USA Today

Florida’s coastal homes may lose value as climate-fueled storms intensify insurance risk

Kate Cimini, USA TODAY- Florida – September 25, 2023

Climate-fueled disasters like Hurricane Ian are wreaking havoc on home values across the nation, but Florida’s messy insurance market makes it one of the most stressed, new research out of a nonprofit climate modeling group indicates.

High insurance premiums and a state-backed requirement that homeowners covered by the state-backed insurer of last resort enroll in the National Flood Insurance Program over the next three years could drop home values up to 40% in Florida in the next 30 years, data provided by First Street Foundation shows. And climate and insurance experts say that may further gentrify Florida’s coastal regions and barrier islands.

Using what First Street representatives described as a typical institutional-investing calculation, First Street Foundation found some homes, adjusting for 2023 insurance costs, have already lost up to 19% of their value.

The News-Press reported earlier this month on middle-class families being forced off Fort Myers Beach due to the rising costs associated with living on a barrier island in a time of stronger storms, including more stringent, expensive building requirements and a high demand for Beach property.

Experts say this trend will likely continue in coastal communities as high-income buyers who can afford to go without insurance rebuild and repair out of pocket. They say it will take a concerted effort among state and federal officials, as well as insurance and reinsurance companies to avoid climate-spurred migration and subsequent gentrification of Florida’s coast.

Do property values go down after a hurricane in Florida?

Geographer Zac Taylor, a professor with the Delft University of Technology in Norway, studies the connection between climate change and the insurance industry in Florida. Taylor uses they/them pronouns.

They urged caution in reassessing home values but agreed that this was a possible outcome based on current climate models.

Some of Florida’s more vulnerable coastline may even see corporations purchasing homes with the intent to rent them out, Taylor said, though real estate investor purchases of single-family homes dropped 45% in the second quarter of 2023, compared to a year ago, per realty company Redfin.

Soon, “only wealthy people will be able to afford to remain in coastal areas,” said Taylor.

What areas are being gentrified in Florida?

Gentrification of Florida’s coastline may have already begun in areas hardest-hit by Ian.

This is likely to continue as a number of factors drive up the costs associated with living along the Sunshine State’s coast thanks to sea level rise, a 2022 study out of Florida State University predicted.

“Eventually, people are likely to start moving inland from coastal areas as the costs of staying become too great,” the report reads. “Those that are further inland are more likely to be displaced by higher income residents who eventually move inland in the process of relocating to higher ground.”

On Pine Island, a community whose year-round residents are largely working-class, people are cutting back their monthly budgets and searching desperately for cheaper insurance after rates rose in response to Hurricane Ian’s devastation of the barrier island. Some are leaving the island after too many problems with insurance, said nonprofit civic group Matlacha Hookers president Joanne Correia.

Guylinda DeMyers and her husband have lived in Pine Island’s St. James City for 20 years, she estimates, but after this most recent hurricane, she said they plan to sell their home and leave for safer climes − once their insurance company pays their claim.

They’ve yet to see a penny of their claim from People’s Trust, she said, even though it’s been almost a year. In fact, it’s been so long, their policy has expired. They haven’t pursued a new one because “there’s nothing to insure,” DeMeyers said. “It’s broken.”

She doesn’t think they’ll get what the home was worth before the storm, but says her realtor has told her the property itself – an ocean-front lot ‒ is valuable enough by itself.

But DeMeyers is determined to see her claim through – if not for her, then for her husband, who has Alzheimer’s. She’s lived through three major hurricanes and subsequent rising insurance costs.

“It’s not safe here anymore,” DeMeyers said. “We need a stable place.”

On Fort Myers Beach, another one of Florida’s vulnerable barrier islands, coastal gentrification is already underway. Renters and low-income homeowners are finding there’s nothing in their budget on the island anymore. The island is home to just 5,700 residents year-round, and the loss of even a few is significant.

“I feel like I’ve lost my community,” former Fort Myers Beach resident Cheri Warren told Chad Gillis of The News-Press in early September. Warren’s one-story home was destroyed during Hurricane Ian; now, she and her husband found it was too costly to repair it and have left the barrier island for the mainland. They plan to sell their lot at a later date, when the market has stabilized.

Has home insurance gone up in Florida?

For its new study, released in September, First Street Foundation founder and CEO Matthew Eby said the nonprofit, like institutional investors, calculated home values by dividing the amount of what a property would rent for over the course of a year, minus operating costs (which includes insurance costs), by 5%, an average risk amount.

While most homeowners look at the prices their neighbors homes are selling for in order to figure out how much theirs could be worth, this approach can take a while to show fluctuations in real home value, said First Street Foundation’s head of climate implications Jeremy Porter. Institutional investors use a standard calculation that First Street Foundation employed to “take the uncertainty out of the equation,” he said.

But with the cost of insurance rising due to both inflation and natural disasters like hurricanes and fires, risks increase as well. That means that operating costs have increased, particularly for Floridians who have no option for insurance other than state-created nonprofit Citizens Property Insurance Corporation. Citizens was created to insure homes that all other carriers refused to insure − the riskiest properties.

Not only is Citizens often more expensive than other carriers, as state law allows them to charge an actuarially-sound amount, but Florida legislators recently passed a law requiring homeowners who get their insurance through Citizens also enroll their homes in the National Flood Insurance Program, a federal insurance program.

That increases a homeowner’s operating costs even further.

“When … you don’t have anywhere else to go and you are beholden to whatever increase in prices that they just decide to put on you, there’s no way out,” Eby said.

Since 2017, Citizens’ number of policies have increased 168%, while the average premium has also increased from roughly $2,000 to more than $3,000 annually.

Citizens spokesman Michael Peltier said Citizens is held to a policy premium increase of 12% annually, and increases are subject to state approval.

Although California and Louisiana are facing rocketing insurance costs as well, according to First Street Foundation’s data, Eby said, “Florida has the biggest problem.”

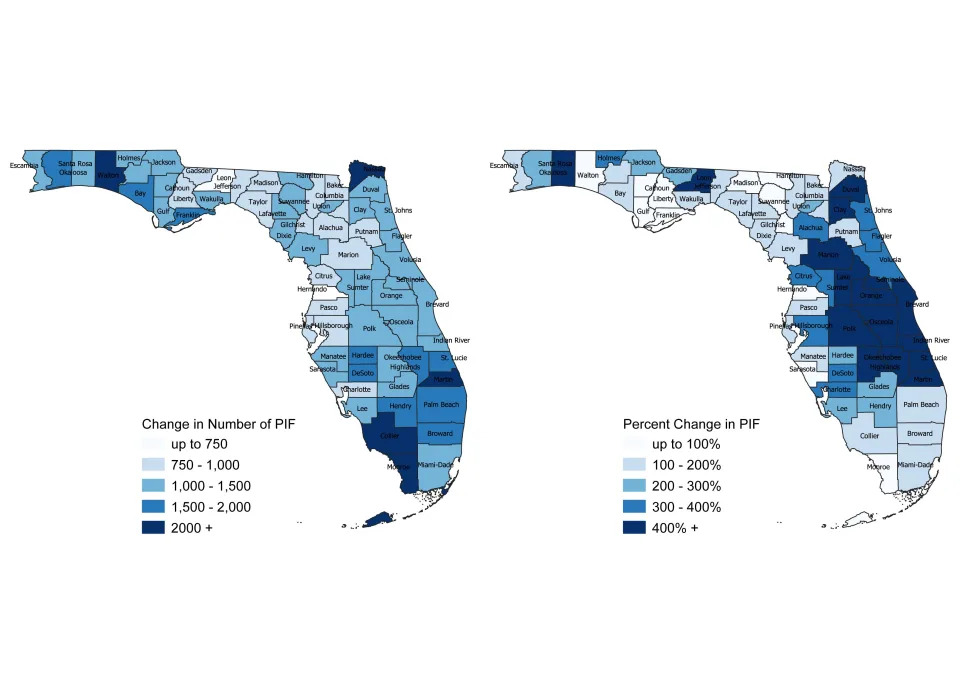

The nonprofit examined the number of policies Citizens holds in Florida going back to 2017, when Citizens held roughly 500,000 policies. Eby noted that increased over time, and dramatically grew in 2021 as private insurance companies began to pull out of the state. After Ian, it shot up once again.

Citizens currently holds 1.5 million policies in force, and, Peltier said, expects that to increase to 1.7 million by the end of 2023.

“The major insurance companies have all been pulling out of Florida, leaving Citizens the largest insurer in the state,” said Eby. “The insurance company of last resort, the very last one that you want to go to for your insurance, is now the insurer for the entire state.”

| County | Citizens Policies in Force (07/2023) | Citizens Average Premium (07/2023) | Average Homeowners Insurance Across County |

| Duval | 24,503 | $1,790.81 | $1,168 |

| Leon | 4,433 | $1,229.12 | $1,185 |

| Collier | 13,594 | $5,489.82 | $1,645 |

| Lee | 38,716 | $2,626.48 | $1,168 |

| Palm Beach | 132,811 | $851.61 | $1,514 |

| Sarasota | 33,399 | $2,940.27 | $1,445 |

| Escambia | 13,085 | $3,241.48 | $1,153 |

‘Not all doom and gloom’: How this Florida Gen Z homebuyer bought in an uncertain market

Insurance and natural disasters: How billion-dollar hurricanes, other disasters are starting to reshape your insurance bill

Are Florida property values going up?

Rising homeowners’ insurance bill have yet to translate that to loss of equity, Porter said.

“When you go to sell it, that’s when the property devaluation becomes realized – at the closing table,” Porter said. But even those who hang on to their homes may feel it the next time Florida gets hit by another major weather event like Ian, he cautioned.

Then, he said, taxpayers will be the ones hurting.

“At some point, the amount of exposure on Citizens is too much, relative to its premiums,” said Porter. “If it’s not accounted for properly there has to be some kind of a subsidy from Florida taxpayers one way or another.”

Eventually, Porter predicted, “the state of Florida is going to have to ask the federal government for a bailout if they if they end up getting hit by a disaster that empties the coffers.”

According to Peltier, Citizens has a number of backstops to keep itself solvent. First, he said, if the state-created nonprofit goes through its premium-driven surplus, like all other insurers in the state it has access to the Florida hurricane catastrophe fund. It also purchases reinsurance to cover the possibility that the catastrophe fund is exhausted. Finally, Peltier said, Citizens is required by law to levy assessments on policyholders to make up any deficits.

This article originally appeared on Fort Myers News-Press: Florida home insurance risk intensified by climate-fueled storms