MarketWatch – The Human Cost

This woman was told her mortgage was paid off: 10 years later, she received a foreclosure notice in the mail. She decided to fight.

Aarthi Swaminathan – May 2, 2023

Mortgages originated in the early 2000’s and largely forgotten are now being pursued by debt collectors. Government officials are concerned.

Rose Prophete bought her home in Canarsie, Brooklyn, N.Y. in May 2005. She thought she had paid off her loans until recently, when a company approached her about a debt she thought she had settled a long time ago.

The company expected Prophete to pay up over $130,000, or face foreclosure.

When refinancing her mortgage on the home, Prophete had split her mortgage into two. Prophete said she had been erroneously told that her second mortgage was paid off. That debt, having laid dormant for years, was now being pursued by a debt-collection firm.

Prophete is one of 13 plaintiffs in a 2021 federal lawsuit against the firm, and she recently testified at a field hearing into “zombie debts” held by the Consumer Financial Protection Bureau, a government agency responsible for consumer protection in the financial-services sector.

The CFPB last week announced that it was issuing legal guidance for debt collectors trying to collect on mortgages that were long considered forgiven by borrowers, who in particular had no notices or statements sent over a decade about outstanding debt.

‘This is really frustrating — I don’t want to lose my home.’— Rose Prophete, who bought her home in Brooklyn, N.Y. in May 2005

The federal agency said that a debt collector “who brings or threatens to bring a state-court foreclosure action to collect a time-barred mortgage debt may violate the Fair Debt Collection Practices Act.” Time-barred refers to debt whose statute of limitations has run out.

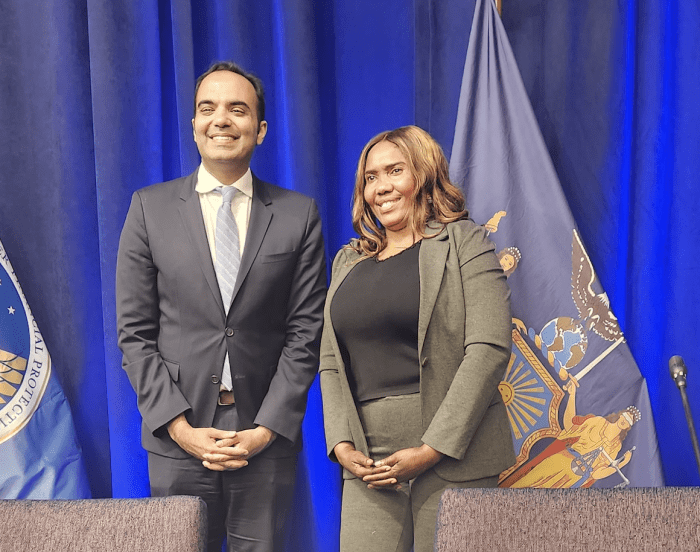

“Debt collectors do not get to claim ignorance of the law or ignorance of the debt’s age,” Rohit Chopra, director of the CFPB, said during the hearing. “If the statute of limitations has expired, taking legal action threatening to bring a suit of foreclosure may be illegal no matter what the debt collector claims to have known. This is the law.”

Prophete, a Haitian immigrant and a hospital technician, said during the CFPB hearing that she had worked three jobs to afford the two-family Brooklyn home, on top of taking care of small children.

According to the lawsuit, a little more than a year after they completed the purchase, the broker who arranged the financing suggested she refinance the mortgage to lower her monthly payments. She agreed to refinance her mortgage into two, as the broker told her that this “financing structure would be the most financially advantageous to her,” per the filing. The first loan was for $504,000 and the second for $63,000 with an interest rate of 9%.

‘Debt collectors do not get to claim ignorance of the law or ignorance of the debt’s age.’— Rohit Chopra, director of the CFPB, speaking about the Fair Debt Collection Practices Act

After a couple of years, she received a note from her first lender that the second loan was fulfilled — that she didn’t need to pay for it. She said she didn’t receive any statements for the second mortgage, so she focused on paying off her first one, the lawsuit said.

She said she never heard back from the mortgage servicer, until over a decade later, in March 2021, when she received a foreclosure notice in the mail. The creditor was attempting to collect on payments due from Jan. 1, 2009 to the date of filing in 2021. The payments had ballooned from $63,000 to over $130,000, according to the lawsuit.

“This is really frustrating — I don’t want to lose my home,” Prophete said during the field hearing.

New York Attorney General Leticia James, who also spoke during the hearing, said that debt-collection firms were engaged in “predatory practices” to “rob individuals of the equity in their home.”

Debt buyers were acquiring these mortgages “often for pennies on the dollar,” James said, and they were now suing homeowners and “seeking to exploit rising housing values by reviving the long-dormant zombie debt.”

“I find this practice predatory and abusive and an affront to the American dream of sustainable home ownership,” she added. “I will fight this despicable practice.”