- Hundreds of millions of dollars of Paycheck Protection Program funds have been claimed by large, publicly traded companies.

- In fact, the U.S. government has allocated at least $243.4 million of the total $349 billion to publicly traded companies, according to Morgan Stanley.

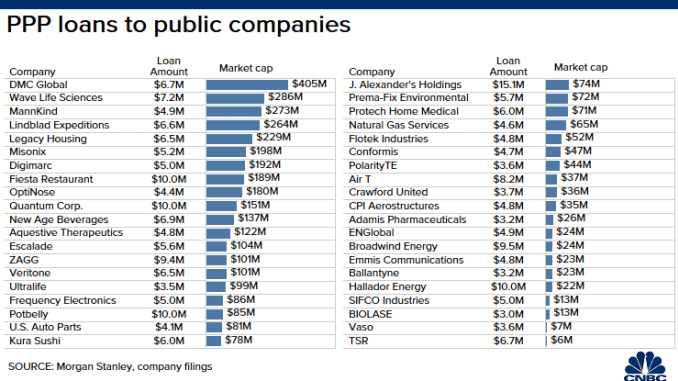

- Several of the companies have market values well in excess of $100 million, including DMC Global, Wave Life Sciences and Fiesta Restaurant Group.

Hundreds of millions of dollars of Paycheck Protection Program emergency funding has been claimed by large, publicly traded companies, new research published by Morgan Stanley shows.

In fact, the U.S. government has allocated at least $243.4 million of the total $349 billion to publicly traded companies, the firm said.

The PPP was designed to help the nation’s smallest, mom-and-pop shops keep employees on payroll and prevent mass layoffs across the country amid the coronavirus pandemic.

New virus aid bill includes $251 billion in PPP, $60 billion to small lenders

New virus aid bill includes $251 billion in PPP, $60 billion to small lenders

But the research shows that several of the companies that have received aid have market values well in excess of $100 million, including DMC Global ($405 million), Wave Life Sciences ($286 million) and Fiesta Restaurant Group ($189 million). Fiesta, which employs more than 10,000 people, according to its last reported annual number, received a PPP loan of $10 million, Morgan Stanley’s data showed.

At least 75 companies that have received the aid were publicly traded and received a combined $300 million in low-interest, taxpayer-backed loans, according to a separate report published by The Associated Press.

“I think you’ve seen some pretty shameful acts by some large companies to take advantage of the system,” said Howard Schultz, former Starbucks chairman and CEO. Instead, the government should act “as a backstop for the banks to give every small business and every independent restaurant a bridge to the vaccine. And that is the money and the resources to make it through.”

Statistics released by the Small Business Administration last week showed that 4,400 of the approved loans exceeded $5 million. The size of the typical loan nationally was $206,000, according to the SBA report released April 16.

The SBA awarded the plurality of PPP dollars (13.12%) to the construction industry. Professional, scientific and technical services received 12.65%, manufacturing received 11.96%, health care received 11.65% and accommodation and food services received 8.9%.

Congress approved the first-come-first-served PPP in March as part of the massive $2.2 trillion CARES Act, which at the time promised to ease some of the financial burden for many of the nation’s smallest business owners. But the program ran out of money on Thursday, when the SBA announced that it was “unable to accept new applications for the Paycheck Protection Program based on available appropriations funding.”

The nation’s top lawmakers have in recent weeks worked to expand the small-business funding.

Staffers for Sen. Chuck Schumer and House Speaker Nancy Pelosi have been in talks with the Treasury Department on drafting another bill, which appeared nearly finished by Monday evening.

Schumer, the top Democrat in the Senate, said Tuesday that he believes the chamber will pas an aditional relief bill for small businesses later in the day.

He told CNN he spoke “well past midnight” with Pelosi, White House Chief of Staff Mark Meadows and Treasury Secretary Steven Mnuchin and “came to an agreement on just about every issue.”

By Sunday, deliberations between Republicans and Democrats included setting aside $310 billion more into the PPP. Some $60 billion of that sum would be earmarked for rural and minority groups while $60 billion would go to the Economic Injury Disaster Loan program, a separate relief offered by the SBA for small businesses.

Mnuchin said the deal may include $75 billion in funding for health-care providers and hospitals and $25 billion for Covid-19 testing.

— CNBC’s Lauren Hirsch contributed reporting.

Click here to read more of CNBC’s coronavirus coverage.

CNBC.COM