The New York Times

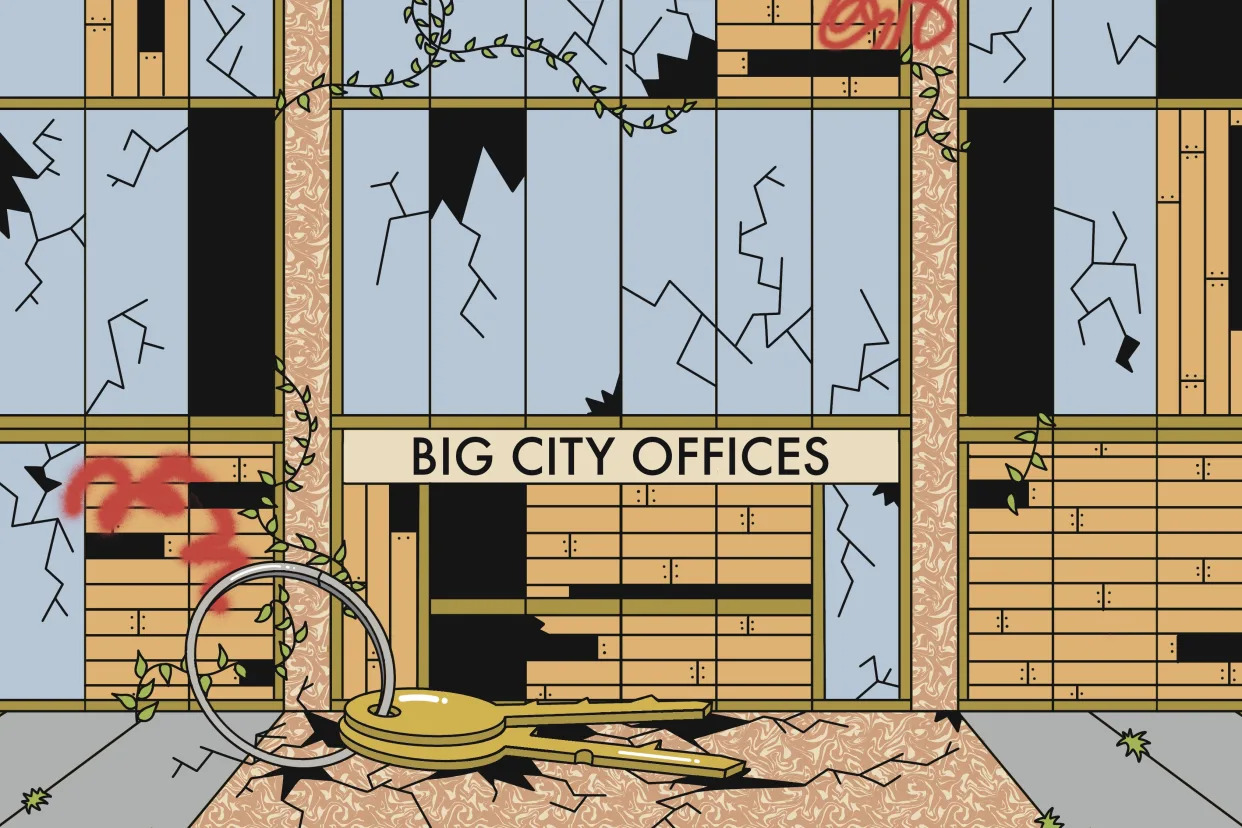

With Offices Sitting Empty, Landlords Are ‘Handing Back the Keys’

Peter Eavis – December 2, 2023

Office landlords, hit hard by the work-from-home revolution, are resorting to a desperate measure in the real estate world: “handing back the keys.”

When this happens, the landlord stops paying the mortgage on the office building or declines to refinance it. The bank or investors who made the loan then repossess the building.

Some of the biggest names in commercial real estate, like Brookfield and Blackstone, have defaulted on mortgages and have started or completed the process of handing back the keys on office towers. The tactic reveals both the depth of the problems in the office market and the ability of big property companies to push much of the financial pain onto others — in this case, banks and other lenders.

Since the pandemic began, office employees showed they could get their jobs done from home, and many have been reluctant to come back. And companies realized they could save a lot of money by renting less office space, making many office towers unprofitable for their owners and turning many business districts into ghost towns. About 23% of office space in the United States was vacant or available for sublet at the end of November, according to Avison Young, a real estate services firm, compared with 16% before the pandemic.

Handing back the keys is a drastic move, but it makes sense because it can limit a landlord’s losses on a building.

Take a property company that bought an office tower for $100 million just before the pandemic, investing $25 million of its own money and borrowing $75 million. If the building is hemorrhaging tenants and now has a value of $45 million, the landlord’s initial investment could be worth zero — and the lower rent income may not be enough to cover the building’s costs.

Rather than continue to pay interest and other expenses, the landlord can decide to default on the loan, which means the lenders get the beleaguered building. And in theory, the lenders could end up with a $30 million loss — the difference between the amount they lent ($75 million) and the resale value of the building ($45 million).

Today’s handing back the keys is reminiscent of the term “jingle mail,” which became notorious after the financial crisis of 2008 when homeowners abandoned their homes — and supposedly sent their keys back to their banks — because their homes were worth far less than what they owed on the mortgage.

But there is a difference: Big property companies can keep doing business after they default and are even considered savvy for jettisoning distressed buildings. But homeowners who stopped paying their mortgages suffered a huge hit to their credit ratings and had to find somewhere else to live.