney based in Peoria, Illinois.

Chapter 12 is a part of the federal bankruptcy code that is designed for family farmers and fishermen to restructure their debts. It was created during the 1980s farm crisis as a simple court procedure to let family farmers keep operating while working out a plan to repay lenders.

The increase in cases had been somewhat expected, bankruptcy experts and agricultural economists said, as farmers face trade battles, ever-mounting farm debt, prolonged low commodity prices, volatile weather patterns and a fatal pig disease that has decimated China’s herd.

Even billions of dollars spent over the past two years in government agricultural assistance has not stemmed the bleeding.

Nearly one-third of projected U.S. net farm income in 2019 came from government aid and taxpayer-subsidized commodity insurance payments, according to the U.S. Department of Agriculture.

The court data indicates those supports did help prevent a more serious economic fallout, said John Newton, chief economist for the American Farm Bureau Federation.

Some of the biggest bankruptcy rate increases were seen in regions, such as apple growers in the Pacific Northwest, that did not receive much or any of the latest round of trade aid from the Trump administration.

The bankruptcy data “signals that things have not turned around,” said John Newton, chief economist for the American Farm Bureau Federation. “We still have supply and demand uncertainty. If we see prolonged low prices, I wouldn’t expect this trend to slow down.”

Reporting By P.J. Huffstutter; Editing by Dan Grebler

CNBC.COM