Palm Beach Daily News

Climate change and Florida’s home insurance crisis: Here’s what homeowners should know

Lianna Norman, Palm Beach Post – July 19, 2023

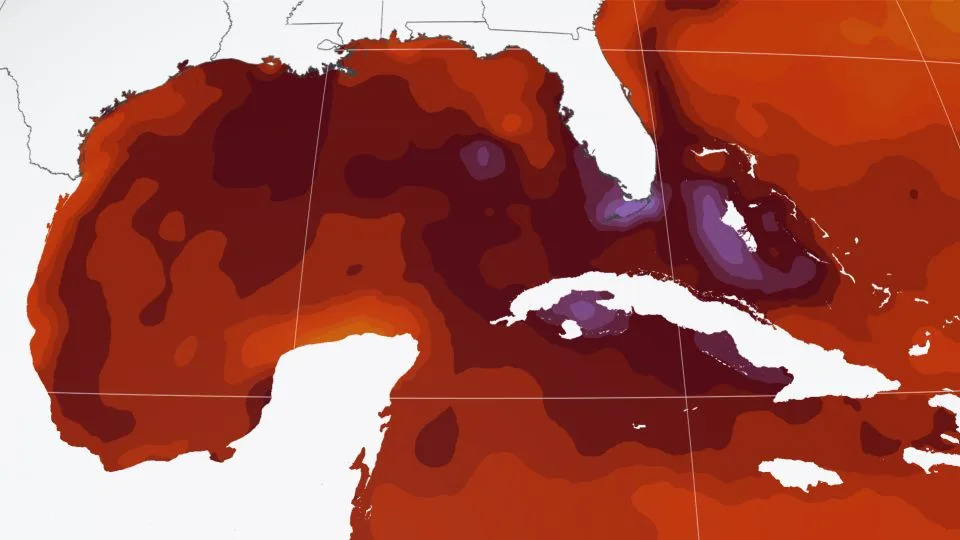

There are many contributors to Florida’s insurance crisis. One of the biggest contributors are huge insurance payouts attached to yearly storm damage following hurricane season, exacerbated by climate change.

Over 100,000 Floridians are scrambling for homeowners insurance after a wave of insurers have stopped writing policies in the disaster-prone state.

Last week, Farmers Insurance became the most recent insurer to drop coverage of Florida, announcing that the “decision was necessary to effectively manage risk exposure.”

Here are four reasons why insurance rates are rising in Florida

- A population boom that started in July 2021 made Florida the fastest-growing state in the nation, according to the Census website. There are now significantly more people living in the state than at this time two years ago, which has resulted in a steady increase in the state’s cost of living and the highest inflation rate in the nation, according to data collected from the U.S. Bureau of Labor Statistics in a Wallethub assessment of inflation in 23 major metropolitan cities.

- There has been a steady increase in insurance payouts due to changes in the climate for decades, according to reports from the National Flood Insurance Program. Stronger and more frequent storms, tornadoes, hurricanes and heat waves, combined with more people living in Florida, means a higher probability of insurance companies having to make huge payouts – particularly during hurricane season.

- Costs for building materials and repairing property both increased by more than 30% during the pandemic, according to a 2022 report on building costs by the National Association of Home Builders.

- Lawsuits between insurance companies and contractors or insurance companies and policyholders. According to the Insurance Information Institute, only 9% of the nation’s home insurance claims come from Florida. But 79% of the nation’s homeowners’ insurance lawsuits come from the state.

Florida’s insurance crisis: Farmers Insurance is the 4th major insurer to leave Florida

How has climate change affected the insurance industry?

Hurricane Ian, the last major hurricane to seriously impact Florida homeowners in the fall of 2022, cost the National Flood Insurance Program more than $1.2 billion in payouts to policyholders recovering from damage.

“FEMA estimates Hurricane Ian could potentially result in NFIP claims losses between $3.7-$5.2 billion,” FEMA’s website says. “The losses include flood insurance claims received from five states, with the majority of claims coming from Florida.”

A study led by researchers from the Pacific Northwest National Laboratory and published in a peer-reviewed journal found that Hurricanes impacting the U.S. could rise by one-third compared to what hurricane season looks like now, at the rate that the climate is currently changing.

Florida isn’t the only state affected. Some insurance policy providers have also hiked prices or dropped out of states like California, Colorado and Louisiana due to rising risk of insuring homes in flooding or wildfire-prone areas.

The cost of the insurance crisis: Homeowners’ insurance costs are going up amid climate change. Here’s how to lower yours.

Which insurance companies are dropping customers in Florida?

This month, Farmers Insurance joined Bankers Insurance and Lexington Insurance, a subsidiary of AIG, in dropping out of Florida’s insurance market.

AAA is still writing policies, but the company said this week they will not renew its package policies that combine home, automobile and optional umbrella coverage. AAA says a “small number” of customers will be affected.

The Florida Department of Financial Services has a list of 14 companies that are in liquidation. This means that the Office of Insurance Regulation determined that there are grounds for the Department of Financial Services to proceed with charging these companies for delinquency.

Here are the insurers from that list that offered property insurance:

- American Capital Assurance Corp.

- Avatar Property and Casualty Insurance Co.

- FedNat Insurance Co.

- Florida Specialty Insurance Co.

- Gulfstream Property and Casualty Insurance Co.

- Southern Fidelity Insurance Co.

- St. Johns Insurance Co.

- United Property and Casualty Insurance Co.

- Weston Property & Casualty Insurance Co.

Insurance costs are rising in Florida: Does your Florida county rank in the state’s most expensive home insurance premiums?

What’s the average cost of homeowners insurance in Florida?

Floridians pay some of the highest prices for home insurance in the nation. Most are paying about $6,000 for their yearly home insurance premium, an increase of 42% compared with last year, a spokesperson for the Insurance Information Institute told USA TODAY.

With each year and each hurricane season, the cost for homeowners insurance in Florida increases exponentially faster than the national rate.

Lianna Norman covers trending news in Palm Beach County for The Palm Beach Post.