Yahoo Money

Democrat senators to credit bureaus: Protect Americans’ credit scores amid the coronavirus pandemic

By Janna Heron and Aarthi Swaminathan

Two Democratic senators are urging the national credit reporting agencies to help safeguard the creditworthiness of Americans hurt by the coronavirus pandemic, according to a letter obtained by Yahoo Finance.

Senators Elizabeth Warren (D-MA) and Brian Schatz (D-HI) sent a letter to Equifax, Experian, and TransUnion, inquiring about the actions they are taking to make sure Americans’ credit isn’t damaged permanently if they have trouble paying their bills on time during the crisis.

“If American families and consumers are piled under a mountain of debt during this pandemic and once it ends, the country will struggle to emerge from a deep recession,” Warren and Schatz wrote. “This means that when the crisis is over, months of late or missed payments could add up to not just a mountain of debt, but a cratering credit score that takes away the shovel they might use to dig themselves out.”

Read more: Free credit reports amid coronavirus: Here’s why that’s important

The bureaus maintain the credit reports of consumers that help calculate a credit score, which lenders use to approve new credit and at what terms. The reports are a history of all your credit obligations, including how many accounts you have, how much you owe, and how often you make on-time payments.

While Equifax, Experian, and TransUnion didn’t immediately respond to requests for comment from Yahoo Money, the trade group representing the companies did.

“The companies just received the letter from the Senators and are reviewing it now. We share the Senators’ concerns about how the crisis will impact consumers and we have taken actions to help, including providing increased free access to credit reports, as they announced last week,” said Francis Creighton, president and CEO of the Consumer Data Industry Association. “We have also increased our training of banks and other creditors to help them understand their obligations under the law and to make sure they have tools to help consumers.”

2020.04.27 Letter to Experi… by Aarthi on Scribd

The Coronavirus Aid, Relief, and Economic Security (CARES) Act includes a number of protections for homeowners, renters, and student loan borrowers, the senators pointed out, but “won’t help countless American families and consumers who have other debts that received no protections, including auto loans, credit card debt, payday loans, and other forms of debt.”

The act does amend the Fair Credit Reporting Act (FCRA) to halt harmful credit reporting during the COVID-19 crisis under specific circumstances. If your creditor offers an accommodation on your payments because of the coronavirus, the creditor must report your account as current to the credit bureaus as long you weren’t already behind on payments.

But you have to reach out to your creditor first and agree on the terms of hardship accommodation to avoid negative reporting. You can’t just stop paying your bills with no repercussions, and you must maintain your end of the deal.

The three credit bureaus said last week they are offering free weekly credit reports for all Americans for the next year to help them monitor the accuracy of their credit histories. The bureaus said they sent additional guidance to creditors on reporting during a national emergency.

Equifax also announced earlier this month that it would no longer hurt your credit score if a mobile, wireless, cable, and internet company requested your credit report to open a new account. Before these were considered hard inquiries and could ding your score. When contacted earlier by Yahoo Money, Experian said it had changed its policy in a similar manner, while TransUnion declined to comment.

Sen. Warren and Schatz have requested responses to their letter no later than May 1.

“Our economic revival depends on millions of Americans’ ability to resume their lives after the pandemic abates and the economy reopens,” the letter concluded. “Permanently marred credit scores pose a risk to individuals and to our collective recovery.”

Janna is an editor at Yahoo Money and Cashay.

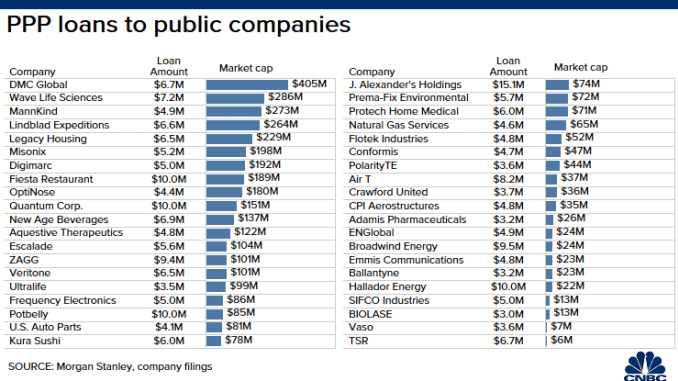

New virus aid bill includes $251 billion in PPP, $60 billion to small lenders

New virus aid bill includes $251 billion in PPP, $60 billion to small lenders

Shake Shack CEO Randy Garutti on returning $10M government loan

Shake Shack CEO Randy Garutti on returning $10M government loan

CNBC.COM