Salon

“He’ll never leave”: Why Trump’s dynasty, built on corruption and violence, won’t end with him

Dean Obeidallah – March 22, 2024

No, you’re not being hyperbolic if you say MAGA is a fascist movement. You’re just being accurate. That was one of the biggest points made by NYU historian Ruth Ben-Ghiat, author of the book “Strongmen: Mussolini to the Present,” during our recent “Salon Talks” conversation.

Ben-Ghiat explained that Donald Trump is leading a “right-wing counterrevolution against the loss of white male privilege,” aimed at taking America back to the time when women, nonwhite people and non-Christians “knew their place.”

But what truly defines MAGA as fascist, Ben-Ghiat said — rather than just right-wing — is its use of violence. “Fascists believe that violence is the way to change history,” she told me. We saw that clearly enough on Jan. 6, 2021, with the attack on the Capitol mean to keep Trump in power despite his loss in the 2020 election.

What is most worrisome going forward, Ben-Ghiat suggested, is Trump’s defense of the Jan. 6 attackers as “hostages” and his promises to pardon them, which seek to change “the perception of violence.” Trump’s message to his loyal followers, she said, is that “violence is sometimes morally necessary and even righteous, and even patriotic.” That, she added, is “what we call sacralizing violence, giving violence a kind of ritual, religious tone.”

Ben-Ghiat sees Trump’s promise to pardon the Jan. 6 insurrectionists as intended to inspire his supporters to commit future acts of violence if that can help him win. The implied promise is that if they commit violent acts and Trump regains the White House, he’ll pardon them too. That’s straight out of the autocrat’s playbook, Ben-Ghiat says: “All authoritarians use pardons” and manipulate the justice system to maintain power.

Ben-Ghiat says she’s not trying to scare us, only to prepare us for what we’re likely to see between now and November — and for a good while after that if Trump wins. Too many Americans still don’t believe, Ben-Ghiat warns, that “it can happen here” — “it” being a fascist takeover. History tells us those people are wrong.

Watch my full conversation with Ruth Ben-Ghiat here or read a transcript of our conversation below, edited for length and clarity.

You’ve been discussing and studying this issue for years, but it seems even more important than ever to talk about authoritarianism.

It’s incredible that it could be upon us. Here’s Trump saying he’s going to be a “dictator for day one,” but we know that they’re never dictators for day one. They never relinquish their powers, so it’s extremely important to understand what we’re up against.

Despite Trump saying he wants to be a dictator and facing 91 felony counts for his attempted coup, the GOP base and millions of Americans still love him. What do you take from that?

Sadly, in history, when these charismatic demagogues come to power, they use emotions to manipulate people. Trump says, “I love you” to his people. He told them he loved them on Jan. 6. He builds a personality cult so he poses as the victim, which is really important because not only are all his crimes presented as persecutions by the “deep state,” but saying he’s being persecuted makes his followers feel protective of him.

You have quotes from MAGA people saying, “Oh, it’s so distressing. We have to be there for him.” That’s what Jan. 6 was. It was many things. It was a violent coup attempt. But he was a leader in distress and he called on people, he brought them to the rally and they responded. They were trying to rescue him. This happens in history. I have quotes in “Strongmen” with people, actual fascists sitting in jail in 1945, where they’re like, “Oh, I was completely magnetized by Mussolini. I didn’t realize what was going on.” So that’s how I see it.

Is history warning us about the fact that Trump has not been held accountable by the system? There was such a long delay in investigating him. He’s finally charged and now he’s using his lawyers to manipulate the system to keep him on the ballot, and maybe not have any of the serious criminal trials before Election Day.

It’s very disheartening, and no one is going to save the American people. My mantra has always been, “Never underestimate the American people.” We had the Women’s March, we had Black Lives Matter. These were the largest protests in history, and they led to electoral [change] in the midterms in 2018 and 2022.

We’ve got to do it. We can’t depend on our institutions, which is very sad in a democracy. But our democracy has been so damaged, including the Supreme Court with Justice Thomas who wouldn’t recuse himself. There’s a whole attempt to delegitimize democracy, and not just Joe Biden, but the whole system. So we have to do this from the ground up.

From an academic point of view, is MAGA an authoritarian movement? Is it a fascist movement? Where does it fall?

It’s pretty fascist.

Why?

The reason I wrote “Strongmen” was to have this 100-year history of authoritarianism, almost all right-wing, because that’s my specialty. Obviously communists had a higher body count than fascism, so I could have put them in there, but for narrative and other reasons, I focus on the right wing. Fascism was the first stage of authoritarianism, but it continued in different forms, like the Cold War military dictatorships.

Trump is very similar to Mussolini in many ways. It checks all the boxes, where it’s this huge right-wing counterrevolution against the loss of white male privilege, and it’s to save civilization, and the whole “great replacement” theory, which is big in the MAGA base, the idea that nonwhites and non-Christians are having too many babies: We’re going to be extinguished. Mussolini talked about this too. You can track a whole series of checkpoints and talking points, and they’re pretty much the same.

What’s the core of fascism? And why do you, as an academic, look at MAGA and say, “Yep, it’s now fascist”?

Mussolini actually was a great sloganeer. He created fascism and had one very simple definition. He called it “a revolution of reaction.” Both those things are true because it upends everything. It disrupts everything. It uses violence. Fascists believe that violence is the way to change history. Rep. Matt Gaetz of Florida, he came to the Iowa State Fair to help Trump in the summer. People are eating their corn dogs, there’s kids there, and he says, “Only through force will we bring change to corrupt D.C.” This is after the coup that tried to do that. So that’s the revolution part. People are given permission to be their most violent selves, their worst selves. It’s a collapse of morals.

The reaction is what I was saying before, where you want to turn the clock back to “the good old days.” MAGA wants to make the nation “great again” by going back to times when women knew their place, as did nonwhites and non-Christians, so things were as they should be. This is part of authoritarianism, which is also a set of attitudes about child-rearing, about traditions, about male authority. All of that, Trump says, is threatened, and so the MAGA base is responding to that.

As an expert in authoritarianism, when you hear Donald Trump defending the people who attacked the Capitol, calling them “hostages” and saying they’ve been treated unfairly, pledging to pardon them, does that raise red flags for you? And if it does, what does it mean?

Totally. One of the major things that fascists did, and that Trump is doing — he’s been doing this through his rallies with frightening relentlessness — is to change the perception of violence. To get people to see that violence is not negative, including violence against your neighbors, or that you’re going to look the other way when your neighbor’s deported. Violence is sometimes morally necessary and even righteous, and even patriotic. He has used his rallies since 2015, and I wrote about this in my report for the Jan. 6 committee, where he’d say, “Oh, in the old days we used to be able to beat people up and nothing happened.” This is thug talk. This is part of fascism.

So Jan. 6 becomes this righteous “Stop the Steal.” The people who have been arrested become patriots. He almost is doing what we call sacralizing violence, giving violence a kind of ritual, religious tone. In his rallies, he has the Jan. 6 prisoners choir sing. This is totally fascist. Trump has these fascist spectacles.

I wrote an essay for Lucid when he kicked off his campaign at Waco, Texas. What a choice! He had the choir and the spectacle of it reminded me of Hitler’s Nuremberg rally. I think I entitled my essay, for my Substack newsletter, “Triumph of the Will, Waco Version.” He knows exactly what he’s doing because he’s a showman, he’s a man of TV, he’s a man of the camera. It’s really scary and it really works. That’s what all of that is about. The pardons are about encouraging people to do more violence, thinking that they’re not going to pay any consequences. That’s actually the essence of authoritarianism and fascism: You arrange government so that you can be violent and corrupt, and get away with it.

When Trump says “I’m going to pardon you for committing these crimes,” then the message becomes “If you commit crimes for me as we get closer to the election, I will do the same for you.”

That’s right. We also want to talk about not just Trump, but the enablers. So Rep. Paul Gosar, who should not be anywhere near government, in my opinion, who hangs out with Nazis, he was promising people pardons to get all the thugs he knew, all the right-wingers who were violent, to come on Jan. 6 — promising them pardons because Trump had just pardoned all these violent people like Roger Stone and Michael Flynn and Steve Bannon. That’s the environment.

All authoritarians use pardons because why do you want people sitting in jail, the worst people in the world, who are for you the best people, when they could be serving you? So Mussolini, Pinochet, they all use pardons to free up the people they need. It’s really awful, but this is where we are.

The fact that you know all this, does it scare you more?

I do. It’s a little eerie that things are unfolding exactly as they have — well, not exactly as they have in the past because it always looks different, which is why some people don’t see it coming. Because no, we’re not 1930s Germany, even though Trump’s saying, “I hope the economy crashes,” which is the Hitler playbook. But it redoubles my mission to speak out and to warn people. The challenge is to reach more people now, reach the people who usually don’t vote, who have no idea.

There was a poll that was very disturbing that said, I forgot what percent, a lot of Americans have never heard Trump’s authoritarian declarations. They’d never heard any of that, and some of them don’t know about his crimes because they don’t follow the news at all.

As a historian, are you concerned that there are Americans who sincerely believe it can’t happen here? “It” being fascism, authoritarianism and the end to self-determination as a people.

Oh, absolutely. Even when I’m speaking to people, and these are people who have come to hear me, so they know what I’m about, when I say things like, “The GOP is an autocratic entity, or it’s become autocratic” — I don’t use the word fascist often — you can see that they’re kind of, “Well, this is a little exaggerated.” It’s like a mental divide between what we hear about abroad and what we are. In the meantime, they’re going to pick their kid up from school, they’re going to the gym, and they don’t have any conception of how their lives would be affected. So it just seems like some blathering by a professor, and that is frustrating.

Sticking to Trump and what he says, at a rally recently, he mocked President Biden’s stutter. At another rally last year, he made fun of Paul Pelosi, Nancy Pelosi’s husband, a man in his 80s who was hit in the head with a hammer. Trump doing that is one thing, but what is more bone-chilling to me is when he did that, the crowd cheered and laughed. With Biden’s stutter, the crowd cheered and laughed. What does that indicate to you?

This is part of his re-marketing of violence as positive. That’s the Pelosi part. There’s a reason that threats to members of Congress and their families are up like 400%.

Mocking the speech impediment is about cruelty. To have an autocracy, you need people to be cruel. You need them to think that solidarity and empathy and kindness are for weak people. That’s totally fascist. That’s what fascism is. In fact, Mussolini, who, like Hitler, read Nietzsche, the philosopher of the Übermensch and all that, and took away from it that if somebody is weak and they’re on a cliff, you should just push them because they’re useless to society. That’s the philosophy. Trump also made fun, years ago, of a New York Times reporter with a disability. And the disabled, just to take that theme for a second, have always been persecuted by fascists and others.

When Biden gave the State of the Union address, he raised the alarm about Trump. What more should he be doing, in talking about Trump, to alert our fellow Americans?

I was glad that he was doing that. You have to respond forcefully. This whole thing partly includes Putin’s maneuvers in Ukraine. Biden came to office and in his first press conference said, “We’ve got to prove democracy works.” So from the very beginning, he was going to not only save democracy in our country, but prove it works abroad and stop these people.

He had a summit with Putin in the summer of 2021. They sat there and Putin was placed as an equal visually, and they had the globe between them. It was in Geneva. I looked at Putin — because I live in these people’s heads, unfortunately — and I got a really bad feeling. He was also being grilled by the U.S. press, including by female journalists, and he didn’t like that at all. He was put on the spot by a female American journalist. I thought, “This is bad,” because there was something about him. So that night I wrote for my Lucid newsletter that Putin could become very reckless over the next months because he felt extremely threatened that Biden was there instead of Trump. It was a nightmare for him that Trump didn’t win. He was risking a lot.

Then we know what happened. He went into Ukraine and before that, he and China made a formal alliance. And so all of this, one way to read it is it’s because of Biden’s commitment to democracy. Now, after Jan. 6, he’s there. He almost didn’t make it into office, but now he’s there and we’re at the showdown. I think he needs to be even more forceful, but at least he’s stepped up.

Trump recently invited Viktor Orban, the prime minister of Hungary, to Mar-a-Lago. He said, “There’s no one that’s a better or smarter leader than Viktor Orbán. He’s fantastic.” What alarm bells go off when you hear that?

Trump has actually been conditioning Americans to see authoritarian leaders like Orbán as positive role models, as well as saying, “I’m going to be a dictator.” One of the interesting things he said after that was that Orbán is a “non-controversial leader because he says, ‘This is the way it’s going to be,’ and everybody accepts it, end of discussion.” So what Trump is saying is that literally being a dictator, dictating what you’re going to do and everybody just submits, shouldn’t be controversial. It’s how it’s going to be.

He’s using these visits not just to curry favor with these autocrats and whatever dirty deals they’re going to have — and it’s all about Putin, because Orbán is a client of Putin — but he’s using these occasions to keep indoctrinating Americans that this is the leadership they’re going to have.

It resonates with some folks in the base. I see interviews where people are like, “Yes, he’ll be a dictator just in the beginning to get everything right.” And you’re like, “You are not upset that he’ll be a dictator because he’ll be your dictator.” That’s the way it is. If Biden said, “I want to be a dictator,” the right would go ballistic, as they should.

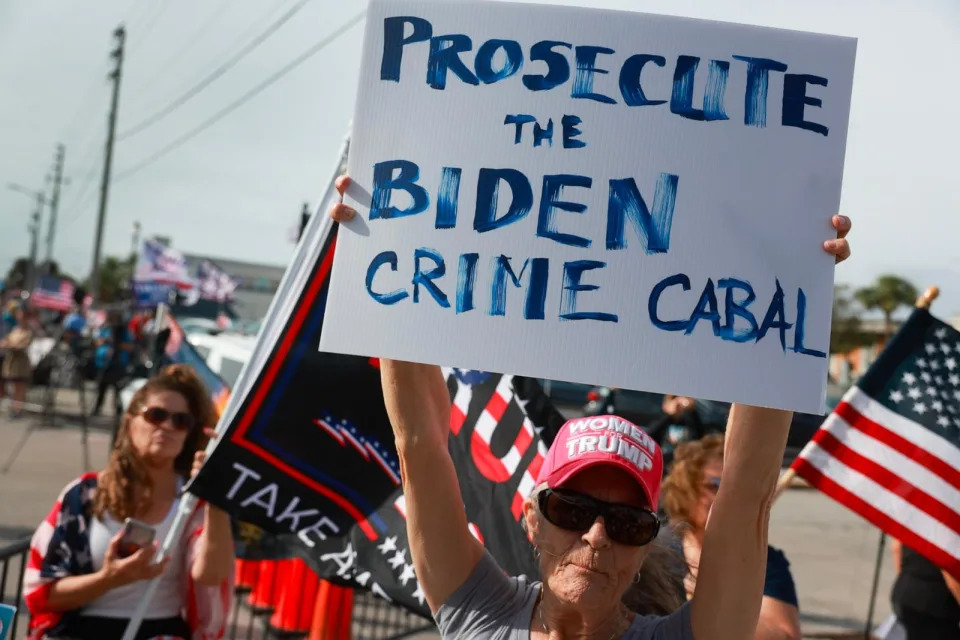

They already say he’s a dictator. That’s what I call the upside-down world of authoritarianism. Marjorie Taylor Greene and others talk about the “Biden regime.” Mussolini did this: Liberal democracy is tyranny, fascism is freedom. Then we get all the way to Auschwitz, where the gates of said, “Work will set you free.” That’s the upside-down world of authoritarianism.

We’re seven or eight months out from the election right now. As we get closer, do you have concerns about violence by the MAGA movement?

I do, because they’re being egged on. There was a news item out of Kansas, where there was a Republican fundraiser and they were using an effigy of Biden and encouraging people to attack it. This kind of violence against anybody who is trying to hold Trump accountable or protect democracy could easily, because of our lax gun laws, happen as the election nears.

If Trump loses in 2024, do you expect a similar scenario as we saw after 2020? Even a call for another Jan. 6-style attack?

I do. Sometimes I’ll have these thoughts and then they come to me and I’m like, “Oh, that’s not good.” It’s very interesting, when a president loses and a new one’s going to come in, there’s a transition team. That transition team is activated after the election is known. Project 2025, which has tens of thousands of people, 70 organizations, it builds itself as a transition team. Probably millions of dollars are being spent with giant staffs to plan a transition as though they think that whatever happens, they’re coming into power. So that is disturbing, and that’s a part of Project 2025 we haven’t thought about. Why are they doing all this if it’s going to be a free and a fair election, and they could lose?

It’s important for President Biden, as a defender of democracy, to adhere to democratic norms. Right now, there’s a debate about whether Biden should give him the standard national intelligence briefing. Do you think that is it in the nation’s best interests for Biden to adhere to this tradition that goes back to the time of Truman or, given the threat that Trump presents — and that he’s actually charged with felonies for mishandling classified documents — should Biden not give him the briefing?

Somebody who has instigated a violent coup to overthrow the government and kept classified documents in the bathroom of his private residence is not exactly trustworthy. It’s not just Trump, it’s also Jared Kushner. We need to be investigating how he came out of the Trump administration immediately into the hands of the Saudis. It’s a whole flow of illicit money and networks. Absolutely he cannot be briefed. If that happens, that’s actually very naive.

If Trump wins in 2024, do you think he would leave office peacefully in 2028?

No. He’ll never leave, and if he falls ill or something, there’s other Trumpers waiting in the wings. It’s a dynasty. You could even see they’re talking about Jared Kushner as secretary of state, which would be perfect for crime, for corruption. You don’t know what will happen, but they build dynasties, and Trump has always had a family business. His two sons are not exactly equipped to take on high public office, but there are other people around. Lara Trump was just put in charge of the Republican National Committee so that every penny will go to [the Trump campaign]. This is classic corruption. So it could be anyone. It could be Lara Trump, who knows? As long as they keep control.

How’s this going to end if Trump ends up being convicted, he loses the election, he’s convicted and put in prison? With authoritarian movements from the past, do you have any guide? Does that weaken the movement, or no?

Yeah, there are polls showing that if he’s actually convicted and sent to jail, he may become irrelevant. We can contrast what has happened after Jan. 6 here with Brazil, where they had a military coup in 1964. They had over 20 years of horrible dictatorship, with torture and all kinds of things, that only ended in 1985. The political class, the judges, they all know. They were there, or their parents were there.

Brazil had its own insurrection, on Jan. 8 [in 2023], but the former president Jair Bolsonaro has been banned from politics until 2030, so his popularity is going down. Same thing happened in Italy without an insurrection: Silvio Berlusconi had over 20 indictments and 14 major corruption trials. He was finally convicted two years after he left office and banned from politics for five years. That’s when his amazing, formidable personality cult shriveled. Because personality cults, they’re like plants. You’ve got to water them, you got to tend to them, and they need the person to be viable and active. If they’re in jail or they’re banned from politics, that’s what you need to end them. So I hope to goodness that happens.